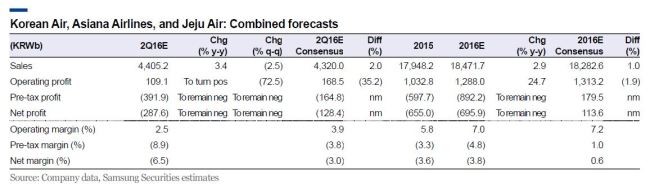

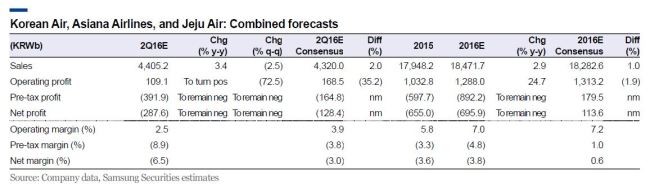

● We believe Korean Air, Asiana Airlines, and Jeju Air generated combined 2Q sales of KRW4.4t, up 3.4% y-y and meeting the consensus, and an operating profit of KRW109.1b that missed the consensus by 35% even as demand grew and costs declined with oil prices.

● We still believe sector profits will turn up in 2H on peak seasonality in 3Q and MERS base effect, and Jeju Air will lead the way.

● Jeju Air is our top pick—we expect fleet expansion and route additions to boost its top line, and operating profit growth to gather pace in 2H as the company in 1H likely booked all of this year’s costs associated with returning leased aircraft.

2Q preview— Profits likely disappointed despite favorable market conditions: We believe the combined 2Q sales of Korean Air, Asiana Airlines, and Jeju Air rose 3.4% y-y to KRW4.4t and the companies turned to an operating profit of KRW109.1b, which would fall 35% short of the consensus despite favorable market conditions.

Outbound and inbound demand grew a respective 14% and 30% y-y, and airlines’ costs likely eased with average jet fuel prices falling 27% y-y to USD54/bbl.

We believe Asiana Airlines is primarily to blame for the disappointing sector profit—the firm likely will post a KRW52.6b operating loss, hurt by falling yields (due to stiffer competition on short-haul routes), and weakening demand and ASP pressure on longhaul routes (where the firm has been adding capacity).

Jeju Air’s operating profit likely disappointed as well because of rising costs associated with fleet expansion and returns of leased aircraft. We believe only Korean Air (KAL) met 2Q profit expectations, but expect the firm to post a net loss this year because of impairment losses on exposure to Hanjin Shipping.

2H outlook— Jeju Air to lead turnaround: We expect sector sales and profits to gather momentum in 2H on peak seasonality in 3Q and MERS base effect, with Jeju Air leading the way.

The firm is scheduled to lease three new aircraft in 2H and has been adding routes to Southeast Asia and Japan, which should lead to robust top-line growth.

Operating profit improvement also should gather pace, as returns of leased aircraft should translate into lower maintenance costs, and it booked all of this year’s costs associated with returning planes in 1H.

Jeju Air is our top pick; we reiterate BUY on the stock with a 12-month target price of KRW41,000. We maintain HOLD on KAL and Asiana, revising down our target price for KAL from KRW30,000 to KRW29,000 to reflect likely impairment losses on its exposure to Hanjin Shipping.

KAL’s share performance will likely be dictated by whether it provides more financial support to HJS, and if it does, how much—we need to keep monitoring Hanjin Shipping’s restructuring.

Meanwhile, we believe the launch of the budget-carrier Air Seoul will further Asiana’s long-term efforts to boost profitability, but the company needs to believe visible earnings improvements and financial-structure reform to receive a higher valuation multiple. We keep our target price at KRW4,900.

Source: Samsung Securities

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)