Located in the heart of Asia, Pakistan is the gateway to the financially liquid Gulf states and the economically advanced Far Eastern tigers. This strategic advantage alone makes Pakistan a marketplace teeming with possibilities.

A large part of the workforce is proficient in English, hardworking and intelligent. Pakistan possesses a large pool of trained and experienced engineers, bankers, lawyers and other professionals, with many having substantial international experience, which is available on cost-effective terms.

Current investment policies have been tailor-made to suit investor needs. Pakistan’s policy trends have been consistent, with liberalization, deregulation, privatization and facilitation being its cornerstones.

The capital markets are being modernized and reforms have resulted in development of improved infrastructure in the stock exchanges of the country. The Securities and Exchange Commission of Pakistan has improved the regulatory environment of the stock exchanges, corporate bond market and the leasing sector. Whilst the federal Board of Revenue has facilitated structural reform in tax and tariffs and the State Bank of Pakistan has invigorated the banking sector into high return on investment.

|

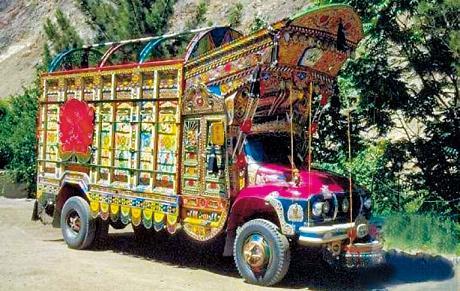

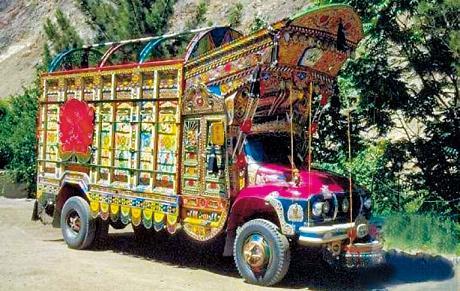

Pakistani truck |

Pakistan’s coal resource potential is estimated to be around 186 billion tons. Of these resources about 175 billion tons are located in Sindh province at Thar ― one of the largest single coal deposits in the world. Thar Coal resources have an estimated potential of generating 100,000 MW of electricity over a period of more than 100 years. Thus, this resource provides a wonderful opportunity for large scale mining & power generation over a long period of time. Thar Coal fields are also located 296 kilometers from Karachi port in the southeastern arid zone region of Pakistan which is one of the most peaceful and harmonious area of the country.

To address the persistent energy gap, the large indigenous coal (lignite) resources at Thar in Sindh Province form an integral part of Pakistan’s long term energy security strategy. The Thar resource has great potential ― depending on the scale of the mining operations ― to be an economic option compared to other energy-sources. The development of Thar is envisioned to emerge through a partnership of government and the private sector, wherein the private sector would assume investment risk subject to viable commercial market conditions and the government would provide the enabling environment and stability necessary to facilitate such investments.

Thar lignite, having a stripping ratio of 6:1 and heating value of 6,200-11,000 BTU/pound, is better than many lignite resources where successful mining and power generation is being done.

Thar Coalfield is declared a Special Economic Zone, and the projects for development of Thar (also including coal mining and power generation) “Projects of National Security.”

Twenty percent (dollar-based) IRR to firms which achieve Financial Close before Dec. 31, 2015 for Mine & Power Plants based on indigenous coal and additional half a percentage IRR i.e. 20.5 percent IARR for firms which Financial Close by or before Dec. 31, 2014.

Exemptions and concessions

― Zero percent customs duties on import of coal mining equipment and machinery including vehicles for site use.

― Exemption on withholding tax to shareholders on dividend for initial 30 years.

― Exemption on withholding tax on procurement of goods and services during project construction and operations.

― Exemption for 30 years on other levies including special excise duty, federal excise duty, WPPF and WWF.

The Potential investment options in Thar Coal include:

Coal mining ― investors interested only in mining may apply for a mine lease for mining the coal.

Integrated Coal & Power Generation Project ― investors may also opt for investing an integrated coal mining and power generation projects.

Mine Mouth Power Project ― Thar coalfields present best opportunity for mine mouth power projects in view of the great demand for energy in the country.