|

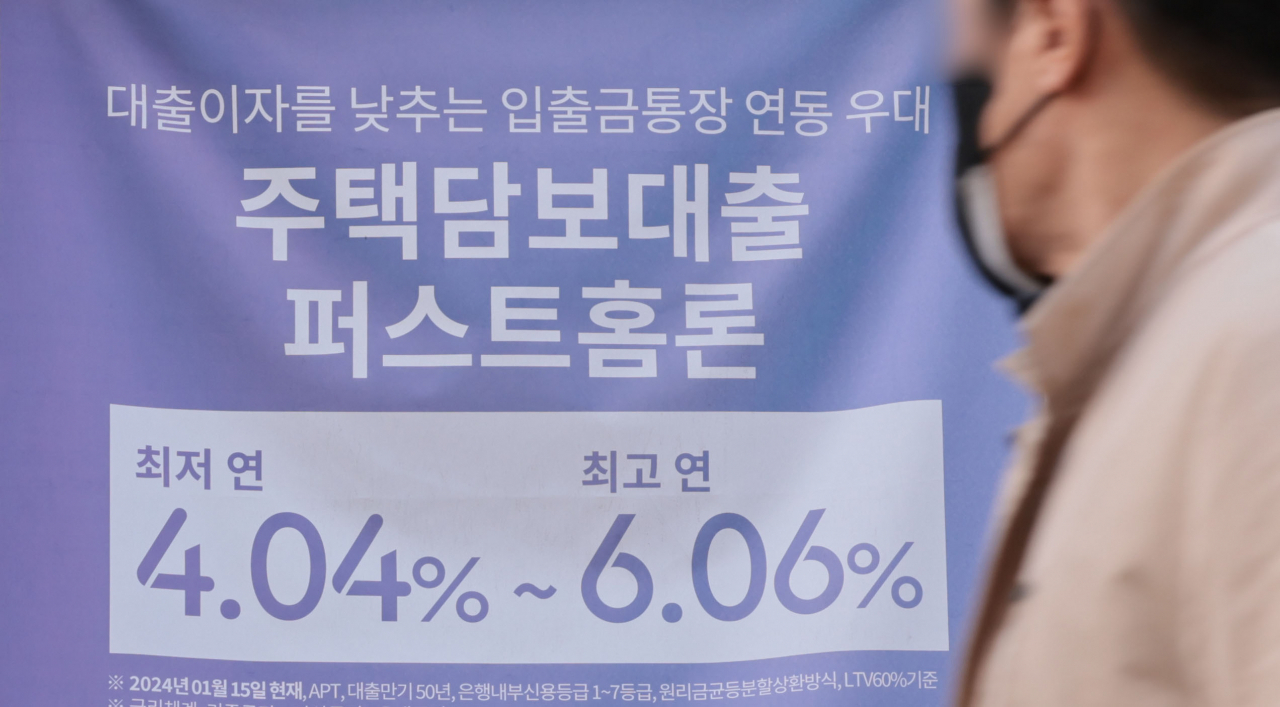

A man walks by a banner promoting a loan product of a Seoul-based bank on Tuesday. (Yonhap) |

Loans extended by insurance companies in South Korea decreased sharply in the third quarter from a year earlier amid high interest rates and tightened lending rules, data showed Friday.

Insurers' outstanding loans reached 266.9 trillion won ($191.4 billion) as of the end of September, down 6.4 trillion won from a year earlier, according to data from the Financial Supervisory Service.

The figure also marks a 0.5 trillion-won decline from three months earlier.

The on-year decrease was attributed to a decline in loans extended both to businesses and households.

Household lending stood at 134.4 trillion won as of the end of September, down 0.3 trillion won from a year earlier, while corporate lending shrank by 6.1 trillion won to 132.4 trillion won over the same period.

The loan delinquency rate, which measures the proportion of loan principal or interest unpaid for at least a month, stood at 0.62 percent at the end of September, up from 0.54 percent a year earlier, according to the financial regulator.

The ratio of insurers' nonperforming loans came to 0.71 percent, down from 0.76 percent a year earlier. (Yonhap)