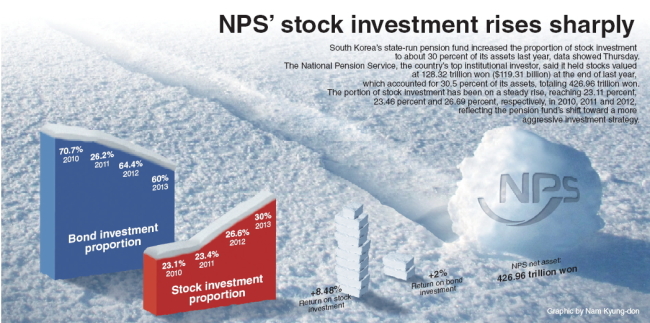

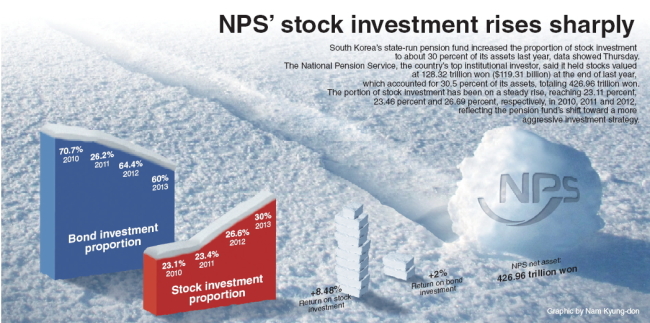

South Korea’s state-run pension fund increased the proportion of stock investment to about 30 percent of its assets last year, data showed Thursday.

The National Pension Service, the country’s top institutional investor, said it held stocks valued at 128.32 trillion won ($119.31 billion) at the end of last year, which accounted for 30.5 percent of its assets totaling 426.96 trillion won.

The portion of stock investment has been on a steady rise, reaching 23.11 percent, 23.46 percent and 26.69 percent, respectively, in 2010, 2011 and 2012, reflecting the pension fund’s shift toward a more aggressive investment strategy.