Online shopping can often be full of hassles. Shoppers have to install a package of security programs to fend off possible hacking attempts, enter credit card information, and type in a long and complex password. They need to repeat the routine again if a single mistake is made along the way.

Mobile payment services, however, have eliminated such hurdles plaguing online shoppers.

The mobile payments boast built-in security programs, a simple and easy-to-use user interface, and a high level of compatibility as they are often available at both online and brick-and-mortar shops.

Seeing business opportunities in the mobile payment segment, a number of players from various industries are joining the fray to cash in on the burgeoning technology, accelerating the advent of the cashless society.

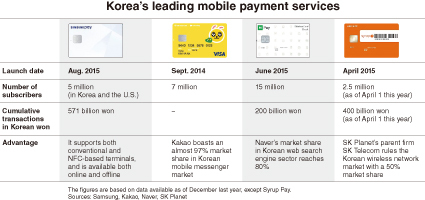

Samsung Electronics threw down the gauntlet by launching its mobile payment solution Samsung Pay in the Korean market in 2015, posing a challenge to its rival Apple, which rolled out Apple Pay a year before.

Despite its belated launch, Samsung’s contactless payment system was more widely used than Apple’s due to its better compatibility. Samsung Pay is available with the existing payment terminals at stores for credit and debit cards as well as NFC sensors while Apple Pay only works with NFC-based terminals.

Samsung is aiming high as it seemingly plans to incorporate Samsung Pay in all of its products, including smartphones, wearables and TVs.

The company will reportedly have its mobile payment solution installed in its virtual reality headset Gear VR, which will allow users to purchase 3-D movies and games with their preregistered credit cards on the headset.

Samsung is said to be working with Oculus, the codeveloper of Gear VR, to create identification measures for payment via the device. The fingerprint scanning technology currently is the only identification method for Samsung Pay.

Park Gang-ho, an analyst from Daeshin Securities, expects Samsung’s mobile payment solution to gain traction in the months ahead, saying that “Samsung Pay will be one of the factors that boost Samsung’s earnings in the second quarter.”

A lot of firms are following suit, rolling out their own mobile payments: e-commerce companies Coupang and SK Planet; Internet giants Naver and Kakao; telecom firms SK Telecom, LG Uplus, and KT; and retail firms Shinsegae, Lotte Department Store, and Hyundai Department Stores, to name a few.

“Both the number of transactions and the amount of purchases via Syrup Pay have increased to 2.5 million amounting to 400 billion won ($347 million) since its release in April last year,” said Joo Jae-yool, a public relations manager at SK Planet, fully-owned by mobile carrier SK Telecom.

Contactless payment services providers are also trying to form alliances through partnerships in a bid to increase their presence.

Samsung has joined hands with banks and financial institutions around the world, such as China UnionPay and MasterCard. Kakao, Naver and SK Planet have all released debit cards working with their online payment systems in partnership with domestic banks. Those debit cards give rewards to users, such as up to 1 or 2 percent cashback per month.

“The launch of the debit cards is aimed at attracting more subscribers both online and off-line, and the tie-ups between Kakao and banking and card companies are a boon for both counterparts,” said Seo ri-ahn, a public relations manager.

Ordering food with mobile payment Kakao Pay took up around 10 percent of the overall orders via Baedal Minjok on average, but the figure jumped to more than 20 percent, according to industry sources.

“The figure will continue to increase down the road,” a market official said.

Market research firm TrendForce forecast that the global mobile payment market will grow from $620 billion this year to $1 trillion in 2019.

By Kim Young-won (

wone0102@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)