ToolGen and Genexine -- to be called ToolGenexine after merger -- held a strategy briefing for the media and investors earlier this week in an attempt to pacify their concerned shareholders.

The merger of the biotech companies, announced June 19, has stirred up mixed sentiments in the domestic bio industry. One side heralded it as a rare case of bio firms forging ties rather than the more common business model of a traditional chemical pharma firm acquiring a smaller biotech startup with innovative technology.

Shareholders of both the companies will have to approve the deal on July 30, with a dateline set for Aug. 31. ToolGenexine shares will go public on Sept. 30.

For shareholders, the merger announcement came as a surprise, since the decision-making process did not involve consultation by any accounting firm or investment bank, and was directly negotiated by the respective founders -- Genexine CTO Sung Young-chul and ToolGen founder Kim Jin-su -- who are also the majority stockholders.

|

Genexine founder Sung Young-chul (Lim Jeong-yeo/The Korea Herald) |

After what they describe as a four-year-long talks, they agreed to merge Kosdaq-listed Genexine and Konex-listed ToolGen at a 1:1.2062866 ratio which values a Genexine share at 65,472 won ($56) and a ToolGen share at 78,978 won.

As the two firms are listed on different bourses, the validity of valuation is a point of contention. But the ToolGen shareholders are not too happy, and expressed disappointment. They are of the view that this merger was an expediency measure of taking a detour to go public on the Kosdaq.

The shareholders have weathered the ups and downs of the company, through on-going patent disputes with Seoul National University and University of California, Berkeley, that had stalled it from being listed on the Kosdaq.

“It surprises me that our shareholders are not excited by this merger,” said ToolGen’s Kim at the briefing.

“Genexine and ToolGen complement each other. Our combined efforts will not only lead to the success of both companies but also yield a meaningful outcome for the Korean pharma industry,” he said, adding that the merger will shorten the time it would have taken ToolGen’s technology to commercialize by many years.

ToolGen has patented CRISPR/Cas9 molecular scissors technology, and Genexine is running global clinical trials for its immuno-oncology drug hyleukin-7 and cervical cancer treatment.

As for Genexine’s Sung, his confidence in ToolGen’s CRISPR technology is solid.

“As a CTO focused on research and development for Genexine, my goal is to make the company grow further even without me,” said Sung, “Humans are finite, I won’t be around forever.”

“To create a corporate culture that will last, and for Genexine to become a company that continues to generate new growth engines, it was paramount to bring in a key technology that will boost its gene therapy, and that was DNA scissors CRISPR,” Sung said.

CRISPR are DNA sequences that can be used to find a specific part of the genome while gene editing using the Cas9 protein.

ToolGen has CRISPR-related patents in seven countries -- Australia, Korea, Europe, Singapore, US and China. The company was the third in the world to have patented original CRISPR technology.

“When I heard ToolGen was facing business difficulties not because of its original technology but because of incidental issues, and that the company was considering selling off to a foreign entity, I thought it would be a national loss.”

Sung said he envisions ToolGenexine to become a “great company that develops innovative and blockbuster drugs for patients without hope.”

ToolGenexine will focus on developing lymphopenia drug (hyleukin-7), HPV+ cancer treatment, bispecific and trispecific antibody to fight cancer, autoimmune disease and metabolic disease, cell and gene therapeutics using CAR-T technology and in-vivo gene therapeutics.

It will also gear up to patent its original CRISPR technology in more locations through US law firm Jones Day.

|

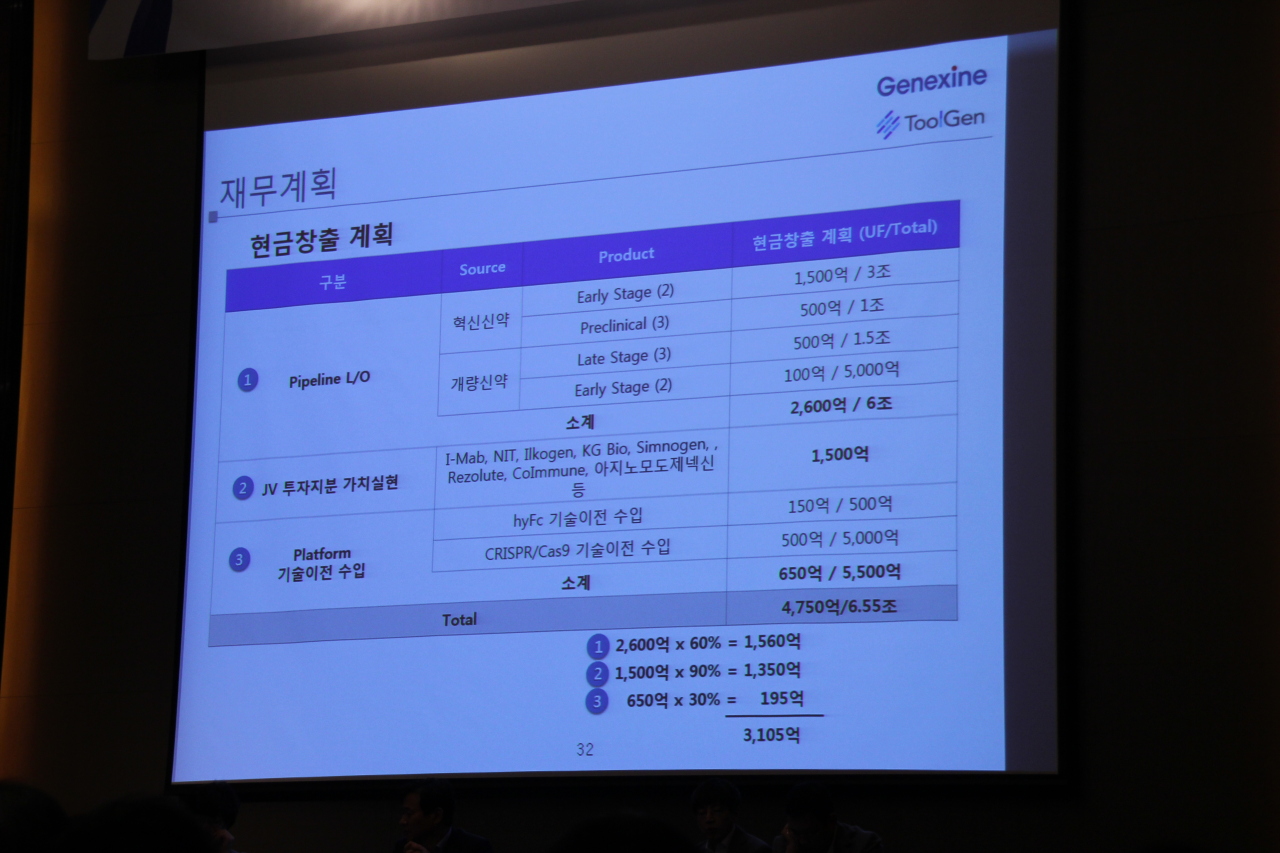

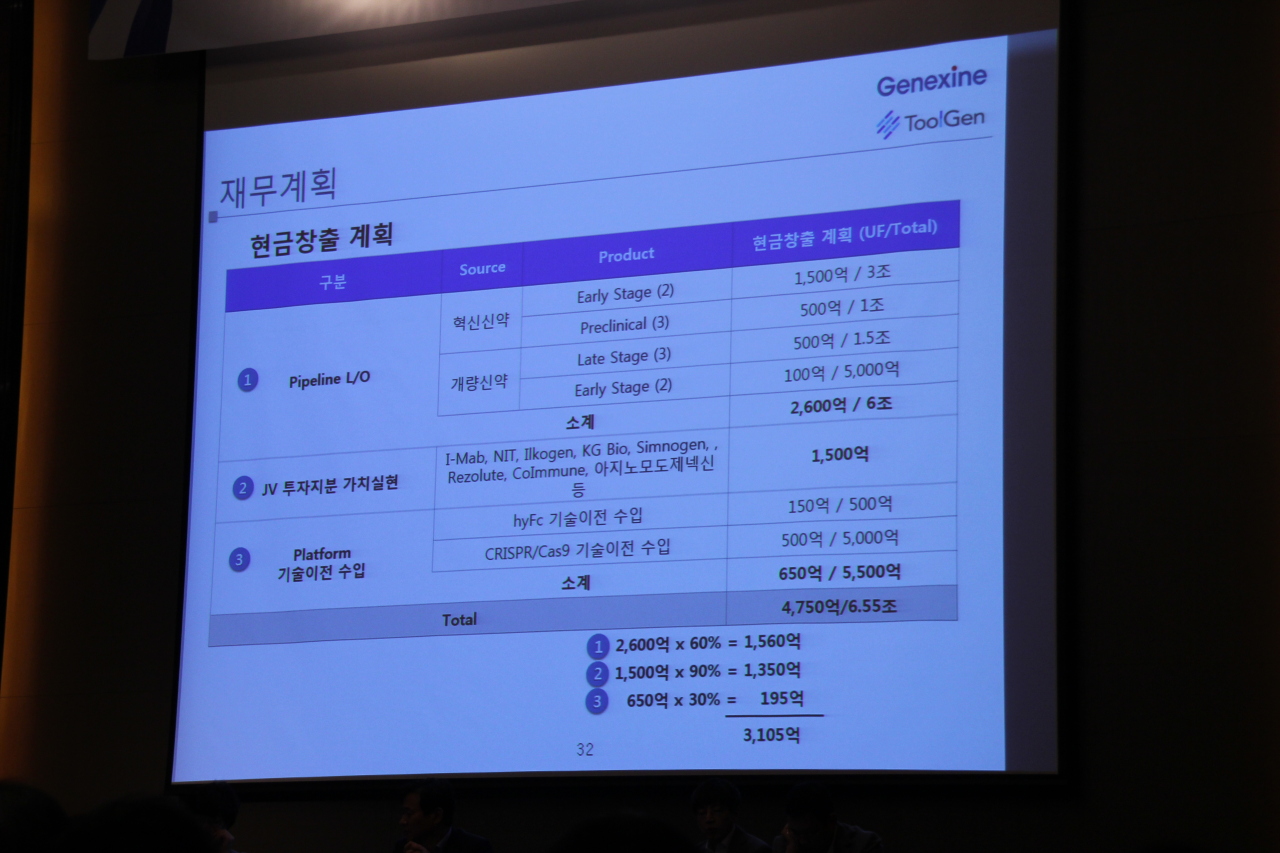

Projected cash inflow of ToolGenexine for the next three years (Lim Jeong-yeo/The Korea Herald) |

|

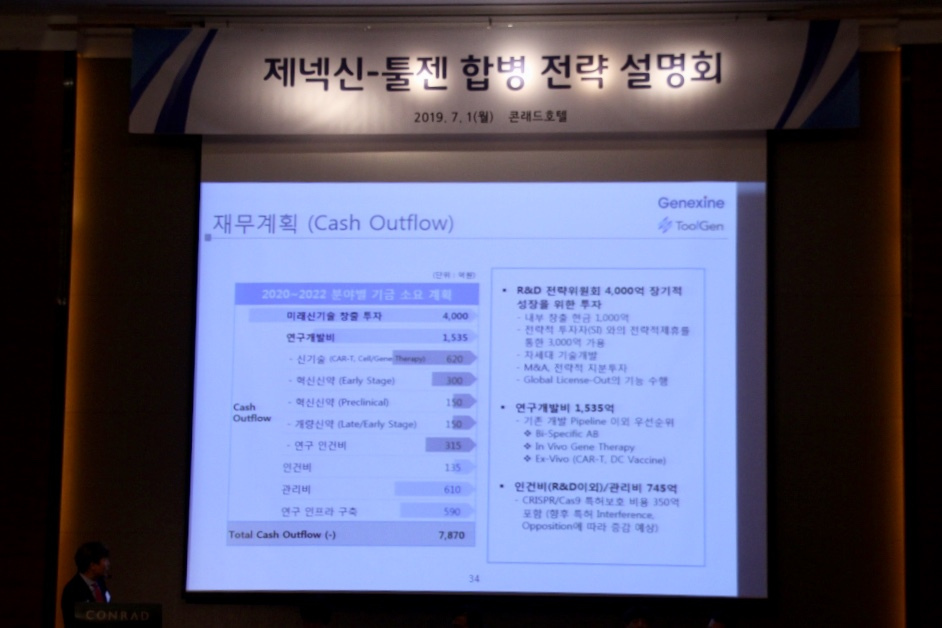

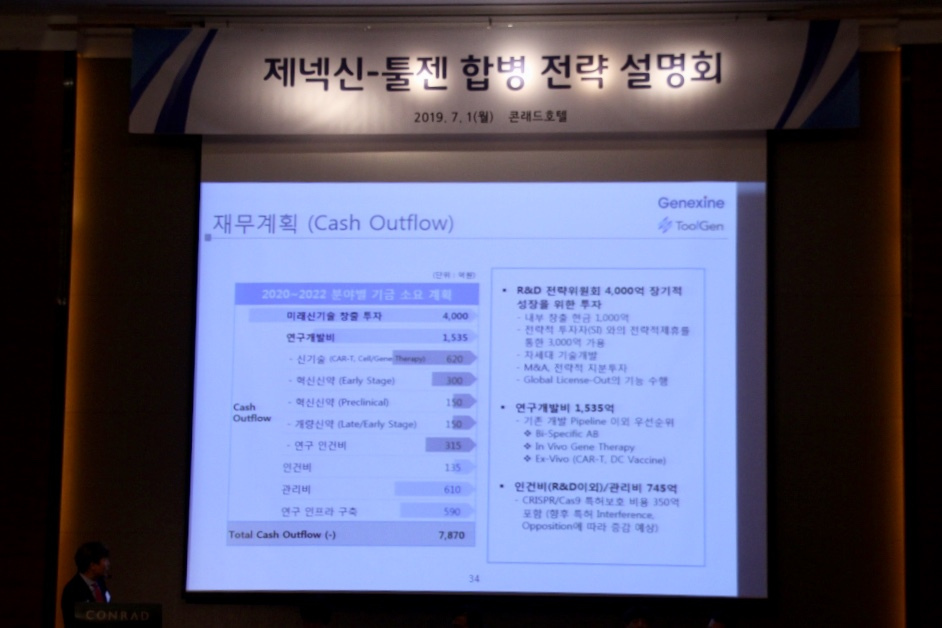

Projected cash outflow of ToolGenexine for the next three years (Lim Jeong-yeo/The Korea Herald) |

Sung briefed that Genexine has 180 billion won in cashable assets, and believes the company could raise an additional 135 billion won in the next three years, as well as anticipated license-out deals worth 175.5 billion won. ToolGen has cashable assets of 30 billion won. Together, the combined total assets of the merged company reaches 530 billion won.

ToolGenexine describes its many pipelines as either novel or innovative drugs. For its novel drugs, the company plans to globally license them out in the early phase of phase 3 clinical trials, which is the beginning stage for commercialization. For its innovative drugs such as immuno-oncology drug and cancer DNA vaccine, the company plans to license out at phase 2, which is the stage where a drug’s efficacy is proven.

The company believes the out-license deals of its two early stage novel drug pipelines will amount to 150 billion won in up-front payments, and its three preclinical trial novel drug pipelines to yield 50 billion won from up-front payments. In the long term, the deals would amount to 4 trillion won, according to company projections.

By Lim Jeong-yeo (

kaylalim@heraldcorp.com)