This is the 44th in a series of articles analyzing major companies traded on the tech-heavy Kosdaq market. -- Ed

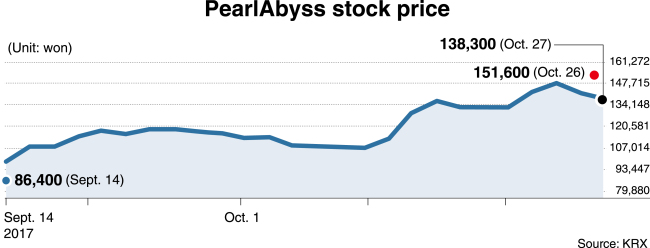

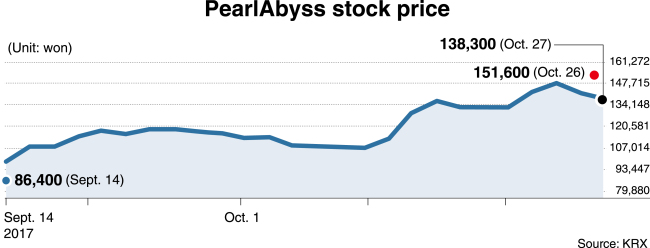

In its seven years of operation, Pearl Abyss has produced just one game -- “Black Desert Online” – but after a weak debut last month its shares have risen 30 percent.

Debuting on Sept. 14 on the second-tier Kosdaq, the game developer, based in Anyang, Gyeonggi Province, has been on a tear in the market for the last two weeks.

Pearl Abyss shares gained 28.7 percent the 10 trading days through Friday, the 20th-steepest climb out of the Kosdaq’s 1,254 firms. It closed at 138,300 won ($122.90) Friday, down 2.4 percent from Thursday.

The market cap stood at 1.67 trillion won Friday, becoming the 14th-largest company on the biotech-dominant Kosdaq. It is Korea’s third-largest games firm, following Kospi-listed giants Netmarble Games with 15.1 trillion won in market cap and NCSoft with 9.26 trillion won.

Pearl Abyss’ initial public offering in September valued the firm at 1.2 trillion won in market cap with its stock initially fixed at 103,000 won. The firm sought to raise capital worth 185.4 billion won from investors.

But Pearl Abyss stocks were undersubscribed -- underwhelming for what was one of the biggest IPOs in the third quarter. Individual investors bought only 43 percent of the initially offered stocks, with the rest going to institutional investors. It marked the second time this year a subscription ratio on the Korean stock market was below 1.

Some cited that investors had learned from Netmarble Games that a large-cap game-related stock would be overvalued in its IPO.

Netmarble Games entered the Kospi market on May 12, drawing 2.7 trillion won in offering shares. But the stock price of the local game sector bellwether, initially offered at 157,000 won, dropped to 123,500 won in mid-August, translating into a loss of over 2 trillion won in market cap, on weak on-quarter performance in the second quarter.

|

(Pearl Abyss) |

Pearl Abyss managed to buck the downtrend, Kim Han-kyung, an analyst at IBK Securities, told The Korea Herald, mainly on the rosy outlook for PC games’ expansion onto mobile platforms.

“The fate of Pearl Abyss on the stock market lies in the performance of the game’s online adaption, which is now drawing a heap of investor attention,” Kim said. Pearl Abyss seeks to take preorders for the mobile version from as early as November and to launch next year.

Black Desert Online, available in more than 100 countries, is an open-world massively multiplayer online role-playing game launched in July 2015 in Korea, about half a year after its closed beta version was released. Run on Pearl Abyss’ own fantasy world-depicting engine and intellectual property, the MMORPG has become one of the most popular games in Japan, Russia, Taiwan and many other territories in Europe and North America.

Analyst Oh Dong-hwan of Samsung Securities attributed eased risks for excessive volume of stock transactions that might have “overhung the stock” to the sudden uptrend in the past two weeks, in addition to optimism about the game’s adaption to the mobile and video game console platform all slated for next year. Nearly 9 percent of Pearl Abyss stocks held by board members were forced to be withheld until Oct. 16, but few shareholders sold off shares on the cited date, wrote Oh in a note.

|

(Pearl Abyss) |

The PC game is also eyeing an entrance to the Chinese market, plans of which have been suspended allegedly due to China’s retaliation against Korea’s deployment of the Terminal High Altitude Area Defense anti-missile system.

If business in China should be met with indefinite suspension, Pearl Abyss’ performance on the Kosdaq will still remain intact, said IBK Securities’ Kim.

Kim Dae-il, the founder and chairman of Pearl Abyss who was formerly a developer of online games including “Continent of the Ninth,” owns 39.04 percent of Pearl Abyss, according to a regulatory filing on Sept. 21.

By Son Ji-hyoung

(

consnow@heraldcorp.com)