|

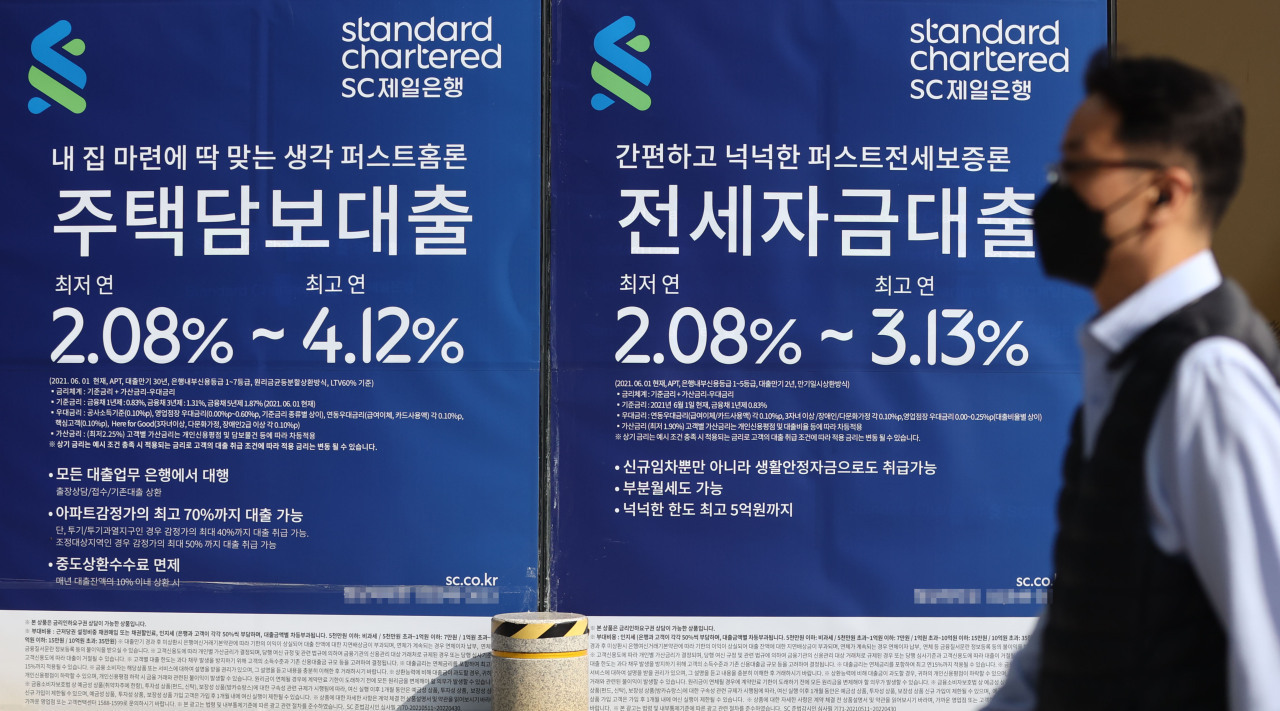

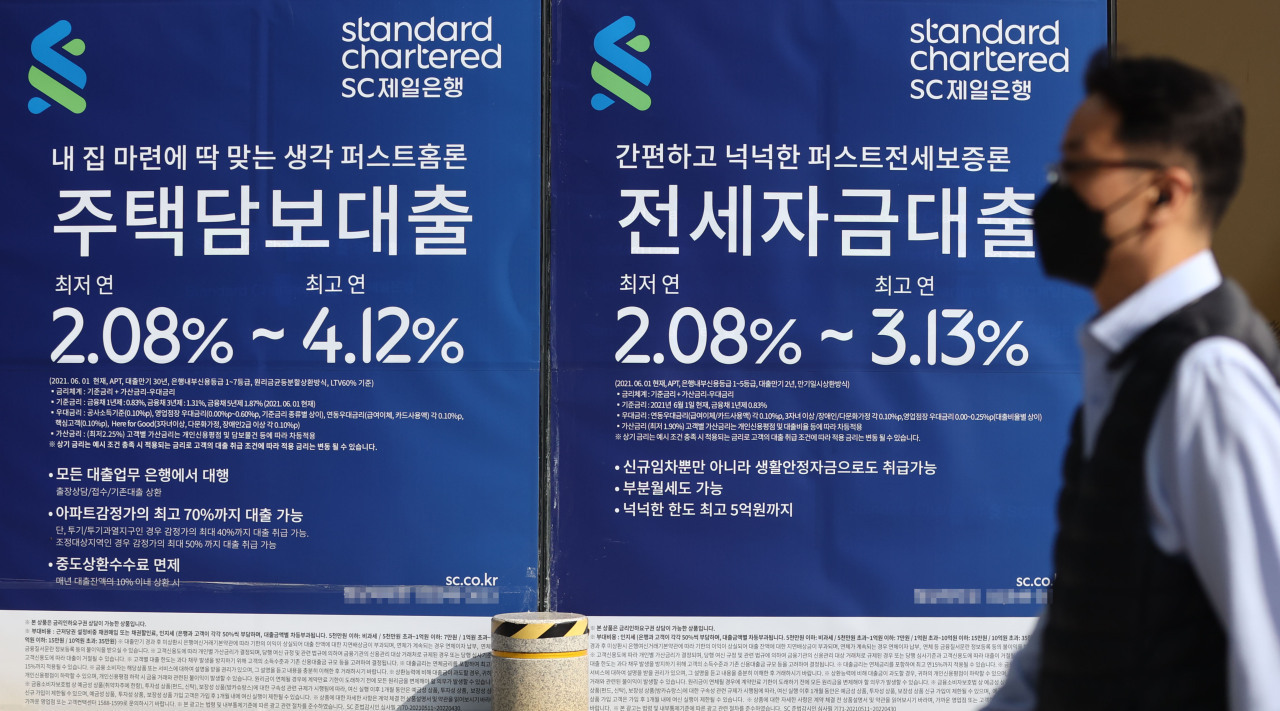

A man passes by advertisements in Seoul promoting Standard Chartered Korea's mortgage products. (Yonhap) |

South Korean banks' mortgage rates hit the highest level in more than 7 years in November amid rising borrowing costs, central bank data showed Thursday,

Banks' mortgage loan rate averaged 3.51 percent in November, up 0.25 percentage point from a month earlier, according to the data by the Bank of Korea (BOK)

This marked the highest since July 2014, when the corresponding rate was 3.54 percent.

Banks' unsecured loan rate also rose 0.54 percentage point to 5.16 percent last month, the highest level since September 2014, when it was 5.29 percent.

The average interest rate on household loans thus rose to 3.61 percent in November from 3.46 percent the prior month, the highest since the 3.61 percent in December 2018.

Loan rates have been on the rise recently in line with the government's drive to put a lid on fast growing household debt and the central bank's rate hikes intended to tame inflation.

In late November, the BOK raised its policy rate by 0.25 percentage point to 1 percent, three months after it announced a quarter percentage point rate hike in August.

The average rate for bank deposits, meanwhile, came to 1.57 percent in November, up 0.28 percentage point from a month earlier, the BOK said.

South Korean lenders' loan-deposit spread, a gauge of banks' profitability from lending, stood at 1.66 percentage points last month, lower than October's 1.78 percentage points. (Yonhap)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)