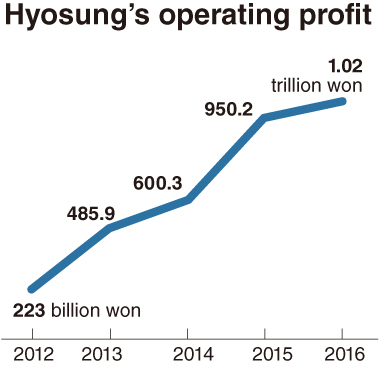

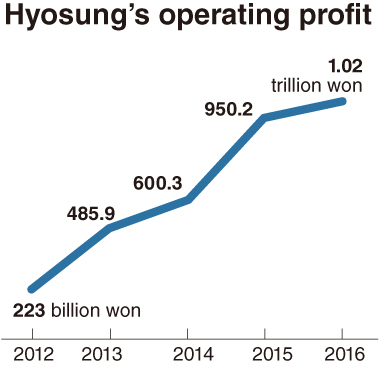

When Hyosung joined the so-called “1 trillion won club,” a league of Korean companies that made 1 trillion won in operating profit last year, the market response was unanimous -- that it didn’t happen by chance.

Over the past 20 years, Hyosung, the dominant South Korean conglomerate focusing on fiber and chemicals, has undertaken a series of restructuring efforts and steadily invested overseas to cut costs while continuing research and development at home.

Its top market position in key products including tire cords and spandex has strengthened the company’s financial muscle over the years, and curbed its debt-to-equity ratio.

Hyosung’s stock value also rose 45 percent on-year as of Friday, on the expectation of its stalwart financial portfolio and sales growth.

“Riding the robust yearly operating profit that topped 1 trillion won (for the first time last year), the forecast for market cap growth and balance sheet reduction remains surefooted,” Son Young-joo, an analyst at Kyobo Securities, wrote in a Tuesday report of Hyosung. “Oil price fluctuations will have little effect on (Hyosung’s) growth confidence backed by its price competitiveness and market dominance.”

|

Hyosung's factories in Vietnam (Hyosung) |

Indeed, the prospect of Hyosung’s performance this year appears to be even rosier as it already garnered 2.87 trillion won in revenue in the first quarter of the year with an operating profit of 232.3 billion won. It was a record quarterly earnings, according to the company.

Behind such robust performances is the strategic and innovative leadership illustrated by Cho Hyun-joon.

Cho, the eldest son of former chairman S.R. Cho, officially took the office at the beginning of the year. The new chairman has been spearheading the growth of the textile giant in recent years, indicated by its stellar performance since 2012.

Hyosung gained 223 billion won in operating profit five years ago, and the size of its income has since surged more than 350 percent on strategic decisions made by the new chairman.

|

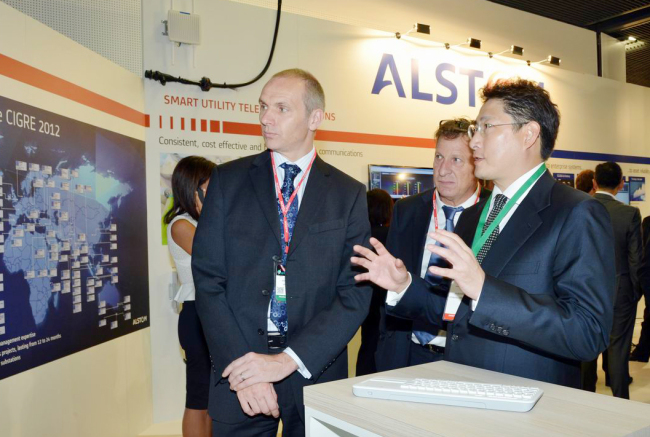

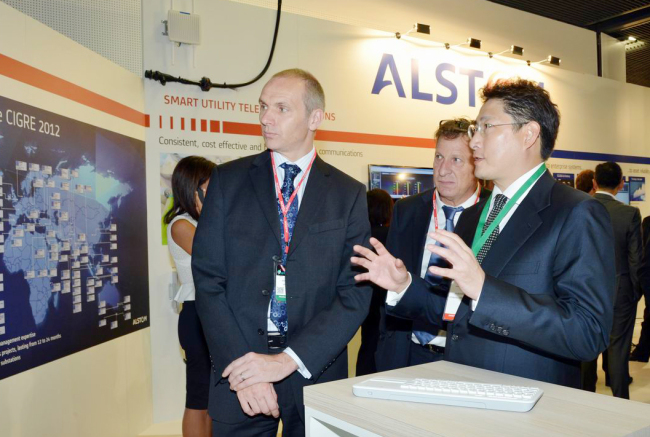

Hyosung Chairman Cho Hyun-joon (right), then president, visits the booth of France’s multinational firm Alstom at an exhibition of the International Council on Large Electric Systems in Paris in August, 2014. (Hyosung) |

“The possibility of Hyosung reaching the 1 trillion won mark again this year seems to be promising. Along with this sense of confidence, we also feel that the company is becoming more energetic than before with new the leadership rising,” a Hyosung spokesperson said.

Launched in 1966 by Cho’s grandfather Cho Hong-jai, Hyosung started producing nylon in Ulsan after the Korean War. Acquiring Hanil Nylon, a rival at that time, made Hyosung the nation’s largest synthetic fiber company. After the founder’s son S.R. Cho returned upon completing his education in Japan and the US, the company expanded on growing demand for clothing, and also entered the infrastructure market by acquiring a local producer of power equipment.

The company underwent massive restructuring after the 1997-1998 Asian financial crisis, selling its blue chip businesses including Hyosung BASF. Hyosung realigned 30 operational units under five groups, by incorporating its affiliates.

The restructuring process, down the road, turned out to have been a golden opportunity for Hyosung, as it led the company to focus on what they can do the best -- high value-added textile products.

The company has since retained its top position in the global markets for spandex and tire cord market, as well as yarn for automobile seat belts and textiles for airbags.

Despite an increase in raw material prices, Hyosung expects steady growth of its cash cow products due to growing demand.

Cho’s successful management has been reflected in the balanced business structures encompassing textiles, industrial materials, chemicals, heavy industries, construction, finance and trade, all of which operated in the black last year.

In addition, Nautilus Hyosung America, the company’s operation in the US, is the largest ATM provider there.

A notable representation of Cho’s nimble management is the group’s operation in Vietnam. Since entering the market in 2008, the South Korean company invested 1 trillion won so far, building manufacturing facilities for spandex, tire cord and power equipment such as low-pressure motor. It also has a production complex in Turkey, targeting the premium market in Europe.

As a B2B enterprise, Cho has always stressed on the importance of ceaseless efforts in developing cutting-edge technology, the company said.

For one, Hyosung is betting on carbon fiber materials, which are one-quarter the weight and 10 times stronger than steel. With the product branded TANSOME, the company expects to see growing demand as it can be applied not only to sports gear, but also for automobiles and space rockets.

This year, it is also moving to further advance into new items including ultra-high voltage transformers, energy storage systems and static synchronous compensators, a cutting-edge energy solution for which Hyosung is the only Korean company to have commercialized technologies.

The company also expects to produce a synergy effect by applying big data analysis based on cloud computing to its technical prowess, through its IT affiliate Hyosung ITX, to expand its systems integration and systems management businesses.

By Cho Chung-un (

christory@heraldcorp.com)

![[From the Scene] At this Starbucks, you need ID: Franchise opens store with view of North Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/29/20241129050068_0.jpg)