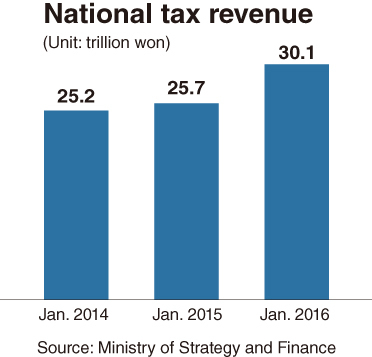

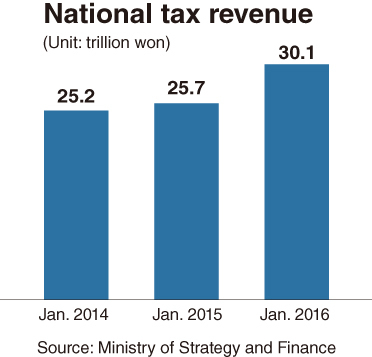

A monthly fiscal report released by the Finance Ministry last week showed that Korea’s national tax revenue reached 30.1 trillion won ($25.3 billion) in January, up 4.4 trillion won from a year earlier. This accounts for 13.5 percent of the total national tax revenue planned to be collected throughout the year, compared with the corresponding figures for the same months in 2014 and 2015, which stood at 11.7 percent and 11.9 percent, respectively.

This spike has drawn some skeptical and grumbling responses from individual taxpayers and companies that have been going through a hard time amid a prolonged economic downturn.

Financial experts attribute the revenue increase partly to a boost in property transactions and consumer spending in the fourth quarter of last year. Under the current rules, levies on real estate deals made in November are paid in January and value-added taxes collected in a quarter are reflected in the following month’s revenue record.

Property transactions jumped by 12.1 percent last November from a year earlier, as many people wanted to buy houses before the tightening of rules on mortgage loans. The government took a set of measures in the last quarter of 2015 to help boost domestic consumption, including arranging for nationwide sales promotion events and cutting excise taxes.

According to the ministry’s report, 7.3 trillion won in income tax, including levies on real estate transactions, was collected in January, up 1.5 trillion won from a year earlier, while VAT revenue showed an increase of 600 billion won to 14.1 trillion won.

But salaried workers also saw taxes on their earnings rising by 15 percent over the cited period, with their pay barely increasing. Furthermore, few decent jobs have been created over the past year, with the youth unemployment rate reaching its record high of 9.5 percent in January.

Financial experts note the steep rise in tax burden on waged workers is attributable mainly to a cut in tax credits on their incomes.

Local companies, which are struggling with decreasing demand and deteriorating profitability, paid 1.5 trillion won in corporate tax in January, an increase of 700 billion won from the year before.

This sharp rise in corporate tax led some business leaders to complain about the taxation system during their meeting with the head of the National Tax Service last week. They said overlapping tax audits by central and local governments and excessive demand for documents were weighing on corporate management.

But the concern for financial authorities here is that any possible increase in revenue will still fall far short of catching up with a rapid run-up in national debt.

The total debt owed by the central government reached a record high of 561.2 trillion won in November, increasing by 58.2 trillion won over the past year. Fiscal deficit exceeded 30 trillion won in the first 11 months of last year, as the government drew up a supplementary budget and other stimulus packages to boost the slowing growth.

“The increase in tax revenue is far from enough to offset the pace of debt rise,” said a Finance Ministry official.

Many economists say policymakers should focus on reinvigorating the sluggish economy rather than on increasing revenues in the short run.

“Reducing tax burden on companies may be the most effective way to increase revenues through continued economic growth,” said Huh Won-je, a researcher at the Korea Economic Research Institute. He cited the results of some studies that showed corporate tax revenue had been more closely connected with economic conditions than that of any other taxes since the 2008 global financial crisis.

By Kim Kyung-ho (

khkim@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)