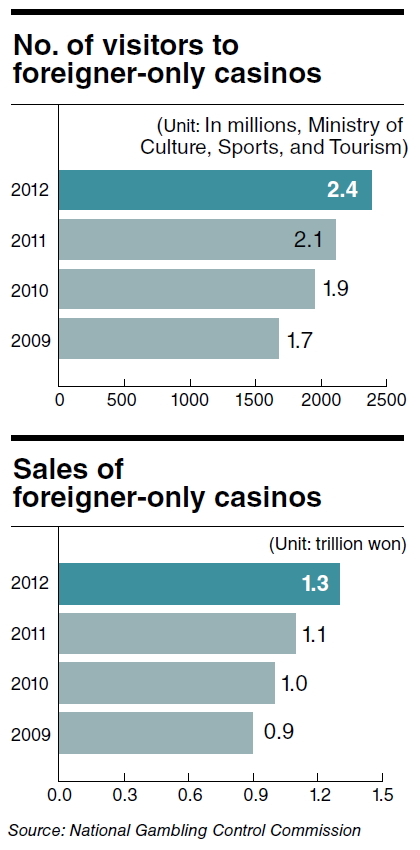

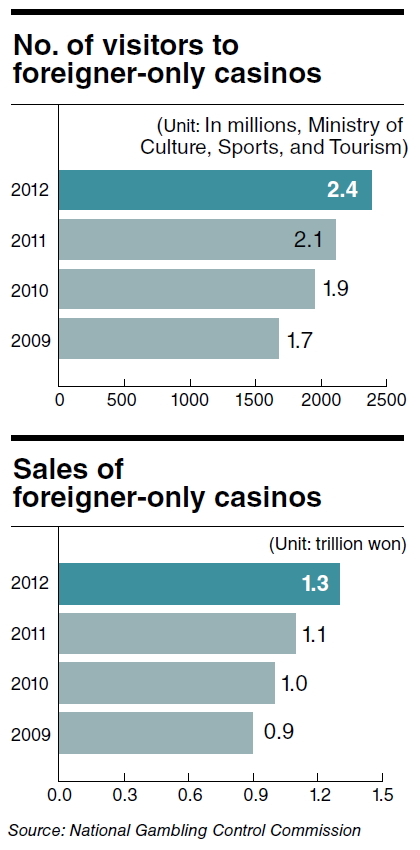

The nation’s 16 casinos exclusive to non-Koreans are enjoying a business boom, marking record-high sales reaching 1.3 trillion won ($1.2 billion) last year, according to the National Gambling Control Commission.

Behind the growth of the casino business is the increased inflow of Chinese visitors. According to the Ministry of Culture, Sports and Tourism on Monday, the number of Chinese gamblers visiting Korean casinos surpassed that of Japanese high-rollers for the first time last year, making up 40.7 percent of total foreign visitors to casinos. Japanese gamblers followed with a 33 percent share.

“We found that there is correlation between the growth of foreigner-only casinos and the increase in Chinese visitors. Visitors to foreigner-only casinos have been steadily increasing since 2005 in response to the sharp rise in Chinese tourists,” Woori Investment & Securities said in a recent report on the nation’s casino industry.

|

Paradise Casino in Seoul is crowded with foreign tourists. |

The number of Chinese tourists to Korea soared 27.8 percent to 3.74 million last year from a year earlier, outnumbering Japanese visitors for the first time, the ministry’s data showed.

“Most of all, as the number of high-net-worth Chinese visitors who have more than 10 million yuan ($1.6 million) worth of non-property invested assets is expected to keep growing, we are recommending our customers a buy for leading casino stocks,’’ the Woori report said.

“These Chinese VIPs are allegedly known to visit Korean casinos three or four times a year. We estimate that around 5,000 Chinese VIPs per year actively visit Korea’s foreigner-only casinos in Korea.”

While there are 16 foreigner-only casinos in operation nationwide, the market has been dominated by two casino operators: Paradise Group and Grand Korea Leisure, or GKL. Industry sources said Paradise Group and GKL together take more than 70 percent of the foreigner-only casino market. Paradise Group runs five casinos nationwide, while GKL operates three casinos under the Seven Luck brand in Seoul and Busan. A 17th casino in Gangwon Province welcomes both Korean and foreign guests and is the only casino Koreans can patronize.

Both companies have beefed up sales and marketing activities for Chinese VIP customers. For instance, GKL, which falls behind Paradise in attracting Chinese customers, recently announced it doubled its marketing workforce deployed to mainland China.

A promising growth potential of the nation’s casino industry has drawn foreign investors.

As the government lowered barriers to opening a casino in free economic zones last year, several foreign companies are reportedly waiting for feedback from the Ministry of Culture, Sports and Tourism, after submitting documents for a business license.

U.S.-based Caesars Entertainment Corporation and Lippo Group, an Indonesian company, is one of them. They presented a plan to build an integrated resort-type casino facility in Yeongjongdo, part of the Incheon Free Economic Zone. Universal Entertainment Corporation, a Japanese casino firm, also applied to build a gambling facility near the Incheon International Airport.

Paradise and GKL are also allegedly considering the establishment of integrated resort-type casinos in Korea.

The competition overseas, particularly throughout Asia, is growing. Inspired by the success stories of casinos in Macau and Singapore, the Philippines and Vietnam are seeking ways to expand their casino business for foreign visitors. Japan and Taiwan are also moving to legalize casino business.

With casino expansion plans at home and in other Asian countries, concerns about the long-term outlook for the nation’s casino business are growing.

An analyst from Woori Investment & Securities, however, downplayed the concerns, saying that Korea would appeal to Chinese VIP gamblers mainly due to its geopolitical advantage.

“VIP casino players tend to prioritize geographical proximity when they select their casino destinations. Chinese VIPs visiting foreigner-only casinos in Korea largely come from Beijing, Shanghai and Shenyang, all of which are a two-hour flight to Incheon International Airport. It would take longer to fly from these cities to other Asian countries, so the expansion of other casinos in Asia is not likely to have a big impact on domestic casinos,” he said.

Rather, industry watchers predicted that the business upturn of the local casinos for foreign passport holders will continue for the time being, based on solid demand and expansion of facilities.

By Seo Jee-yeon (

jyseo@heraldcorp.com)