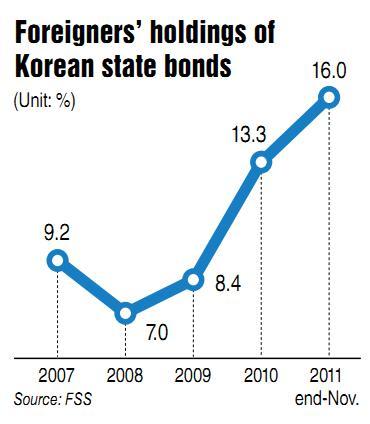

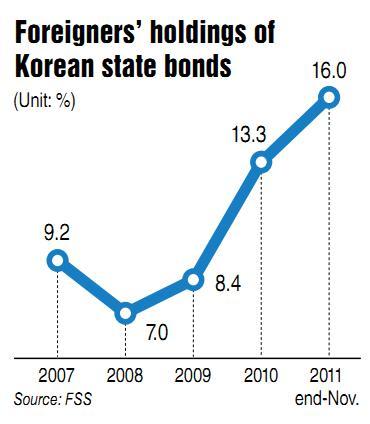

Foreign investors have been raising their holdings in Korean government bonds, data showed on Wednesday, amid mixed reactions about its impact on the Korean economy.

According to data from the Financial Supervisory Service and the Korea Financial Investment Association, the amount of listed government bonds owned by foreign investors reached 63.06 trillion won ($55.9 billion) at the end of November, accounting for 16 percent of total government bond ownership.

The record-high foreign bond ownership, which is up from 13.3 percent recorded in December last year, reflects the shifting view among fund managers in favor of Asian economies with better growth prospects over faltering eurozone countries.

Analysts said the sharp increase is a positive sign, as long as it’s a reflection of heightened confidence in the Korean economy, but the popularity of government bonds among foreign investors could backfire if capital is suddenly pulled out of the local bond market in the face of financial turmoil.

The foreign ownership of Korea’s state bonds stood at 9.2 percent in 2007 and declined to 7 percent in 2008 before rising to 8.4 percent in 2009 and extending its upward momentum this year.

The preference for government bonds, supposedly safe haven investment assets compared with other corporate bonds and riskier instruments, is also illustrated in the structure of bond portfolios managed by foreign investors. The proportion of Korean government bonds among the total holdings including monetary stabilization bonds and corporate bonds rose to 72.8 percent last month, up from 64.4 percent in December last year.

By country, the U.S. leads the pack with holdings of Korean bonds worth 18.8 trillion won, followed by Luxembourg (14.2 trillion won), Thailand (10.9 trillion won), China (10.2 trillion won), Malaysia (7.8 trillion won), Britain (3.5 trillion won) and Singapore (3.3 trillion won).

In particular, China and Asian countries are showing a strong appetite for Korea’s state bonds. China, led by its state-run agencies, raised its holdings from 79.6 billion won in 2008 to 6.6 trillion won in 2010. Malaysian investors’ government bond ownership came in at 4.28 trillion won at the end of last year, expanding from a mere 34 billion won recorded in 2008.

The merits of Korea’s government bonds are expected to draw more funds from foreign investors, but if the ownership level reaches 20 percent, a negative impact could not be ruled out, analysts said.

Foreign investment focused on government bonds could generate massive simultaneous maturation on a regular basis, which in turn adds to volatility in the local market.

By Yang Sung-jin

(

insight@heraldcorp.com)