|

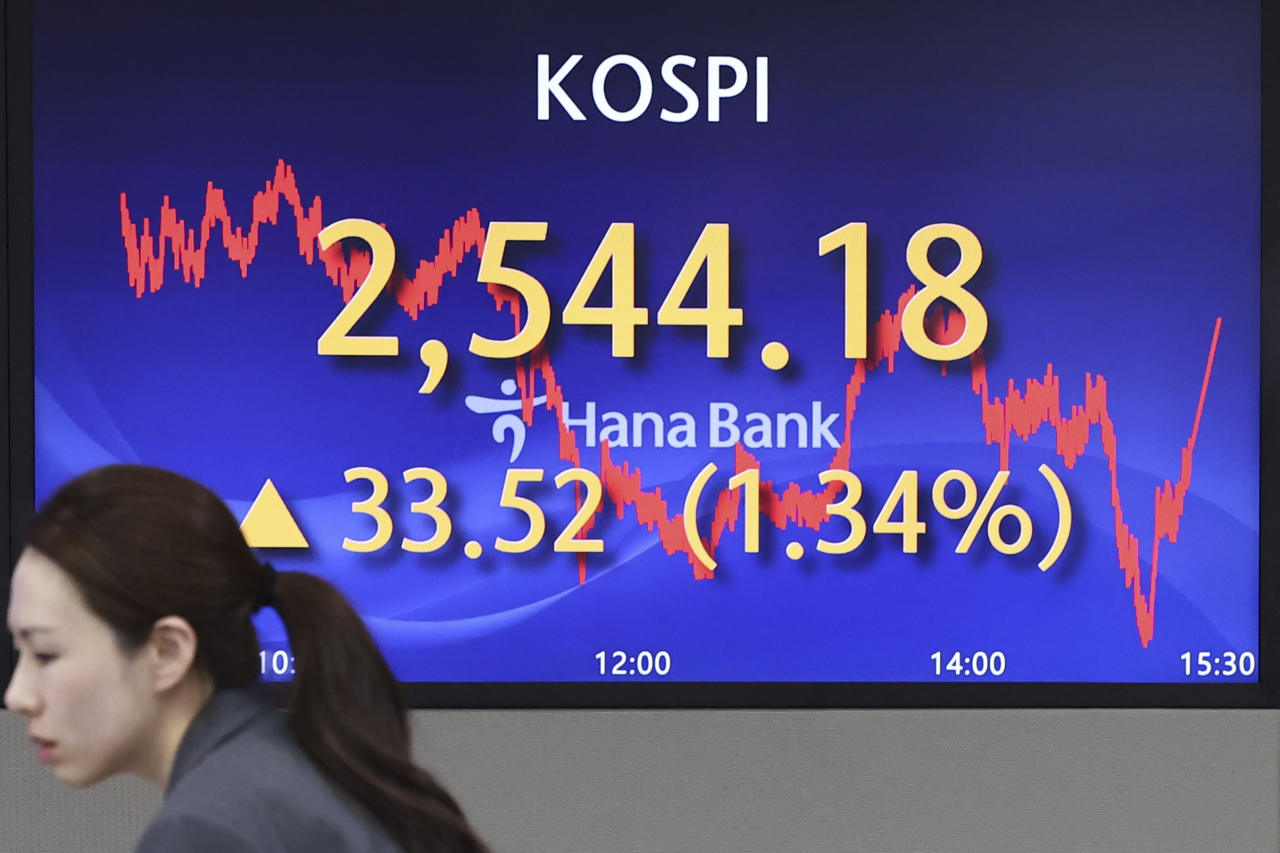

An electronic board showing the Korea Composite Stock Price Index at a dealing room of the Hana Bank headquarters in Seoul on Thursday. (Yonhap) |

South Korean stocks rose sharply Thursday as investors scooped up major tech shares while cheering the US Federal Reserve's hint over rate cuts in 2024.

The benchmark Korea Composite Stock Price Index shot up 33.52 points, or 1.34 percent, to close at 2,544.18.

Trade volume was high at 522.5 million shares worth 12.78 trillion won ($9.8 billion), with winners outpacing losers 463 to 418.

Foreigners bought a net 624.2 billion won, while individuals dumped a net 1.33 trillion won. Institutions bought a net 692 billion won.

Investors scooped up blue chips after the Federal Reserve announced its decision to keep its rate between 5.25 and 5.50 percent, and hinted that its hiking campaign may be near or at an end.

"Blue-chip stocks, particularly in the semiconductor sector, gained momentum fueled by increased foreign buying," said Han Ji-young, an analyst from Kiwoom Securities.

Top tech giant Samsung Electronics shot up 0.41 percent to 73,100 won as investors sought after undervalued blue chips.

No. 2 chipmaker SK hynix moved up 4.19 percent to 136,700 won. Leading battery maker LG Energy Solution gained 3.05 percent to 422,500 won.

Naver, which operates South Korea's top online portal, shot up 4.45 percent to 223,000 won as well, with Kakao also jumping 6.68 percent to 54,300 won.

KB Financial moved up 0.78 percent to 51,900 won, and Shinhan Financial climbed 2.29 percent to 37,900 won.

The local currency closed at 1,295.4 won against the US dollar, up 24.5 won from the previous session's close. (Yonhap)