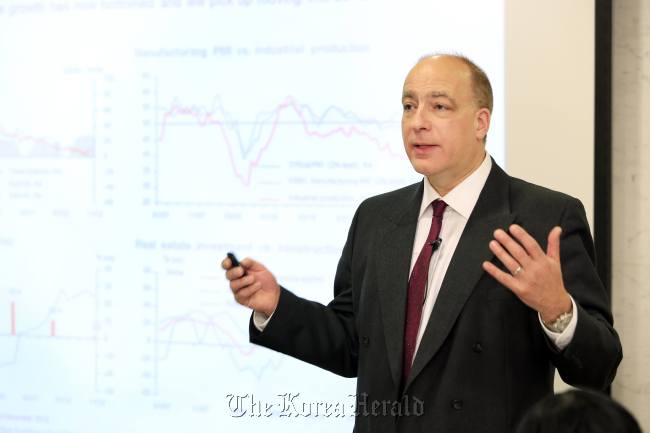

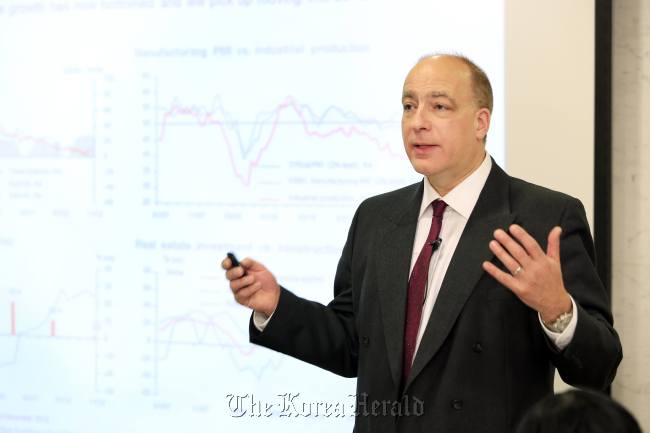

The year 2013 will be the investors’ struggle for a comeback amid a low-yield environment, making high-yield bonds and emerging market equities attractive, said Philip Poole, global head of macro and investment strategy at the Hongkong and Shanghai Banking Corp. on Monday.

According to HSBC’s scenario, the key developed world interest rates will stay close to zero for at least another two years.

Poole advised investing in emerging countries rather than developed countries, and to go for private bonds rather than state-issued bonds.

He claimed that, in the next 10 years or so, the yields from state-issued bonds from developed countries likely will stay close to zero. Investment in emerging market countries and high-yield bonds are high in risk, but worth taking note, he said.

|

Philip Poole, HSBC global head of macro |

Last year, 2012, was a choppy trading environment for financial assets, Poole said in a press conference in Seoul, with the first quarter of 2012 shooting up with yields, but then crashing with the massive sell-offs in the second quarter. The market rebounded as the European Central Bank intervened in the third quarter, and remained relatively strong in the fourth quarter.

Poole claimed that what happens in the ongoing eurozone crisis, the U.S. fiscal adjustment and the outlook for China are the three critical factors for the 2013 outlook for bond investment.

“Europe has some characteristics that are similar to Japan,” Poole said, pointing to high indebtedness both in the government sector and the household sector. “Deflation has been a persistent threat, despite loose monetary policy, government debt has spiraled higher but nominal bond yields stayed very low.”

“Although the U.S. did not fall off the fiscal cliff, this is not the end of the story,” Poole said, stressing that there are two important deadlines coming up in the next six weeks ― the debt ceiling and timing of spending cuts. The polarization between Democrats and Republicans makes reaching a significant bipartisan deficit cutting deal difficult, he said.

The political horse-trading will now switch to March deadlines for raising the debt ceiling on federal borrowing and the delayed sequester, Poole said, suggesting that these negotiations are unlikely to go smoothly and may disturb the risk appetite again in 2013.

According to Poole, China’s economic slowdown already hit the bottom line and will pick up in 2013.

“China’s economic growth was very weak in 2012, where many people whined about a so-called hard landing in China,” he said.

By Chung Joo-won (

joowonc@heraldcorp.com)