The market valuations of tech giants

Naver and

Kakao stand in stark contrast, with their mobile strategies expected to affect their profitability in the opposite directions.

According to Oh Dong-hwan, an analyst at Samsung Securities, the valuation of Naver is on the rise due to its mobile-focused strategies, while that of Kakao is going downhill as it seeks offline-to-online business models.

The country’s largest portal Naver will continue to post annual growth rates of around 20 percent based on its strong “mobile-only” initiative, the analyst said.

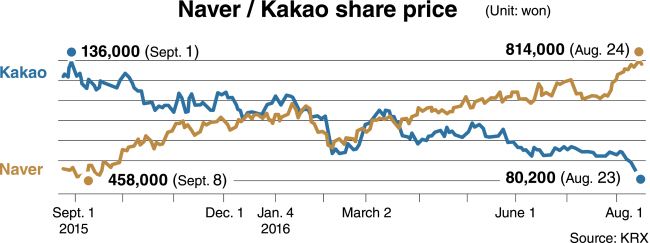

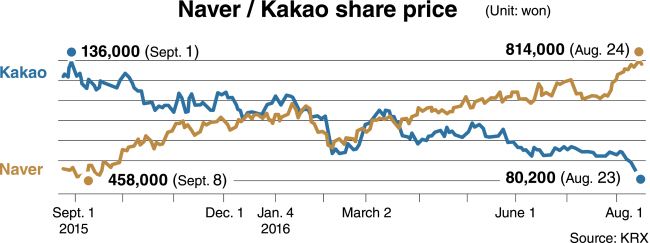

The portal giant that used to rely heavily on desktop PCs is now seeing higher sales from mobile advertisements, especially after the overhaul of its mobile version. The expansion of its mobile shopping businesses that center on Naver Pay is noticeable, raising its stock value by 27.5 percent from early this year.

On the other hand, the analyst projected declines in the profitability of Kakao -- the operator of the biggest mobile messenger application in the country -- citing the company’s recent investment in the online-to-offline business amid falling ad sales. Its share price has plummeted around 30 percent compared to January.

“While Naver is expected to see further growth based on increasing ad sales on its mobile platform and high expectations on Line’s growth, it seems inevitable for Kakao to see falls in profitability in the short term and its valuation seems burdensome,” Oh said.

Naver’s new SNOW app, a video-based communication platform, is gaining popularity, with its number of downloads surpassing 60 million globally. It will be a new profit model for the company, said Oh.

The company plans to use the SNOW app to continue its global expansion, targeting Southeast Asian countries. It set up a subsidiary named SNOW earlier this month.

Line is also expected to bring in higher ad sales as the mobile messenger platform is going to launch new services such as news, he said. The Tokyo-headquartered subsidiary’s value has grown to nearly 10 trillion won ($8.8 billion) after it made a successful dual listing in New York and Tokyo in July, marking the biggest tech initial public offering of the year.

“Expectations of Line’s move onto the Nikkei are rising, sending the company’s value to a higher level,” Oh said.

Meanwhile, the analyst pointed out the sluggish performances of Kakao’s PC-based portals and the aggravating profitability of the online business.

Although the company is scheduled to introduce ads through Kakao Channel, a new content platform connected with all other Kakao services, early next year as a complementary measure, it will need much more aggressive tactics to boost sales, he said.

The analyst raised his target price for Naver by 15.8 percent to reach 940,000 won, while shedding 3 percent for Kakao to 80,000 won.

Naver closed at 804,000 won per share Thursday, down 0.99 percent from the previous trading session, while Kakao finished at 81,000 won, down 1.82 percent.

By Song Su-hyun (

song@heraldcorp.com)