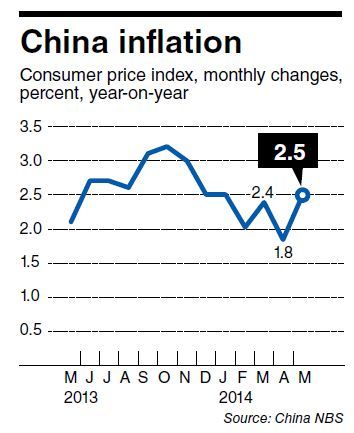

BEIJING (AFP) ― China’s annual inflation rose sharply in May to its highest level in four months, official data showed Tuesday, likely easing concerns about deflationary risks in the world’s second-biggest economy.

The consumer price index increased by 2.5 percent year-on-year last month, accelerating from 1.8 percent in April, the National Bureau of Statistics said in a statement. It was the highest figure since January also saw CPI rise 2.5 percent.

The May figure matched the median forecast in a poll of 15 economists by the Wall Street Journal.

The increase was mainly driven by rises in food costs, particularly a 20 percent surge in the cost of fruit, the NBS said.

Despite the rebound in May, CPI was still well below the 3.5 percent annual target set by Beijing in March and may ease worries about possible deflation in the Chinese economy, a key driver of world growth.

The producer price index ― a measure of costs for goods at the factory gate and a leading indicator of the trend for CPI ― also improved to a decline of 1.4 percent in May, the NBS said in a separate statement.

That was up from a decrease of 2.0 percent in April and marked the highest level since December, when PPI was also minus 1.4 percent, according to official data.

Moderate inflation can be a boon to consumption as it encourages consumers to buy before prices go up. In contrast, as Japan has seen, falling prices encourage consumers to put off spending and companies to delay investment, both of which act as brakes on growth.

In the first five months of the year, CPI increased by 2.3 percent from the same period in 2013, the NBS said.

The inflation data come after figures showed renewed vigor in China’s manufacturing sector, with official and private surveys indicating an improving situation.

Gross domestic product grew 7.4 percent in the first three months of 2014, weaker than the 7.7 percent recorded in October-December last year and the worst pace since a similar 7.4 percent expansion in the third quarter of 2012.

Beijing has introduced a number of measures to spur growth, including lowering the amount of cash selective banks must hold as reserve, financial support for small companies and targeted infrastructure outlays.

But it has so far refrained from more aggressive steps such as interest rate cuts, citing worries about excessive credit.

China’s leaders say they want consumer spending and other forms of private demand to propel the economy into a future of more sustainable, albeit slower, growth.

The new model would steer the Chinese economy away from an over-reliance on huge and often wasteful investment projects that have girded decades of past expansion.