Economic policymakers here are keeping a watchful eye on the recent rise in the value of the won against the dollar, which they worry will be a further drag on the country’s declining exports.

Vice Finance Minister Choi Sang-mok suggested last week that if necessary, the government would take market-stabilizing measures against sharp currency swings.

“We are concerned that the won is appreciating at a particularly fast pace, while the U.S. dollar has been weakening for weeks,” he said.

The Korean currency gained ground against the greenback by about 7 percent over the past month, bouncing back from nearly 1,200 won in the wake of the British vote to exit the European Union in late June. The won-dollar exchange rate closed at a 13-month low of 1,106.1 won at the local currency market Tuesday.

Analysts say the won will continue strengthening as a weaker than expected growth of the U.S. economy in the second quarter eases concerns about a possible U.S. rate hike in the coming months. Also adding up to push up the won’s value are Korea’s long streak of current account surplus, which was extended to a record 54 straight months in July, and foreign investors’ net purchases of Korean stocks in recent months.

The won has also recently recovered losses against the currencies of China and Japan, which was incurred by the shock of the Brexit referendum result. The Korean currency, which was down to 1,160 won per the Japanese yen and to nearly 170 won per the Chinese yuan shortly after the vote, now hovers around 1,080 won and 160 won.

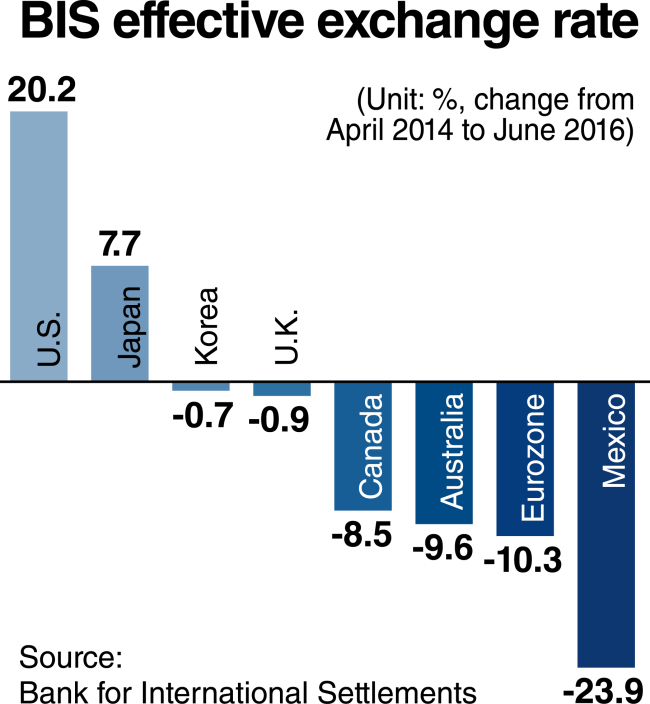

An index compiled by the Bank for International Settlements also shows the won has remained relatively strong in recent years, compared to currencies of major economies.

The BIS real effective exchange rate of the won declined by 0.7 percent from April 2014 to June 2016, during which the Bank of Korea cut its benchmark policy rate on five occasions from 2.5 percent to a record low of 1.25 percent. The figure is far lower than the average reduction of 2.4 percent for the 26 countries covered by the index, which is calculated as weighted averages of bilateral exchange rates, with 2010 as its base year.

Coupled with lowering oil prices and slowing global trade, the strengthening won is expected to continue to weigh down Korea’s exports, which fell for the 19th consecutive month in July. Trade officials hope that the downward trend will be reversed in August but their wish may still remain beyond reach amid the upward currency movement.

What troubles policymakers is they have little effective tools to keep the won’s appreciation in what they see as a proper range.

The central bank is not in a position to further cut the rate anytime soon. Other aggressive measures that can seem to intervene in the foreign exchange market may risk being labeled by the U.S. as currency manipulator.

In April, the U.S. put Korea and four other countries with huge trade surplus with the world’s largest economy -- China, Japan, Germany and Taiwan -- on a currency monitoring list.

If any of the five economies meets a set of criteria used to judge unfair practices under a law passed in February, it would trigger action by the U.S. president to enter discussion with the country and seek potential penalties.

Experts here note reducing currency volatility may be more important than the exchange rate itself for business activities.

“If currency fluctuates too greatly, companies have more difficulties forecasting profits and setting up investment plans,” said Baek Da-mi, a researcher at the Hyundai Research Institute, a private think tank.

In February, the won soared above 1,234 won against the dollar, the highest level in five and a half years, prompting Finance Minister Yoo Il-ho to suggest the government would take a firm and swift action against excess fluctuations in the currency market.

Finance Ministry officials say they are strengthen monitoring of the foreign exchange market and have a contingency plan to cope with any sharp currency movements.

Experts note the government needs to seek more comprehensive and fundamental measures to prevent risk from currency volatility.

An essential part of such an endeavor, they say, should be a reduction in the country’s current account surplus, which exceeded $100 billion last year, accounting for 7.7 percent of its gross domestic product. The ratio was the seventh largest in the world after Singapore at 19.7 percent, the Netherlands at 11 percent, Norway at 9 percent, Thailand at 8.8 percent and Germany with 8.5 percent.

Efforts to boost exports need to be coupled with measures to increase investments abroad and imports of advanced industrial equipment and facilities that could help bolster the country’s long-term growth, economists say.

They indicate Korea should also actively consider concluding currency swap deals with Japan and other major advanced economies to prepare for another possible turbulence in global markets.

By Kim Kyung-ho (

khkim@heraldcorp.com)