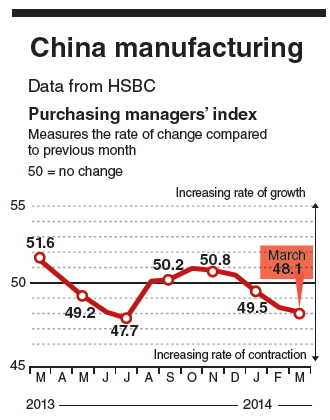

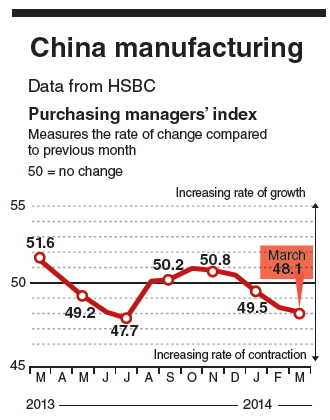

A Chinese manufacturing index unexpectedly fell, underscoring the risk that leaders will need to add stimulus to meet this year’s economic-growth goal.

The Purchasing Managers’ Index from HSBC Holdings Plc and Markit Economics dropped to 48.1 in March, the companies said Monday. The preliminary reading compares with the 48.7 median estimate of 22 analysts surveyed by Bloomberg News and February’s final 48.5 figure. Numbers above 50 signal expansion.

The Australian dollar fell and copper extended losses as the report suggested Premier Li Keqiang will have a tougher time meeting a growth target of about 7.5 percent this year amid efforts to curb pollution and financial risks from surging debt. The State Council, or cabinet, said last week that China will speed up construction projects and other measures to support the world’s second-largest economy.

“Weakness is broadly-based with domestic demand softening further,” Qu Hongbin, Hong Kong-based chief China economist at HSBC, said in a statement. “We expect Beijing to launch a series of policy measures to stabilize growth. Likely options include lowering entry barriers for private investment, targeted spending on subways, air-cleaning and public housing, and guiding lending rates lower.”

China’s benchmark Shanghai Composite Index fluctuated after the report and was up 0.3 percent at 10:20 a.m. local time after reversing gains earlier Monday. The Australian dollar dropped 0.2 percent to 90.7 U.S. cents.

|

An employee welds during the manufacture of construction machinery in Sany Heavy Industry Co.’s assembly shop in Changsha, Hunan Province, China. (Bloomberg) |

The manufacturing report, known as the Flash PMI, is typically based on 85 percent to 90 percent of responses to surveys sent to purchasing managers at manufacturers. The final reading will be released April 1.

On the same day, the National Bureau of Statistics and China Federation of Logistics and Purchasing will publish their own survey of purchasing managers at about 3,000 manufacturing companies. The official gauge’s February reading was 50.2, an eight-month low and down from January’s 50.5.

The PMIs have increasingly become a barometer of China’s economy for global investors. One advantage is that they’re among the first gauges for each month, as government reports on trade, industrial output and retail sales typically are released several weeks later.

Monday’s report gives some indication of how much a slowdown in the first two months of the year extended into March. Economists at companies including JPMorgan Chase & Co. and Goldman Sachs Group Inc. earlier this month cut their projections for China’s growth after fixed-asset investment rose at the slowest January-February pace since 2001, industrial production trailed estimates and exports fell by the most since 2009.

The median estimate for first-quarter gross domestic product growth dropped to 7.4 percent in March from 7.6 percent in February, according to Bloomberg News surveys of analysts. For the full year, the median forecast slid to 7.4 percent, which would be the weakest annual pace since 1990.

The recent economic data and retention of the same growth target as last year have spurred speculation that China will loosen monetary policy. Eleven of 21 economists surveyed by Bloomberg this month see a cut in banks’ reserve-requirement ratio in 2014, compared with six out of 18 analysts in February.

Premier Li, speaking March 13 at an annual press briefing, said there’s some flexibility around the growth target this year, without specifying how much of a slowdown he would tolerate. He also indicated confidence in achieving the goal without stimulus.

The State Council indicated in a statement this month the government will try to front-load spending without enacting new measures. Li is also trying to fulfill pledges in his first annual government work report delivered March 5, where he vowed to “declare war” on pollution and address debt risks.

Those dangers have been marked by events this year that include China’s first onshore bond default, with solar-cell maker Shanghai Chaori Solar Energy Science & Technology Co. failing to pay creditors in early March.

Also this month, government officials familiar with the matter said Zhejiang Xingrun Real Estate Co., a closely held real estate developer with 3.5 billion yuan ($562 million) of debt, collapsed and its largest shareholder was detained. In January, a 3 billion-yuan China Credit Trust Co. product that lent money to a failed coal miner was bailed out, avoiding a default.

BYD Co., the Chinese automaker backed by Warren Buffett’s Berkshire Hathaway Inc., projected first-quarter profit that fell short of estimates, sending its shares down 14 percent in Hong Kong on March 20. BYD estimated profit of as low as 5 million yuan in the January-to-March period, implying a decline of as much as 96 percent from a year earlier. (Bloomberg)