The main opposition party fueled debate on changing the taxation system early this month by proposing to raise taxes for big corporations and high income earners.

The proposal by the Minjoo Party of Korea was met with an immediate objection from Finance Ministry officials, who had left tax rates unchanged in a draft tax code revision disclosed days earlier.

The party’s chief policymaker said he was ready to engage in a heated debate with the government on the direction of taxation overhaul in the upcoming regular parliamentary session that starts next month. He contended the policy to bolster growth through tax cuts for the rich has ended in failure.

Both of the tax code revisions set out by the opposition party and the government, however, fell short of addressing the thorny question of reducing the bloated proportion of waged workers exempted from paying taxes.

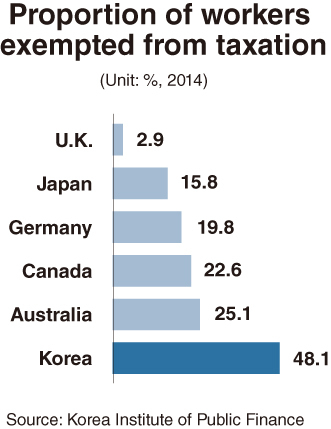

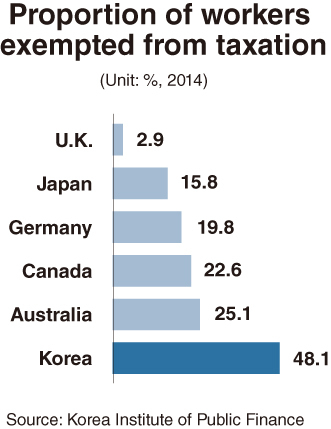

According to a report released by the Korea Institute of Public Finance last month, 48.1 percent of Korean workers went without paying a penny in earned income tax in 2014. The ratio is about 10 percent higher than the average for the 34-member Organization for Economic Cooperation and Development, with the corresponding figures remaining at 2.9 percent in Britain, 15.8 percent in Japan, 19.8 percent in Germany and 22.6 percent in Canada.

Experts indicate that Korea can hardly be expected to maintain fiscal soundness over the long term while leaving nearly half of its waged workers exempted from taxation.

The ratio of wage earners who paid no taxes in the country fell from 47.6 percent in 2006 to 32.4 percent in 2013, before soaring again in 2014 as the government patched up the taxation scheme to placate complaints from salaried workers who were subject to heavier tax burdens.

The tax code revision proposed by the government last month would extend most of the tax breaks that were to be suspended at the end of this year.

“It is necessary to push ahead with increasing levies on high income earners and scrapping tax breaks simultaneously to enhance income redistribution and widen the tax base,” said Kim Jae-jin, a KIPF researcher.

Some economic commentators give positive assessment to the opposition party’s plan for raising the tax rate applied to individuals whose annual earned income is above 500 million won ($455,800) from the existing 38 percent to 41 percent, which they indicate is still lower than the average ceiling of 43.3 percent among OECD members.

The measure, which would affect about 18,000 people, is expected to bring an estimated 400 billion won in additional income tax. The amount may not be a significant increase in revenue but could still be viewed as a meaningful step toward narrowing the income gap.

According to figures from the KIPF, the share of the top 1 percent group in the country’s total income rose from 11.08 percent in 2007 to 11.66 percent in 2012.

Critics say the opposition party’s proposal would do little to improve the distorted structure of the country’s taxation system, as it turns a blind eye to the excessive proportion of waged workers exempted from paying taxes.

Korea’s ratio of income tax to gross domestic product stands at 3.7 percent, far below the OECD average of 8.6 percent. According to figures from the Finance Ministry, the top 10 percent income bracket in Korea accounts for 75.4 percent of total income tax revenue, compared with 69.8 percent in the U.S. and 58.6 percent in the U.K.

Experts note the proportion of wage earners who pay no taxes should be reduced to the 30 percent range if the country’s income tax to GDP ratio is to be on a level similar to the OECD average.

“The revision drawn up by the opposition party would increase the number of workers exempted from taxation more than our version,” said a Finance Ministry official, who asked not to be named.

But critics say the government is in no position to find fault with the opposition party’s proposal as its own tax code revision does little to reduce the overstretch of tax breaks.

In the period leading to next year’s presidential election, it may be politically difficult to put in place any measure unpopular with voters.

Experts say, however, government policymakers and lawmakers should work together to hammer out a new taxation system that could ensure long-term fiscal soundness by both increasing taxes on the rich and reducing the number of workers exempted from paying taxes.

By Kim Kyung-ho (

khkim@heraldcorp.com)