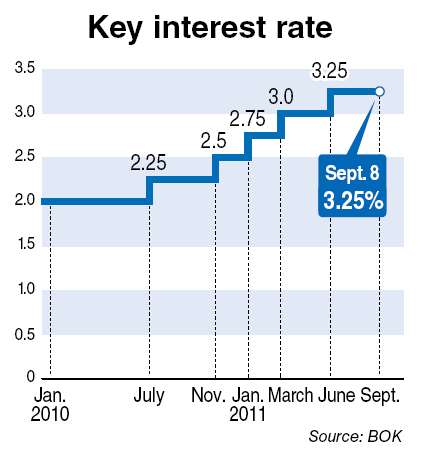

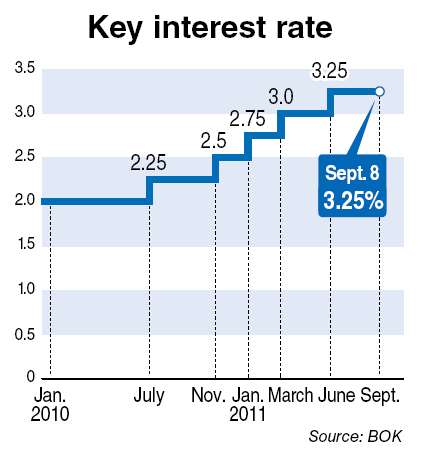

The Bank of Korea kept the benchmark interest rate unchanged at 3.25 percent Thursday despite inflationary pressures, leaving it steady for the third consecutive month.

The decision of the central bank’s Monetary Policy Committee reflected global uncertainty, including the eurozone debt crisis, BOK Gov. Kim Choong-soo told a news conference.

“Consumer prices stay at a high level. But as Korea is highly dependent on global economic conditions, we think that it is proper to take the external factors into consideration,” he said.

He also said it would be difficult for the policy committee to hike the benchmark rate if external conditions continue to remain unstable in the coming months.

The issue is whether the BOK will gloss over the growing inflationary pressure while consumer price inflation reached the 5 percent range in August, due mostly to sharp rises in the prices of agricultural products.

Despite the external factors, the central bank would not scrap the monetary policy for gradual tightening during the fourth quarter, Kim added.

The bank said in statement that “the committee, while closely monitoring financial and economic risk factors both at home and abroad, will conduct monetary policy with a greater emphasis on ensuring that the basis for price stability is firmly anchored while the economy continues its sound growth.”

The nation’s consumer prices surged 5.3 percent in August from a year earlier, faster than 4.7 percent growth in July. Core inflation, which excludes volatile oil and food prices, climbed 4 percent on-year in August ― the highest growth rate in 28 months.

Research analysts are divided over whether the BOK will raise the rate at least 25 basis points during the remainder of the year.

A group of analysts forecast that one rate hike would be feasible in the coming three rate-setting discussion in October, November and December.

Meanwhile, it seems that the BOK’s decision also reflects the situation that the country will see far lower-than-expected GDP growth rate for this year, which might make the bank to raise the interest rate.

Foreign investment banks have revised down their economic growth predictions for Korea, reflecting worsening external factors such as continuing U.S. and European debt woes that could damage the country’s export-driven economy.

Korea’s revised growth rate of 4.0 percent is the lowest among the 10 Asian countries, except for Thailand (3.9 percent).

Morgan Stanley said in a report issued on Aug. 26 that Korea’s economy would rise 3.8 percent this year, a figure revised down from 4.5 percent.

By Kim Yon-se (

kys@heraldcorp.com)