We find that demand for replacement equipment (RE) tires in Europe and the US has been slowing down from 2Q16, due mainly to the rise in inventory levels in sales channels.

Global demand growth is continuing at a sluggish pace, estimated around 2% YTD-2016, making it difficult to raise tire prices. Meanwhile, domestic tire companies are likely to post solid operating profit for 2Q16 as a whole, but may see earnings momentum turn sluggish from 2H16 due to the rise in raw material input prices and high base demand.

We thus maintain our sector rating at NEUTRAL. Among the three domestic companies, we prefer Hankook Tire and maintain our HOLD ratings for Kumho Tire and Nexen Tire.

Review of 2Q16 demand: RE demand slowing down in Europe and the US

Compared with 1Q16, positives for 2Q16 global tire demand included the rise in original equipment (OE) tire demand (+11% YoY for Apr-May) in Europe. Normalization of Hyundai Motor Group‘s global production from 2Q16 added to the positives for domestic tire makers.

However, we find that demand for RE tires in Europe (accounting for 23% of global tire demand) and in the US (accounting for 19%) has been slowing down from 2Q16, due mainly to the rise in inventory levels in sales channels and the subsequent cutback in order placements by dealers.

Global demand growth has been continuing at a sluggish pace since 2015, estimated around 2% for YTD-2016. Limited demand growth, in line with our initial expectations at the start of the year, is making it difficult for tire makers to raise tire prices.

With difficulties in raising prices weighing on sentiment toward domestic tire makers, we maintain our NEUTRAL rating for the sector.

2Q16 likely solid but profitability to dip in 3Q16

Despite challenging market conditions, Hankook Tire and Nexen Tire should continue to post solid earnings for 2Q16 as in 1Q16, with KRW depreciation leading to stronger sales and higher ASP levels.

Operating profit growth should also continue at double-digit levels for 2Q16, in line with market consensus, backed by the rise in sales and decline in raw material input prices.

Meanwhile, Kumho Tire should report stronger operating profit for 2Q16 versus 1Q16, but slower-than-expected improvement should keep sales roughly 18% short of current market consensus.

In addition, we expect the pre-tax profit of all three domestic tire makers to fall short of market consensus, due to FX translation losses from the USD-denominated borrowings of Chinese subsidiaries following RMB devaluation at the end of the quarter (detailed earnings preview numbers for the three companies will follow).

In all, domestic tire companies are likely to post solid operating profit for 2Q16 as a whole, but may see earnings momentum turn sluggish from 2H16 due to the rise in raw material input prices and high base.

Prefer Hankook Tire; HOLD maintained for Kumho Tire and Nexen Tire

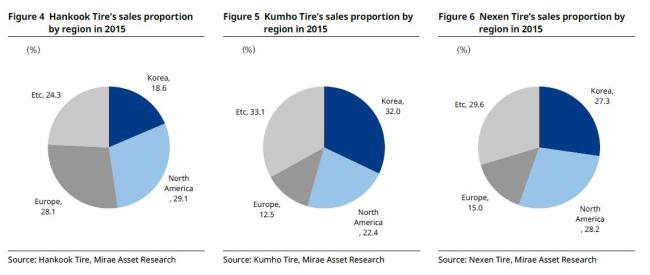

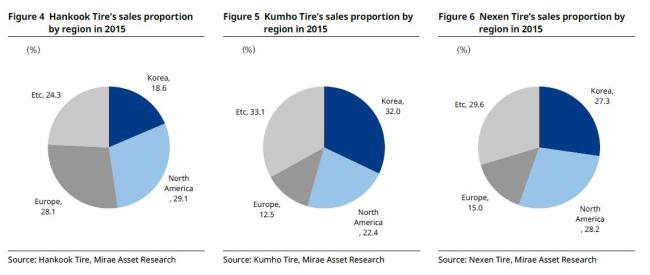

Among the three domestic companies, Hankook Tire depends the most on the European market for sales, and concerns are thus rising over the Brexit impact on demand.

Nevertheless, the company continues to boast the steadiest earnings power among the three. With shares also trading at the lowest valuation levels among the three, we continue to prefer Hankook Tire.

Kumho Tire shares sharply gained in June from stake sale issues, but our base-case scenario puts the fair price of shares at KRW8,500. For Nexen Tire, we lower our target price to KRW14,000 (from KRW15,000) reflecting downward adjustments made to full-year earnings forecasts.

With the growth stock premium dissipating, peer-average P/E levels look fair for tire sector shares.

Source: Mirae Asset Securities http://securities.miraeasset.co.kr/eng/jsp/main.jsp