Hyundai Motor chairman Chung Mong-koo and his son’s bid to sell some of their stakes in their business empire has failed.

But this will not hinder the Chung family’s attempt to accelerate a father-to-son management transfer inside the world’s fifth-largest automaker, observers said.

On Monday, Chung and his son Eui-sun, who is also the vice chairman of the nation’s top automaker, reportedly sent a notice to institutional investors that they plan to sell a combined 13.4 percent of the logistics firm Hyundai Glovis, but failed to find a suitor. Their value is estimated at 1.3 trillion won ($1.1 billion) based on the closing price on Monday and the owners sought a block deal, with a discount of 7.5-12 percent.

The main reason to the failure is seen to be the hefty price: A lump-sum of 1.3 trillion won appears hefty even for those who have been interested in the company for a long time, market insiders said.

“There are no immediate plans to resume the sales bid,” a Hyundai Motor official said.

However, analysts suggest that the Chung family will continue to seek the stake sales. Firstly, they need the money, and secondly, they need to streamline corporate governance to avoid ever-tightening state regulation.

The estimated asking price of 1.3 trillion won is equivalent to the price of 5.6 percent of the shares Hyundai Steel holds in Hyundai Mobis, an auto parts manufacturing unit of the business group and de facto holding company of the conglomerate.

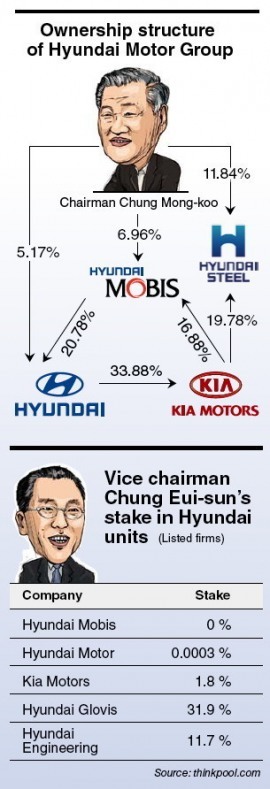

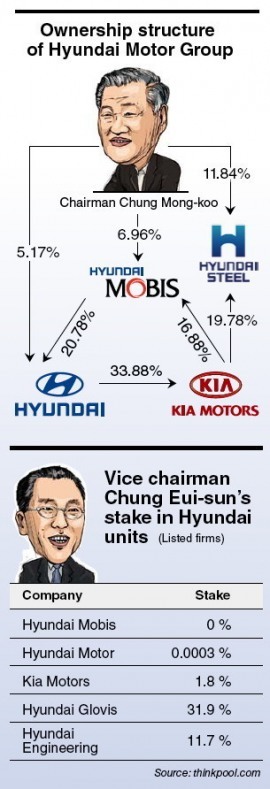

Mobis is the largest shareholder of Hyundai Motor Co. with a 20.8 percent stake. While chairman Chung owns 6.96 percent of Mobis, his son Eui-sun has no shares. And there have been speculations that the senior Chung may buy Hyundai Steel’s lot and give it to Eui-sun in order to secure the son’s rcontrol over Hyundai Motor Group through Mobis.

“After Hyundai Motor Group announced its jaw-dropping plan to invest 10 trillion won in real estate development in southern Seoul for a new headquarters building in September, the price of Mobis stocks dropped by nearly 30 percent. Even if the father and son have to pay heavy donation tax of up to 20 percent, the timing couldn’t be better,” an analyst said.

From a business point of view, the Chung family needs to reduce its shares in Glovis in order to avoid the heavy regulation on intragroup transactions levied on large enterprises whose owners and families own stakes of 30 percent or more in other affiliates. Chairman Chung has 11.5 percent and his son has 31.9 percent, exceeding the government limit.

“If sold, the shares could have saved the father and son from paying 10 billion won annually in fair trade tax,” Cho Su-hong, a stock analyst, was quoted as saying.

The junior Chung, who is attending the Detroit Motor Show, also emphasized that the deal was for “corporate governance” rather than managerial succession.

“Judging by the amount of discount offered, we can see that the Chung family is determined to get rid of their shares quickly, no matter the reason. It is certain that they will try for a sale again,” another analyst said.

By Bae Ji-sook (

baejisook@heraldcorp.com)