The year 2013 was a turning point for self-made billionaire Park Hyeon-joo, founder of Mirae Asset Financial Group. The company, debuted in 1997 as a mutual fund management firm, advanced onto the list of the nation’s top 30 conglomerates by assets last year for the first time in its 17-year history.

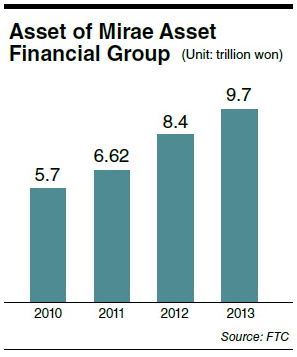

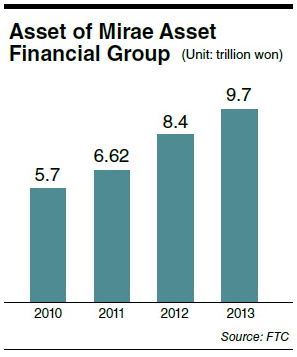

According to the Fair Trade Commission, the nonmanufacturing group was ranked 29th with 9.7 trillion won ($9.4 billion) in terms of assets. Mirae Asset has continued to expand its assets for the past five years by diversifying its business portfolio beyond its core fund management business.

“As of 2013, the company has become a leading South Korean conglomerate with 30 affiliates not only in financial but also in nonfinancial sectors,’’ industry watchers said.

The fast growth of the group has boosted the wealth of the 56-year-old mutual fund tycoon. Forbes announced last April that Park is the 16th richest person in Korea, worth a net $1.5 billion.

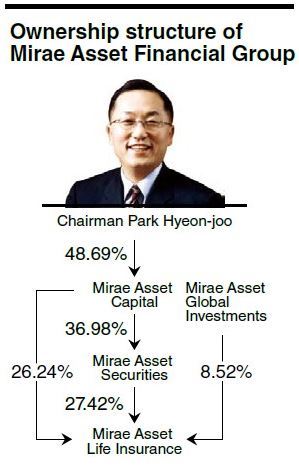

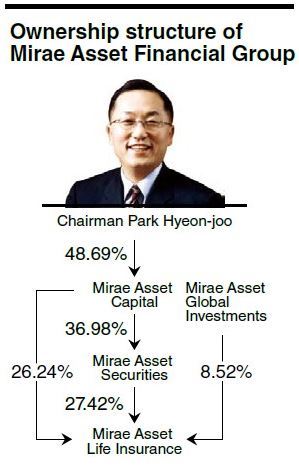

For now, the main source of Park’s wealth comes from his stake in affiliates, including Mirae Asset Securities, the group’s only listed unit. He controls the stock brokerage arm through another affiliate, Mirae Asset Capital, in which he holds a 48.69 percent stake.

Investment portfolio diversification

Last week, there was a rumor that Mirae Asset Global Investments, the group’s asset management arm, was in discussions with U.S.-based Somerset Partners to buy 1801 K St., a landmark building in Washington D.C., for $440 million.

Mirae Asset declined to comment on the rumor. Industry sources, however, believe the firm is close to inking the deal, citing the five previous overseas real estate deals in which Mirae Asset was recently involved.

In an effort to search for alternative investment products beyond mutual funds, Mirae Asset is apparently eyeing foreign commercial real estate. It has continued to buy high-rise office buildings or commercial properties like premium hotels in such metropolitan cities as Shanghai, Sao Paulo, Sydney and Chicago since 2006.

“Entering a low-growth era, the firm will aggressively look for alternative investment products offering a stable income source beyond return-on-stock or bond investments. Real estate will be one such product,” chairman Park said in his 2012 New Year’s message.

|

Chairman Park Hyeon-joo |

Besides real estate, Mirae Asset is also hunting for companies auctioned in the global market. As a case in point, a Mirae Asset PE fund-led consortium acquired U.S. coffee chain Coffee Bean & Tea Leaf last year. The deal was estimated at up to 500 billion won.

Another private equity fund operated by Mirae Asset is pushing for a deal with GS Engineering and Construction to secure the builder’s 68 percent stake in Parnas Hotel for around 1 trillion won. Parnas Hotel, a hotel management firm, runs Grand InterContinental Hotel in Samseong-dong, Seoul.

Many industry watchers have reacted positively to changes in Mirae Asset’s investment strategies.

“Mirae Asset was heavily dependent on stock-based mutual funds and so diversification in its investment portfolio was necessary,’’ a fund manager who worked for foreign asset management firms for years said on condition of anonymity. “In addition, it needs to further sharpen fund management skills to become a globally renowned fund manager.’’

Growth through challenges Chairman Park, who was a star stock broker in the 1990s, found a business opportunity in mutual funds and introduced the nation’s first stock-driven mutual fund in 1997 when it was hit hard by the Asian currency crisis. The high-return but high-risk fund was a big success, offering a double-digit return to investors for years during the Korean economy’s quick recovery.

Based on this success, the company created the “Insight” fund for investing in global blue chips, including Chinese stocks, in 2007.

In a sharp contrast with the previous success, however, the Insight fund was hit hard by the collapse of the Chinese stock market, affected by the U.S.-triggered global economic downturn in 2008.

The return-on-investment of the fund has posted negative growth for the past seven years. The failure of the Insight fund had an impact on the total equity funds managed by Mirae Asset in Korea, which dwindled to 10 trillion won in 2013 from a peak of 50 trillion won in 2007.

Despite the exodus of fund investors, chairman Park, who has pursued “growth through challenges,” swiftly conducted restructuring, while developing a strategy to cope with the crisis. He has stayed in action mode without pulling back, turning to alternative investment products overseas since 2011.

Family-driven ownership structure In terms of wealth accumulation, Mirae Asset chairman Park, who came from a middle-class family and built up his wealth through his own efforts, is different from other chiefs of top conglomerates whose wealth was transferred from their predecessors. At the same time, the group’s ownership structure and governance is similar to theirs.

Mirae Asset is controlled by chairman Park and his family members, like other South Korean conglomerates.

The succession issue will probably not be on the table for a while at Mirae Asset, considering Park’s age and health condition. In addition, he has often publicly mentioned that he will not transfer the managerial rights of the group to his children.

Experts on the matter of succession agreed that it is too early to predict Mirae Asset’s succession plan.

Among chairman Park’s three 20-something-year-old children, Park Ha-min, 25, the eldest daughter, joined Mirae Asset Global Investments last year to learn the real estate investment industry, the company said.

By Seo Jee-yeon (

jyseo@heraldcorp.com)