Few may have anticipated the tremendous impacts of smartphones and mobile applications on conventional businesses from taxi operators to brick-and-mortar retailers when the market began adopting smartphones in earnest less than a decade ago.

Now few can dismiss the striking tech development under which previously dominant business sectors, including financial services, are going through disruptive changes caused mainly by the versatile telecommunications devices.

The mobile payment market, in particular, has recently received the limelight as companies from a variety of industry sectors have been throwing their hat into the burgeoning business ring.

Spearheading the emerging mobile payment industry are smartphone powerhouses Samsung Electronics and Apple, which are pushing their own mobile payment services, Samsung Pay and Apple Pay, respectively.

In his keynote speech at the unveiling event of Samsung’s two new phablets -- the Galaxy Note 5 and Galaxy S6 Edge Plus -- and Samsung Pay this month, the firm’s mobile business unit head Shin Jong-kyun called the launch of the mobile payment system “a brave step forward” to enhance citizens’ mobile experience.

|

A Samsung Galaxy Note 5 user makes a purchase with the Korean tech giant’s mobile payment service Samsung Pay. (Samsung Electronics) |

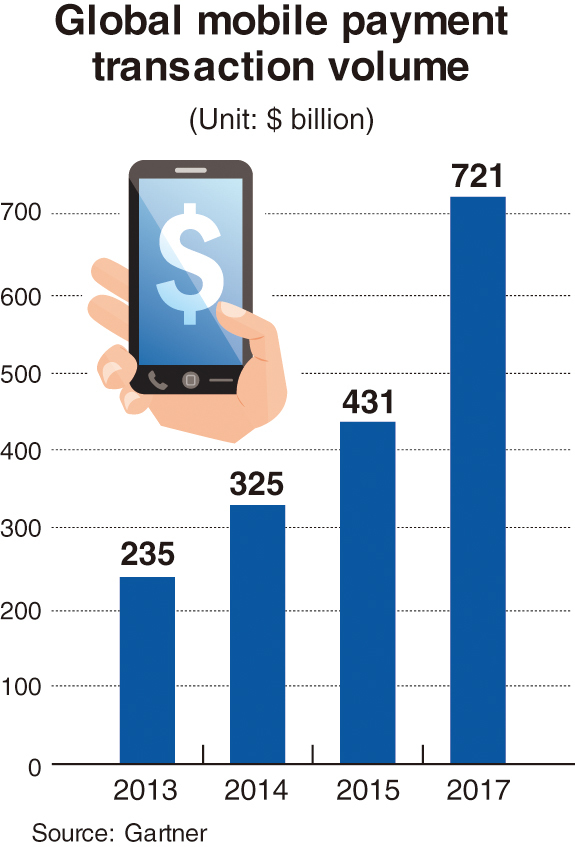

The global mobile payment transactions are expected to surge in the coming years from $235 billion in 2013 to $721 billion in 2017, according to research firm Gartner.

The Korean banking industry is also about to see tectonic changes in the coming years as it will have the first Internet-only banks as early as next year.

From this month, different consortiums consisting of different businesses, such as mobile carriers, banks and online shopping businesses, announced that they would participate in the bidding process for approval to set up the Internet-only bank from the state financial authorities.

Applications for the bidding will be accepted next month, and around one or two consortiums are expected to receive the government permission.

Daum Kakao started the race by forming a consortium with Korea Investment Holdings and KB Kookmin Bank.

Among those aiming to jump into the banking sector are consortiums led respectively by mobile messenger operator Daum Kakao, telecom firm KT, online shopping business Interpark and start-up alliance 500V.

“The competition to win the approval to build the first Internet-only bank would get further heated up down the road,” a market analyst said.

By Kim Young-won (wone0102@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)