|

Samsung Group’s de facto head Lee Jae-yong (Yonhap) |

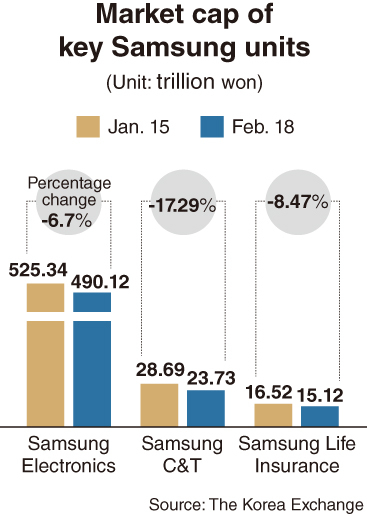

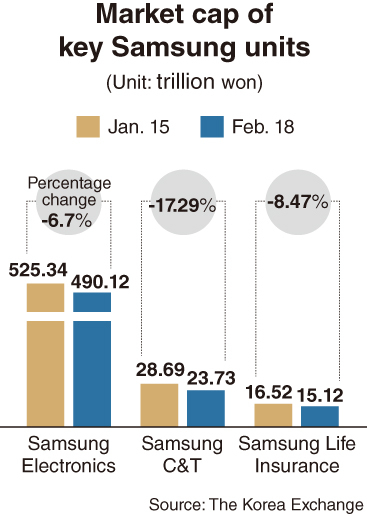

The market capitalization of Samsung Group, South Korea’s largest conglomerate, shrunk by around 42 trillion won ($38.01 billion) after its de facto head Lee Jae-yong was sent back to jail last month, the Korea Exchange’s market data showed Thursday.

The combined market value of 16 listed firms within the nation’s telecom-to-chemicals conglomerate came to 695.87 trillion won at Thursday’s closing bell, losing 41.93 trillion won or 5.68 percent from the closing Jan. 15, the last trading session before the court decided the Samsung heir’s fate. The value of preferred stocks was excluded from the latest assessment.

Among the affiliated firms, Samsung C&T’s stock was affected the most. The construction and trading unit’s shares plummeted 17.26 percent apiece, while its market cap declined by 4.96 trillion won, over the cited period. Lee is the biggest shareholder of the blue-chip firm, holding a stake of more than 17 percent.

The group’s crown jewel, Samsung Electronics, logged the biggest loss in market value. The tech giant’s shares retreated 6.7 percent and its market value vanished by 35.22 trillion won. Lee’s stake in Samsung Electronics amounted to 0.7 percent, the data showed.

While most of the affiliated firms’ market cap decreased, Samsung Life Insurance’s value shrank by 1.4 trillion won, followed by Samsung Biologics and Samsung Fire & Marine Insurance with 1.39 trillion won and 830 billion won, respectively.

Samsung SDI, the battery-making unit, was the only Samsung affiliate that saw its market value rise. Its market cap increased by 3.58 trillion won amid growth in the electric vehicle battery market.

Market watchers say the top conglomerate’s sudden decline in market value during its leader’s absence was partially the result of investors becoming disheartened. But the fall of the key stock index and the high expectations that boosted Samsung’s stocks earlier in the year on anticipation of a chip boom had more influence, they explain.

“The owner’s absence is one of the reasons but the major reason behind (the value plunging) is the falling stock price of Samsung Electronics,” said Choi Yoo-joon, an analyst at Shinhan Financial Investment. “Samsung Group’s market cap highly depends on the tech blue-chip and the firm’s stock is in the adjustment from the fast rising at the end of last year.”

Daishin Securities analyst Park Kang-ho said Lee’s arrest may have affected investor sentiment but that investors’ profit-taking was a more influential factor in the vanished market cap. At the same time, the expert linked the result to the nation’s benchmark Kospi’s recent fall from the 3,200-point level to the 3,100-point level.

He further forecast that if the group continues to see “strong fundamentals” in the second and third quarters, the market cap is likely to rise again.

On Jan. 18 an appellate court sentenced Lee to 2 1/2 years in prison for bribery in a high-profile case involving former President Park Geun-hye. On the day of the ruling, Samsung Group’s combined market value crashed by 28 trillion won.

By Jie Ye-eun (

yeeun@heraldcorp.com)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/19/20240419050617_0.jpg)