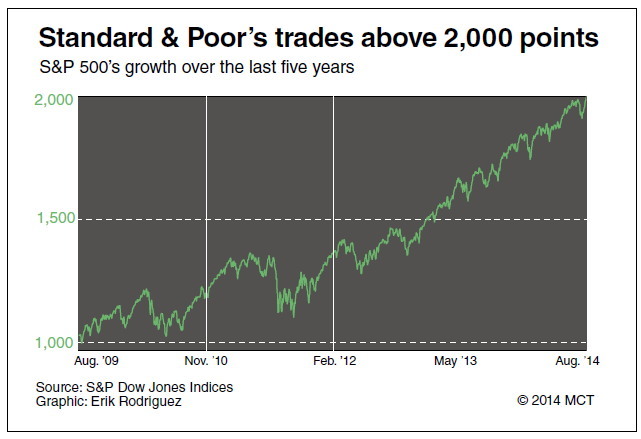

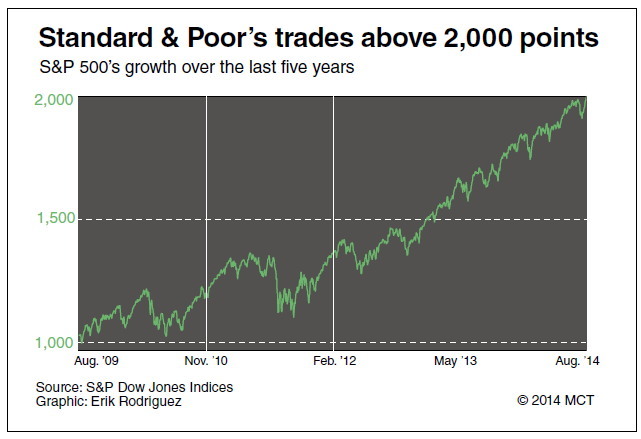

The U.S. stock market notched another first on Monday as the Standard & Poor’s 500 index nudged briefly past the 2,000-point mark and closed with its second record high in a week.

The move was the latest milestone in a five-year rally for U.S. stocks, which are enjoying a late-summer revival after dipping earlier this month on concerns about geopolitical tensions in Russia and the Middle East.

Investors have put aside those concerns for now, focusing instead on the improving outlook for the U.S. economy, rising earnings and corporate deals.

News on Monday that Burger King was in talks to acquire doughnut chain Tim Hortons and create a new holding company headquartered in Canada had stocks pointing higher in premarket trading. That built on word over the weekend that California biotech company InterMune agreed to sell itself to Swiss pharmaceutical company Roche for $8.3 billion. Some other names in biotech also got a boost from the deal.

The deals overshadowed disappointing news in the housing market.

Shortly after the market opened, the Commerce Department reported that sales of new homes slid 2.4 percent last month. Homebuilder stocks declined, but the losses didn’t spread to the broader market. In fact, stocks did the opposite.

The S&P 500, a widely followed barometer of the stock market, crossed above 2,000 in the first hour of trading.

The index fluctuated above and below the milestone throughout the day and ended just below that mark.

“The index number itself is somewhat symbolic,” said David Kelley, JPMorgan Funds’ chief global strategist. “It’s a continuation of what we’ve seen all year.”

All told, the S&P 500 added 9.52 points, or 0.5 percent, to 1,997.92. It closed at a record last Thursday of 1,992.37. (AP)