Korea’s Free Trade Agreement with the European Union, which is to celebrate its second anniversary on Monday, was the country’s seventh trade pact, and the one of largest scale.

Upon its effectuation in July 2011, the government assured that the pact would bring tangible benefits to the economy by lowering the tariffs on Korea’s key strategic export items, such as cars, electric devices and textile goods.

After two years of implementation, however, the economic leverage of the Korea-EU FTA still seems to be subject to disputes.

The European Union, the largest economic bloc in the world, is also Korea’s second-largest trading partner, ranked after China.

Back in 2010, the nation’s total trade volume and export volume with the EU were $92.2 billion and $53.5 billion, respectively. The trade balance surplus, too, was $14.8 billion, which was 1.6 times larger than that with the U.S., according to the Ministry of Trade, Industry and Energy.

The Korea-EU FTA reflects Europe’s appreciation of Korea’s geographic and economic significance as it is the EU’s first-ever trade pact to be signed in the Northeast Asian region.

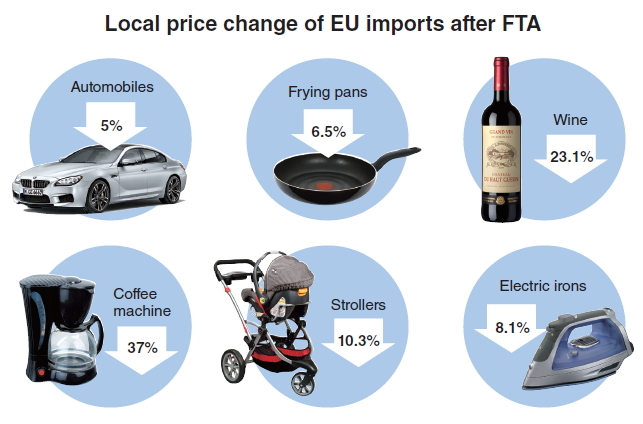

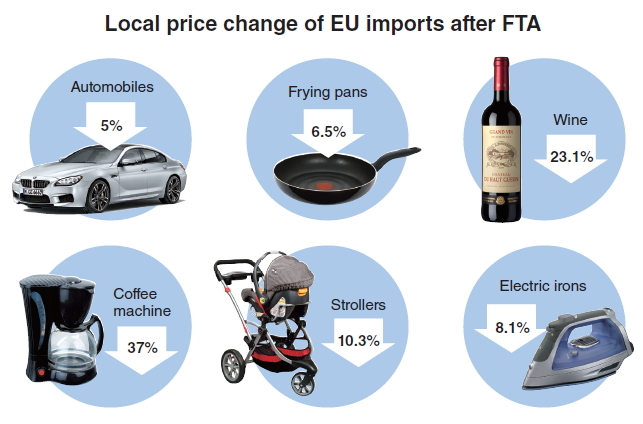

It is a comprehensive agreement, allowing a wide range and level of tariff cuts on most of the key trade items, such as coffee machines, wine, strollers, electric irons, frying pans and cars. The consumer price of the corresponding items in the domestic market thus fell by a considerable margin.

The overall trade figures over the past two years, however, did not meet the original expectations.

According to the ministry’s recent data, Korea’s exports to the EU from last July to May this year amounted to $43.7 billion, down 6.5 percent on-year.

Additionally, the period marked the first trade deficit in Korea-EU exports since 1998 at minus $1 billion, according to the Korea Customs Service.

Also, the amount of foreign direct investment during the same period fell 13.3 percent on-year to $3.3 billion, data showed.

“The decline is mainly attributable to the decrease in demand, triggered by the financial crisis and resulting economic stagnation in the European region,” said Vice Minister Kim Jae-hong.

The decline was especially visible in the heavy industries, in which most of the major customers are based in Europe.

The effects of the FTA were nevertheless visible as the margin was minimal for tariff-cut items, proving that the trade pact acted as a safety net, the ministry claimed.

Adding to the skepticism over the significance of the Korea-EU FTA, concerns are now being raised that a possible U.S.-EU trade pact could stymie the benefits of Korea’s FTA with the EU.

During the G8 summit held in May in Northern Ireland, U.S. President Obama and leaders of the EU member states officially pledged to kick off talks for the U.S.-EU FTA.

The first round is scheduled to take place this month in Washington with the mutual goal of signing the final pact by the end of next year, according to officials.

The mega trade pact, should it be finalized, would result in the largest trade market as the combined gross domestic product of the U.S. and EU makes up some 47 percent of the world’s economy.

“Korea gained an initiative in the European market by entering the bilateral trade relationship with the EU but may soon lose it, should EU expand its FTA ties with the U.S. or Japan,” said a ministry official.

The ministry-affiliated Korea Trade-Investment Promotion Agency stressed that Korean industries should concentrate on prospective sectors, in order to maintain their current market share.

Representative examples are distribution, energy, environment and sourcing, as well as corporate mergers and acquisitions ― all of which are fortes of Korean companies, officials said.

On the other hand, consumer expectations are once again rising on the price-decrease effect of European cars as the corresponding tariff level is to fall from the current 3.2 percent to 1.6 percent this month.

This change, based on the third round of tariff cuts as stated in the Korea-EU FTA, is expected to bring down the average price of European cars by 500,000 won ($439).

Major automobile brands such as BMW, Mercedes-Benz, Audi and Volkswagen have thus lowered the market prices of their new models, which are to be launched in the next quarter, according to officials.

“Though they are under no obligations, carmakers will feel pressed to cut down on the prices due to the ever-rising level of competition in the market,” said an official.

“The resulting price decrease will eventually act in favor of the consumers.”

By Bae Hyun-jung (

tellme@heraldcorp.com)