|

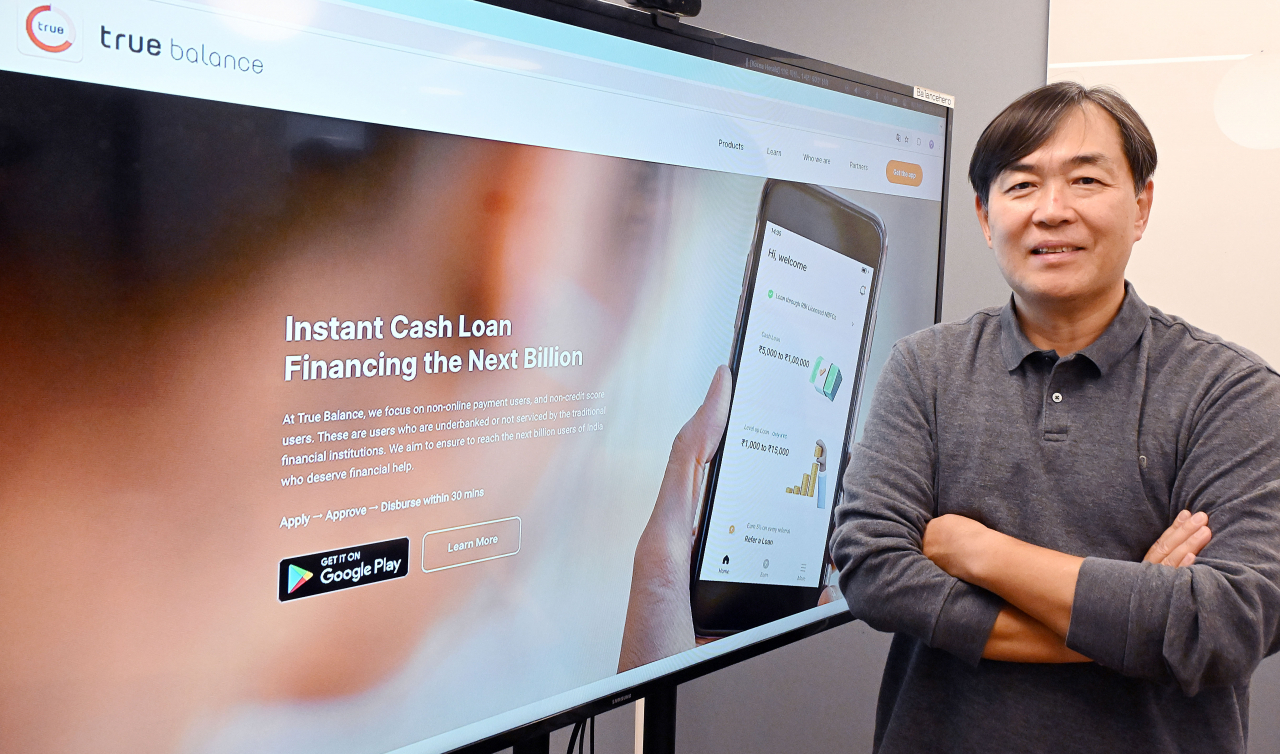

Fin-tech app Balancehero founder and CEO Charlie Lee speaks during an interview with The Korea Herald held at Balancehero's office in Seoul on March 26. (Lee Sang-sub/The Korea Herald) |

South Korean founder and CEO of India-focused mobile finance tech firm Balancehero is seeking to gain further momentum by taking a segmentation approach to India’s vigorous economic run.

"My Indian friends often likened India to an elephant: challenging to set in motion, but once spurred into action, its force is thunderous. Now, it seems the elephant has begun its stampede,” said Balancehero CEO Charlie Lee said in a recent interview with The Korea Herald.

Lee foresaw such exponential growth when he selected India as the location for his business in 2014. As an overseas sales expert with prior experience at a South Korean telecommunication company, he had a deep understanding of the dynamics of Asian economies.

"It took me less than five minutes to pick India," Lee recounted, highlighting its market size, growth rate and market maturity as decisive factors that led to his swift decision.

Despite global economic challenges, India's growth remained robust, surpassing 7 percent on average last year and peaking at 8.4 percent in the final quarter of 2023.

Capitalizing on this strong growth, Balancehero, operator of the fintech app True Balance, exhibited stellar performance, with sales soaring 900 percent over three years to reach 84.5 billion won ($62.4 million) in 2023, while its loan book expanded 11-fold to 430 billion won.

India's next billion

Fueling India's economic surge is its aspiring middle class, defined by Lee as those earning between $2,700 and $7,700 annually. Comprising approximately 1 billion people -- 70 percent of the population -- this segment is three times the US' entire population and 20 times that of South Korea.

"We position ourselves as a 'segment player,' targeting this specific group -- the 'next billion.' This market is experiencing the fastest growth among all segments in the country," Lee explained.

Leveraging the thriving prepaid mobile market, True Balance entered India in 2016, offering data management services. Within a year, it amassed 3 million users and expanded to include recharge payments.

"Given 1 billion people purchasing packages four to five times a month, we're looking at 4-5 billion monthly transactions, making it one of the largest volumes from a single payment market," Lee remarked.

|

Local employees of fin-tech app Balancehero are working in the company's Indian office in Gurugram, northern India, in this picture provided by the company. (Balancehero) |

Text messages for credit evaluation

As Lee geared up to launch lending services through True Balance, he recalled his local friends' apprehensions about the risks involved.

"In India, only around a quarter of the population have credit scores," he noted.

Creating an alternative credit scoring system was thus essential, and building the groundwork for Balancehero's credit evaluation engine was the years spent processing customers' data and call balance.

The company collected information, including app usage, screen time and even phone models, to understand their social behavior. But the most important source was the text messages, which contain crucial transaction information.

"Hence, for us to build a risk management system, processing these messages can be more critical than processing bank statements," Lee stressed.

He noted that with credit information from over 80 million users, Balancehero's credit-building model sets it apart and enhances its competitiveness in the market.

Know thy customer

Lee emphasized the importance of pinpointing targets based on genuine needs. True Balance specializes in microloans ranging from 1,000 to 100,000 rupees ($12-$1,200), with short repayment periods of three to six months. Recently the firm also tested slightly larger loans with a 12-month repayment period.

"The average income in India is 300,000 to 350,000 won. Our target customers earn between the range of 300,000 and 1.5 million won. And these people come to us when they urgently need small amounts of money that they can pay back in a few months," Lee explained, citing instances such as sudden illness, business expansion, or unexpected accidents.

Despite a delinquency rate of 7 to 8 percent -- higher than traditional banks' average of 3 percent -- Lee considers it manageable due to the smaller loan amounts and shorter repayment periods.

"It's about focus. By narrowing down loan amounts and repayment periods, we gain insights into this segment's unique financial needs, allowing us to tailor our services and manage risks efficiently," Lee emphasized.

|

Fin-tech app Balancehero founder and CEO Charlie Lee poses for picture during an interview with The Korea Herald held at Balancehero's office in Seoul on March 26. (Lee Sang-sub/The Korea Herald) |

The next phase for True Balance may involve micro-insurance, reflecting user demand from True Balance users. Looking ahead, Lee envisions entering the deposit business, leveraging credit data from its ACS system.

"Right now, our monthly new loans reach around 50 billion won, and for this, we take out 340 billion won from the banks every month. As our company expands, we'll need to establish our own funding source, which ultimately points to deposit-taking," Lee said.

Going public

As Balancehero matures into its 10th year, during which it has amassed around 100 billion won in funding from its investors, it is considering options to exit investors, likely through a stock market debut.

The markets under consideration include London, the US and Singapore, along with South Korea, where its headquarters and many of the investors are based. The final destination has not been confirmed, Lee stated, adding the decision will be made soon.

"At least next year or after, I'm thinking of exiting the investors," he said, implying he will initiate the pre-IPO process around then.

Lee also has his sights set on overseas expansion, awaiting the opportune moment. While Balancehero first launched True Balance in India, the firm's mission, "finance for all," is applicable to any developing country lacking inclusive financial systems.

"Every startup has its problem statement, ours being 'finance for all.' This mission will remain central to our endeavors regardless of our destination," he affirmed, singling out Indonesia as a potential market for future ventures.

Meanwhile, Balancehero, which started off with a modest team of 10 individuals, has since grown into a company of 250 staff at its Gurugram office. Last year, the company also joined three of India's leading fin-tech associations, including the Internet and Mobile Association of and Digital Lenders Association of India, and received the ISO 9001 certification.