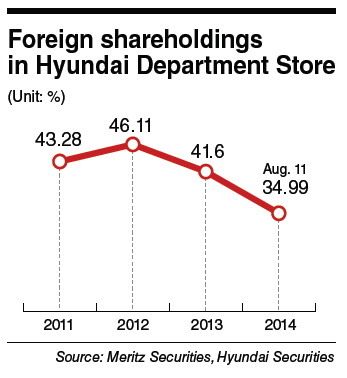

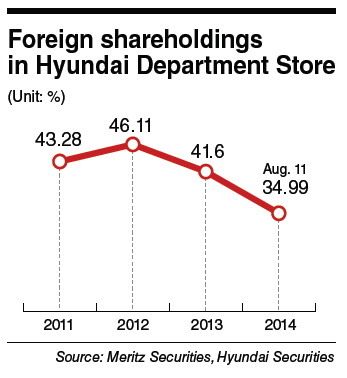

Foreign investors have continued to reduce their stakes in Hyundai Department Store, one of the top three premium retail chains in Korea, since 2012 due to rising doubt over the retailer’s growth potential, industry watchers said.

Hyundai Department Store, listed on the nation’s main bourse, is a flagship affiliate of Hyundai Department Store Group, a family-controlled retail conglomerate in Korea.

“The operating profit of the company fell for the sixth consecutive quarter in the second quarter of this year,” said Lee Sang-gu, a stock analyst from Hyundai Securities.

“From the investors’ point of view, the firm’s premium retail chain business seems to be losing growth momentum.’’

According to financial data from local stock brokerage firms, foreign shareholdings in Hyundai Department Store, which peaked at 46.1 percent in 2011, slid to 43.5 percent in 2012 and 41.6 percent in 2013.

|

Hyundai Department Store Group chairman Chung Ji-sun (The Korea Herald) |

As of Aug. 11, the ratio of foreign investment stood at just under 35 percent.

Foreign investors remained net sellers on Monday despite the company signing a deal to buy Winia Mando, a renowned South Korean kimchi refrigerator maker, the week before.

The deal reflects the retail group’s strategies to go beyond the retail sector to diversify its businesses for growth.

To this end, Hyundai Department Group has also acquired Livart, the nation’s second-largest furniture maker, and Hansome, the nation’s top supplier of women’s apparel.

“To restore investor confidence, it is important for the retail giant to create new growth momentum in its core business, as more than half of its sales come from Hyundai Department Store,” Lee said.

Hyundai Department Store Group posted 12 trillion won ($11.6 billion) in sales last year. In the same time period, the sales of Hyundai Department Store stood at 6.9 trillion won.

“The problem is that high-end department stores face limited growth as Koreans in the middle and even high income brackets have started to cut their spending to prepare for retirement,” Lee said.

As the pattern of consumption changes with the aging population, rivals such as Lotte and Shinsegae have been expanding their premium outlet businesses over the past few years.

“Hyundai Department Store is a late-comer in such terms,” Mirae Asset Securities said in a report.

To address these shortcomings, Hyundai plans to open its first large-scale premium outlet in Gimpo in January 2015. A second such outlet is slated to open in the Songdo district of Incheon in the latter part of next year.

But it would take more than a year to see whether these premium outlets will help improve the embattled department store’s performance, analysts said.

By Seo Jee-yeon (

jyseo@heraldcorp.com)