|

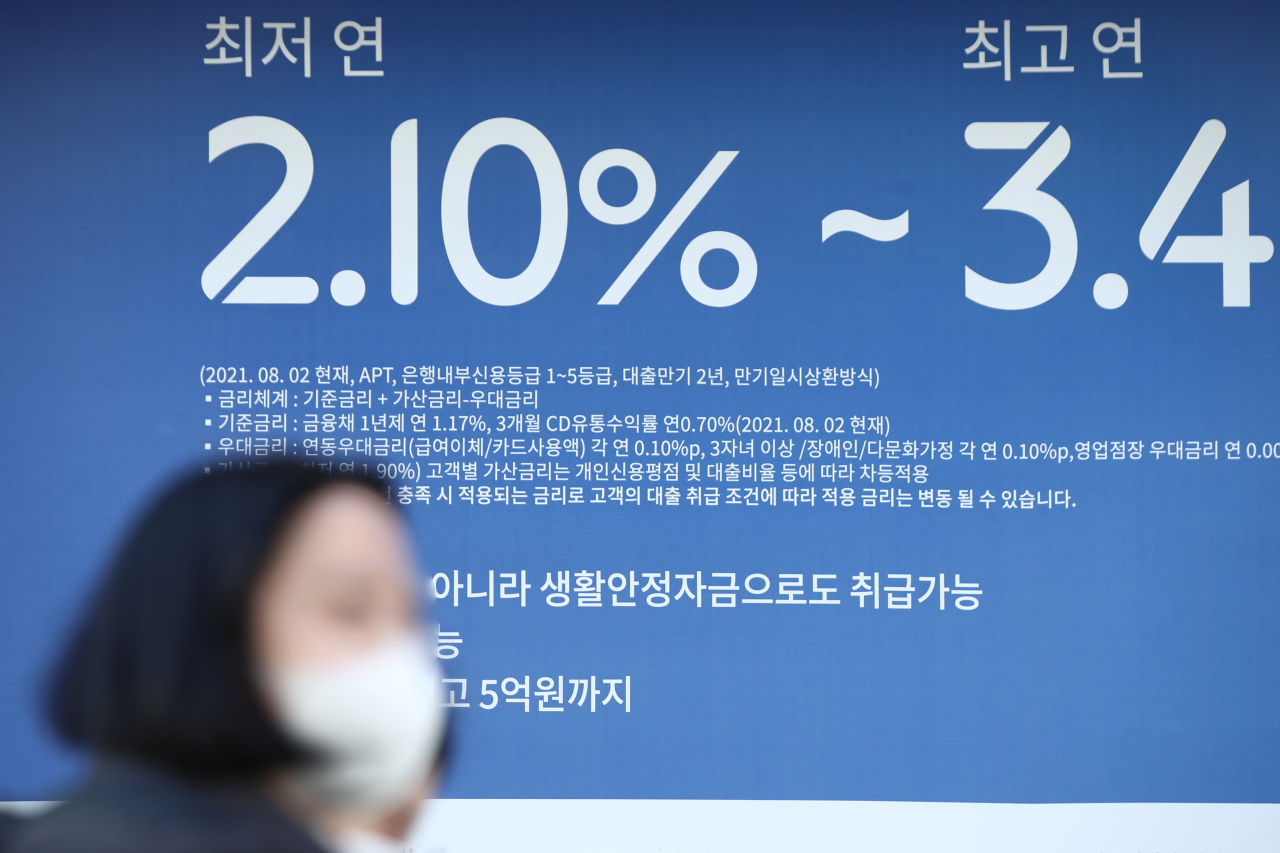

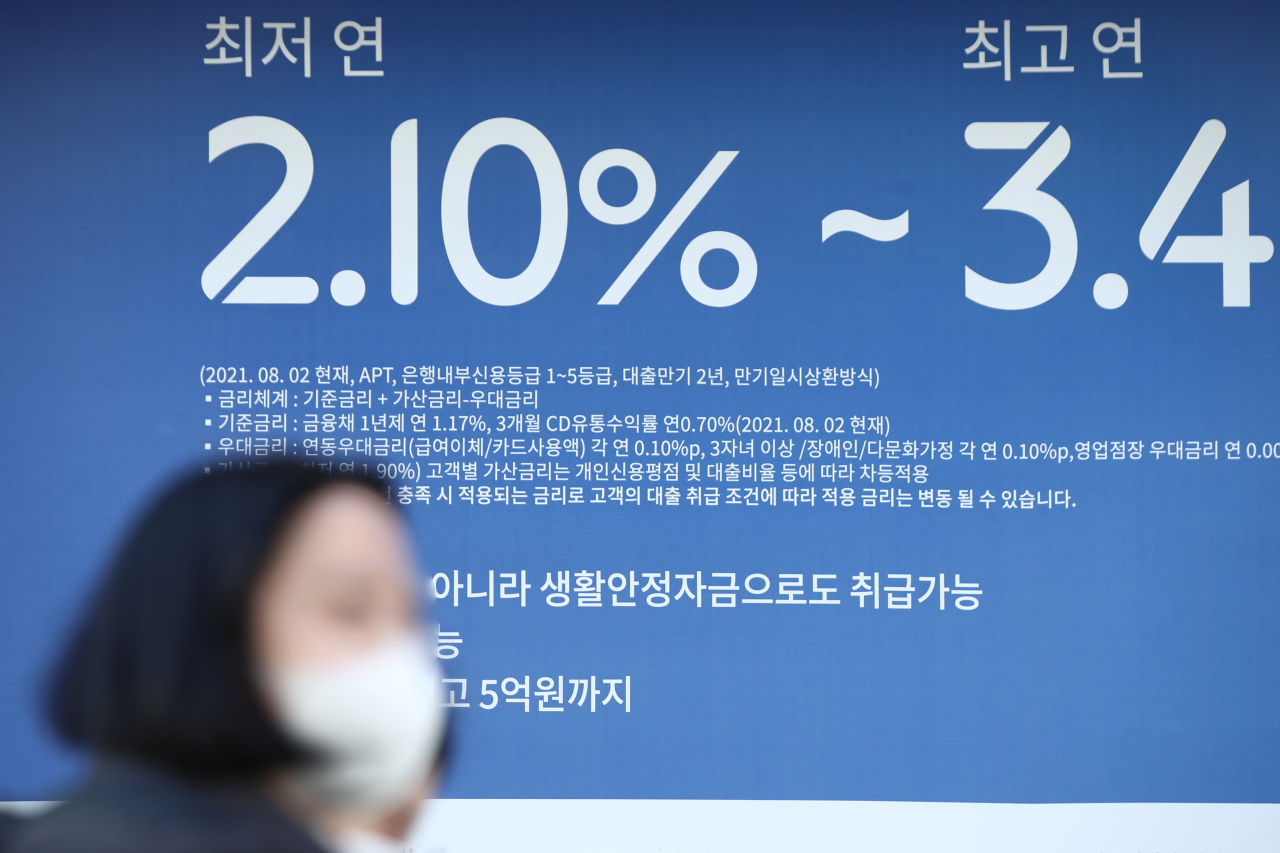

An advertisement for a commercial bank in Seoul shows a loan product`s annual interest rate (Yonhap) |

Banks have started lending again as of Tuesday after months of temporarily suspending their household and mortgage loans, but strict standards from last year are likely to remain or get even tighter this year.

NongHyup Bank, one of the five major commercial banks here, normalized lending of its entire household loan products, including mortgages on Monday. It has also decided to raise its lines of credit from the previous 20 million won ($16,700) to 100 million won.

NongHyup had suspended lending of its household and key mortgage products in June last year on government pressure.

The nation’s third internet-only bank Toss Bank launched in October had to suspend its lending services nine days after its establishment, but resumed its new loan services on Jan. 1. The online bank had to suspend its lending services the financial authorities declined to increase the firm’s lending limit after it exhausted 500 billion-won quota.

Toss Bank is the nation’s third internet-only bank after the launch of the nation’s first and second online banks Kakao Bank and Kbank in 2017.

NongHyup’s industry rival Woori Bank has decided to revive its prime rate loans, which are offered to the banks’ most creditworthy customers from Feb. 3. KB Kookmin Bank has added more prime rate loan options on its portfolio.

Because a bank’s top customers have little chance of defaulting on a loan, the bank can charge lower rates than it does to more risky borrowers.

More banks are expected to loosen up, but borrowers are expected to face stricter lending standards this year, according to recent announcements made by financial authorities.

Starting this month, borrowers with over a total 200 million-won worth of total loans that need to repay more than 40 percent of their annual income in principal and interest will be barred from additional lending. From July the amount of total loans are set to be lowered to 100 million won, enforcing even stricter rules for borrowers, in terms of the debt service ratio, which measures how much a borrower has to pay in principal and interest in proportion to his or her annual income.

In December, the policymaking Financial Services Commission said in December that it has decided to apply stricter rules for jeonse loans. Jeonse is a housing lease system unique to Korea whereby tenants pay a refundable lump-sum deposit instead of monthly rent on a two-year contract. The loans are relatively easy for borrowers to get, because they are issued directly to the property owner, rather than the borrower, and secured against the property.

On top of it, the Bank of Korea’s decision to raise its benchmark interest rate to 1 percent in November 2021 alongside experts’ forecasts of at least two rate hikes scheduled for this year is likely to add further volatility to loan interests.

Noting the increased volatilities, experts have been recommending safer and relatively risk-free loan products for customers.

“I recommend borrowers change their current loans to fixed-rate products or seek fixed-rate loans when taking out a new one,” said Hwang Se-woon, a senior researcher at the Korea Capital Market Institute.

South Korean banks’ loans to households have been growing at an increasingly slower pace in recent months, with the financial authorities’ order to banks to adopt stricter lending rules last year taking effect. The total value of loans extended to households in December gained only 364.9 billion won to 709.5 trillion won. This compares with 2.3 trillion won and 3.4 trillion won gains in November and December, respectively.

Total loans extended to households have been gaining by a monthly average of 11 trillion from January to December last year.

By Jung Min-kyung (

mkjung@heraldcorp.com)