KDB Financial Group has been in last-minute talks with HSBC to acquire the U.K.-based bank’s retail operations in Seoul.

While KDB Financial chairman Kang Man-soo hinted that the acquisition is at hand, a group spokesman said the timing of the deal is still uncertain.

“There is a low possibility that the talks between the two sides will break down,” he said. “But the timing of an agreement is unpredictable at the present stage.”

Downplaying the rumors that the two sides reached a consensus on details on April 2, he said, “The two sides are still fine-tuning a variety of sale terms and takeover price.”

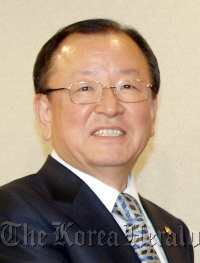

|

Kang Man-soo |

But he said KDB Financial does not rule out the possibility that the two sides will reach an agreement in several days or weeks.

A spokeswoman of HSBC Korea reiterated its position that it “cannot make any comment on market rumors.”

Over the past few months, KDB Financial has been striving to acquire 11 retail branches of HSBC Korea.

Speculation had it that HSBC will close down its retail business operations in Korea this year.

Kang continued to vow to buy a local bank as part of efforts to privatize the group and beef up its competitiveness.

The Financial Services Commission, the nation’s financial regulator, scrapped a plan to sell Woori Financial Group to KDB Financial in June 2011, due to public criticism.

A takeover of a bank is critical for KDB Financial Group because the group needs to expand its deposit base before privatization.

The government, which owns 100 percent of the group, must start reducing its stake no later than May 2014 under the current blueprint for KDB’s privatization.

Kang has said the state-run financial group will sell 10 percent of the shares held by the government by the end of 2012.

He said the stake sale will be carried out through the group’s planned listing, or pushing for initial public offering, on the stock market.

Following similar remarks by chief financial regulator Kim Seok-dong a day before, Kang’s willingness toward the group’s listing on the Korea Exchange hints at public officials’ revitalizing KDB’s privatization process.

Kang, a former finance minister, has been strongly supportive of creating a gigantic financial firm, or so-called mega financial company, through takeovers in a bid to secure the group’s competitiveness in the global market.

By Kim Yon-se (

kys@heraldcorp.com)