|

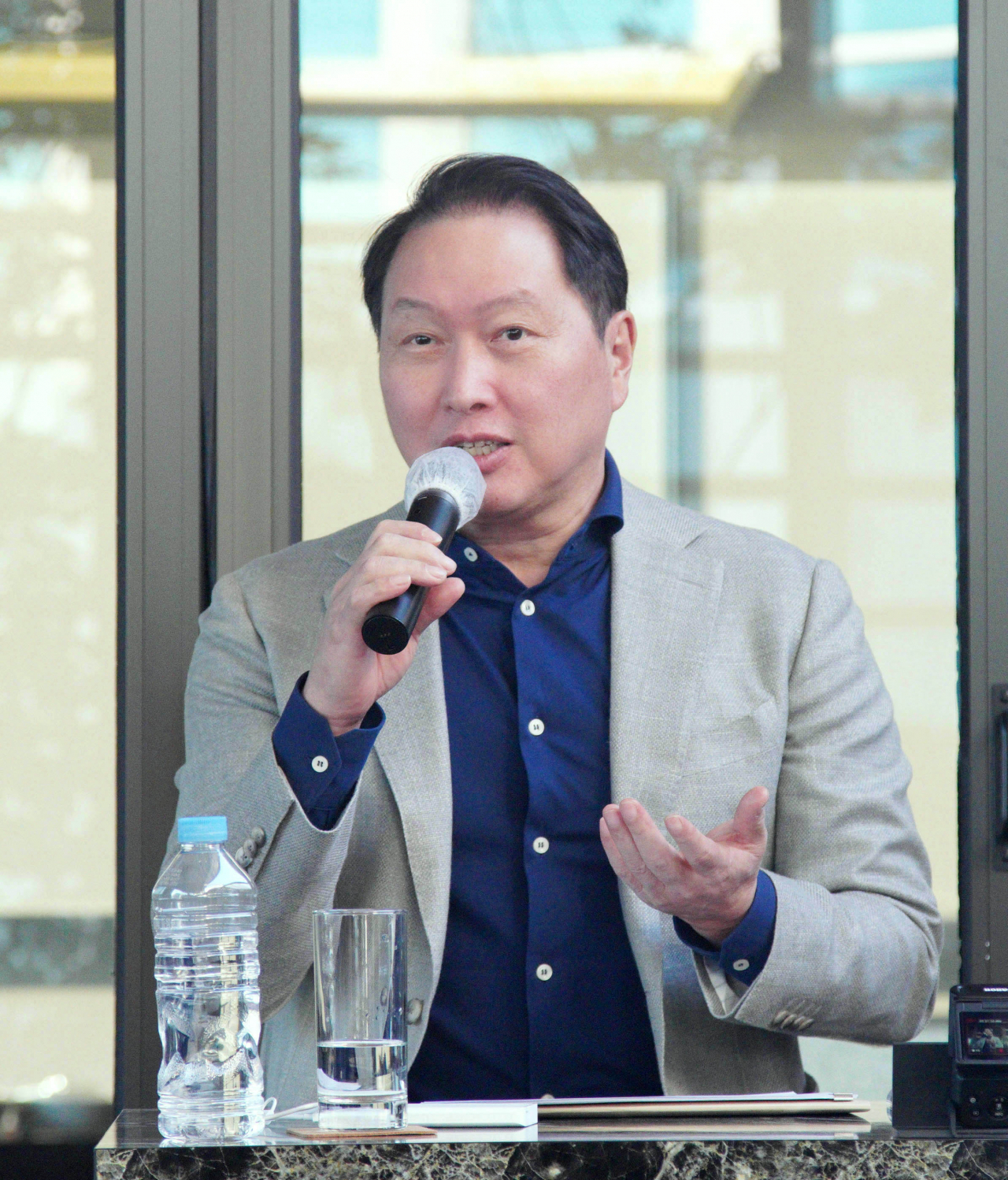

SK Group Chairman Chey Tae-won, who doubles as chair of the Korea Chamber of Commerce and Industry, speaks at a press conference in Seoul on Thursday. (KCCI) |

The chairman of Korea's chip-to-battery conglomerate SK Group said the fate of semiconductor manufacturers will hinge on how smartly they can map out capital expenditure plans, as he believes the recent chip recovery would be short-lived.

The earnings surprise that SK hynix, the group’s crown jewel and the world's second-largest memory chipmaker, logged in the first quarter raised hope that the industry has ended its down cycle after months of operating losses.

SK Group Chairman Chey Tae-won, who doubles as chair of the Korea Chamber of Commerce and Industry, the nation's largest business lobby, stayed cautious, saying the big swing to profit was driven by the base effect stemming from the market hitting rock bottom a year ago.

“This kind of roller coaster will sustain down the road. People say the market has recovered but I don’t think this (upswing) will last long,” he told reporters Thursday during a media conference marking his second term as KCCI chief.

With semiconductor makers facing the physical limitation of shrinking chips to smaller sizes, they are pouring a large sum of money into expanding and improving advanced packaging technology.

“Korea should come up with ways to resolve problems induced by high capital expenditure that companies should spend (on production sites) as many countries offer subsidies and incentives to attract domestic chip manufacturing,” he said.

“How much capital expenditure a chip maker decides to spend will remain a crucial matter to them.”

He said the countries providing a large amount of subsidies usually have reasons such as a lack of infrastructure and high labor costs.

“Korea is well equipped with infrastructure. It’s just that it doesn’t offer much subsidies (compared to other countries),” Chey said.

The SK chairman warned that the world economy’s tendency to prioritize efficiency over dealing with climate change which has been backpedaling in recent years would lead to expensive consequences.

“We are witnessing a regression of the push for environmental, social, and governmental fight against climate change with the focus shifting to things deemed economically effective and efficient,” he said.

Because of the trend, electric vehicles and batteries used for them are crossing the chasm, which refers to a slowing demand in the transition from the early adopter phase to the mainstream market.

“I have been thinking that if we don’t propel (green initiatives) now, we will have to pay higher costs later,” he said. “But the eco-friendly business trend will come back in the long term.”

![[Herald Interview] How Gopizza got big in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/20/20241120050057_0.jpg)