SEJONG -- The automobiles segment was one of the few hot-button issues during South Korea’s respective negotiations for a free trade agreement with the United States and the 28-member European Union.

The Korea-EU FTA and Korea-US FTA, which took effect in July 2011 and March 2012, respectively, heralded the era of import cars in the nation under eased tariff barriers.

|

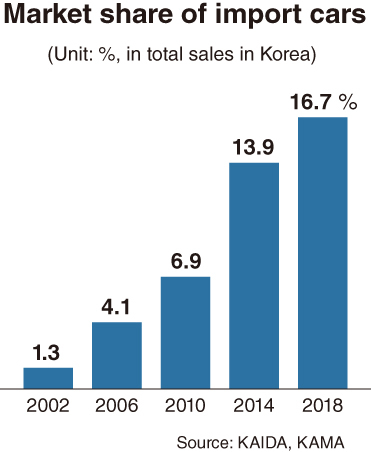

(Graphic by Heo Tae-seong/The Korea Herald) |

Market insiders say that German carmakers -- the most popular import brands in Korea -- have been propelled forward in terms of penetrating into the dominant market share that is held by local brands Hyundai Motor and Kia Motors.

US companies have the opportunity to challenge competitors from Japan, which has yet to sign a free trade pact with Korea, despite the steady popularity of Toyota, Honda and Nissan among local consumers.

Some say Korean consumers’ past protective position toward import brands has waned rapidly over the past decades, irrespective of the free trade agreements.

Nonetheless, data showed that the share of import brands grew sharply in the 2010s. Local dealers also cite foreign carmakers’ price competitiveness in term of targeting middle-income, younger generations here.

A dealer in Seoul attributed their growing presence to their active unveiling of cars with relatively low price tags ranging between 40 million won ($33,800) and 80 million won, compared to their former main targets for the wealthy consumer bracket with premium luxury models priced over 100 million.

A decade ago in 2008, about 61,000 passenger import cars were sold here compared to 958,000 Korean brands. The share of import cars stood at 6 percent, according to the Korea Automobile Importers and Distributors Association and the Korea Automobile Manufacturers Association.

In 2018, foreign and domestic firms sold 260,000 and 1.297 million units, respectively, under which import brands captured 16.7 percent of the market. This marked an all-time high, and indicates that 1 out of every 6 Korean buyers of opted for an import brand last year.

Though their cumulative sales for the first five months of 2019 decreased on an on-year basis in the wake of an economic slowdown, their percentage of total sales of domestic and foreign automakers is projected to post a similar level to that of 2018.

“Their market share stayed under 0.5 percent 20 years ago,” a dealer said. “One out of every 5 or 4 cars to be sold would be import brands in the 2020s.”

He said the preference, among middle-income earners in particular, for import cars has quickly spread from the Seoul metropolitan area to major provincial cities over the past 10 years, adding that the “business of import car dealerships will be prospective across the country.”

After lingering at 0.3 percent in 1998 and 0.4 percent in 2000, they grabbed more than 1 percent of the market for the first time in 2002, according to data from the Korea Automobile Importers and Distributors Association.

The figure has continued to climb after the implementation of the free trade agreements -- from 6.9 percent in 2010 to 10 percent in 2012, 13.9 percent in 2014 and 14.3 percent in 2016.

For this year, based on January-May sales, the market share of import brands came in at 14.7 percent.

|

The Lamborghini Huracan Performante Spyder is showcased at the 2018 Geneva Motor Show. The convertible carries a suggested price of about $308,000. (Lamborghini.com) |

By brand, Mercedes-Benz topped the list with sales of 26,400 over the five months, with its market share among import brands marking 29.4 percent.

BMW ranked second with sales of 14,600 and a share of 16.3 percent, trailed by Lexus at 7,000 and 7.8 percent, Toyota at 4,900 and 5.5 percent, Honda at 4,800 and 5.4 percent and Volvo at 4,300 and 4.8 percent.

US brands such as Ford and Chrysler (owned by Italy-based Fiat) and Ford were closely chasing the share of Japanese makers by posting shares of 4.3 percent and 4.2 percent, respectively. The Ford Explorer ranked as the top in sport utility vehicle sales among import brands in recent years.

The KAIDA calculates sales data of 24 brands, including Lamborghini, Maserati, Bentley and Rolls-Royce, on a monthly, cumulative and yearly basis.

Meanwhile, cars produced by foreign-owned companies, such as SsangYong Motor, GM Korea and Renault Samsung Motors, are classified as domestic brands.

By Kim Yon-se (

kys@heraldcorp.com)