Company targets sector that grows fast

British American Tobacco Korea is striving to shore up its presence in the Korean market with premium cigarette products.

The Korean unit of the global manufacturer has been diversifying its portfolio of pricey cigarettes with Dunhill and Kent brands in a bid to boost profits amid stagnant population growth and rising health concerns.

Although surging prices of tobacco leaves and labor costs led BAT to hike prices of some products by 200 won (19 cents) in April, Korea’s cigarettes largely remain below 3,000 won a pack, one of the lowest among OECD nations.

“BAT is thought to have suffered profitability deterioration, as ex-factory prices have frozen for nine years. The country’s cigarette prices are relatively low in light of its income level,” Baek Woon-mok, an analyst at Daewoo Securities, said in a report.

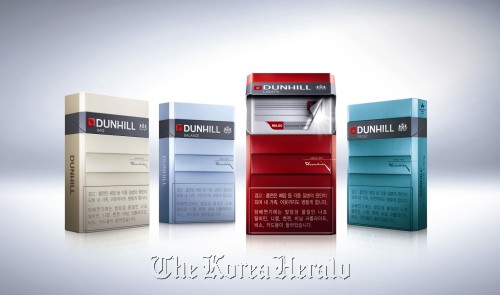

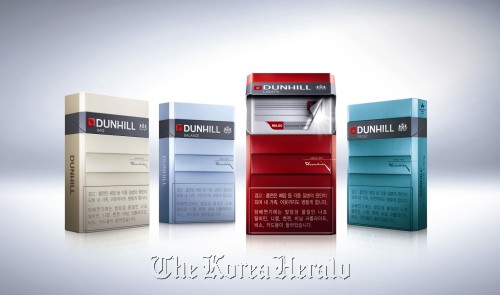

|

Dunhill Reloc |

But the segment of multinational premium cigarettes ― including Dunhill, Kent and Philip Morris International Inc.’s Marlboro and Parliament ― has gradually expanded over the past several years, threatening the dominance of KT&G Corp., according to Euromonitor International.

“Korean consumers became increasingly partial to multinational brands, due to the quality of the tobacco used, as well as their premium packaging,” the London-based research firm said in a report.

“Furthermore, the resistance to imported products, which was previously commonplace in Korea, continued to diminish particularly amongst younger consumers.”

Since its inroads in 1990, BAT has emerged as the No. 2 seller in the world’s eighth-largest tobacco market. It set up a factory in 2002 in Sacheon, South Gyeongsang Province, by injecting around $100 million.

To jack up its 16 percent stake, the company unveiled its capsule filter technology and new packaging last year.

Kent Convertible and Kent Boost give customers an extra burst of menthol when they pop a small ball in the filter.

Kent Convertible, the first of its kind here, took up more than 1 percent within three months after its launch in July 2010, industry figures showed.

“Kent is the second-largest premium brand globally ― outside of the U.S. and China ― sold in over 80 countries,” Guy Meldrum, marketing executive director of BAT Korea, said early this year. “Kent stands for innovation and technology.”

For its Dunhill lineup, BAT churned out a series of new products such as Switch, Nanocut and Fine Cut, and renewed packaging for traditional Dunhill with “Reloc” technology.

The patented inner wrapping method entails a re-sealable double cover to ensure extra freshness for the tobacco.

“Dunhill has been an icon of premium brand in the market,” said chief executive Stephan Liechti. “Dunhill will continue to be a premium leader, keeping the same taste and quality with the premium seal Reloc.”

According to BAT, the premium tobacco sector logged double-digit growth last year and the trend is expected to continue in the coming years.

Another target segment is ultraslim cigarettes.

Dunhill Nanocut and Fine Cut are aimed at biting into the booming market enjoyed by KT&G’s Esse.

“Superslims are a global trend and have been the key design innovation of the last five years, with particular appeal to female smokers but also ‘cross-over’ appeal in a number of markets such as Korea where men have been receptive to the style,” Euromonitor said.

By Shin Hyon-hee (

heeshin@heraldcorp.com)