|

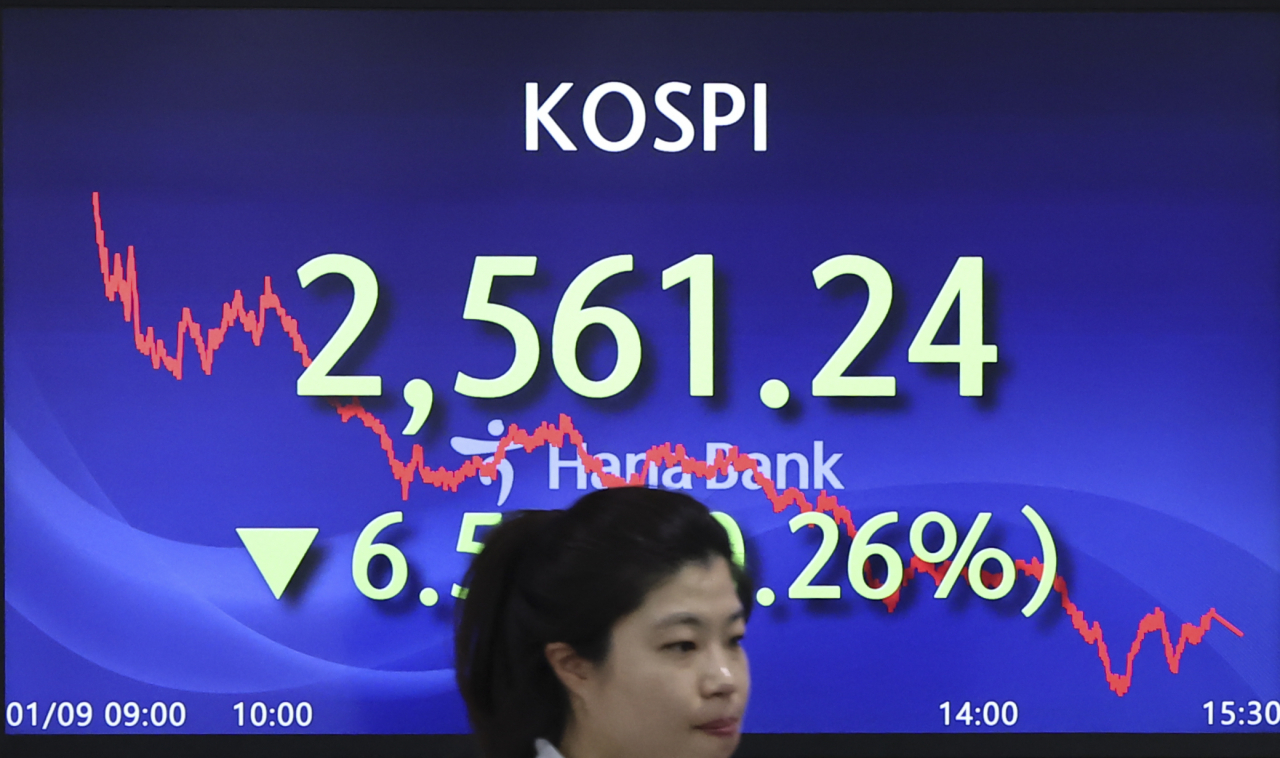

An electronic board showing the Korea Composite Stock Price Index at a dealing room of the Hana Bank headquarters in Seoul on Tuesday. (Yonhap) |

South Korean shares closed lower Tuesday for a fifth consecutive session as institutions continued their selling spree. The local currency slightly rose against the US dollar.

The benchmark Korea Composite Stock Price Index shed 6.58 points, or 0.26 percent, to close at 2,561.24.

Trade volume was moderate at 782.4 million shares worth 8.76 trillion won ($6.66 billion), with gainers outpacing loser 573 to 288.

The Kospi stayed in positive terrain throughout the session following overnight gains on Wall Street but lost earlier gains after institutional investors turned to selling.

"The Kospi came close to breaching the 2,650 mark shortly after the market opened but returned most early gains as net buying by institutions shrank," Lee Kyung-min, an analyst at Daeshin Securities, said.

"Samsung Electronics turned lower after reporting a 4th quarter earning shock, which appears to have put additional downward pressure on the Kospi," the analyst added.

Samsung Electronics forecast its operating profit for the fourth quarter of 2023 to shrink 35 percent on-year to 2.8 trillion won, falling far short of a market estimate of 3.9 trillion won compiled by Yonhap Infomax, the financial data firm of Yonhap News Agency.

Institutions net sold 67.3 billion won worth of local shares, extending their selling spree to a fifth consecutive session. Individuals offloaded a net 10.4 billion won, while foreigners scooped a net 73.8 billion won.

Large caps closed mixed.

Market kingpin Samsung Electronics lost 2.35 percent to 74,700 won, while No. 2 chipmaker SK hynix added 1.03 percent to 137,400 won.

Top internet portal operator Naver gained 1.32 percent to 229,500 won, with leading mobile service provider SK Telecom advancing 0.72 percent to 49,250 won.

Leading automaker Hyundai Motor slipped 0.05 percent to 185,600 won, while its smaller affiliate Kia Motors climbed 0.22 percent to 89,100 won.

The local currency closed at 1,315.70 against the greenback, up 0.30 won from the previous session's close. (Yonhap)