Korea’s corporate tax revenue is projected to surpass the government-set target of 46 trillion won ($40.2 billion) this year, breaking a previous record of 45.9 trillion won reached in 2012, according to tax authorities here.

Taxes collected from companies decreased to 43.9 trillion won in 2013 and 42.7 trillion won in 2014 before rising back to 45 trillion won last year.

This projected increase in corporate tax revenue comes as local companies have seen their operating profits improving due to strenuous cost-saving efforts amid worsening business conditions. According to data from Korea Exchange, the combined operating profits of 516 listed firms closing books in December increased by 14.2 percent from a year earlier to 102.2 trillion won last year, while their total turnover decreased by 3 percent to 1,639.3 trillion won.

The revenue increase is also attributed to measures taken by the government last year to reduce tax breaks for large corporations and impose additional levies on part of their net profits that have not been used to make investments, pay dividends and raise wages.

Opposition parties have called for heightening corporate tax rates to help raise funds needed to expand welfare programs and create more jobs. Campaigning for the general election held Wednesday, the liberal main opposition Minjoo Party of Korea pledged to increase the maximum corporate tax rate from the current 22 percent to 25 percent.

Its interim leader Kim Chong-in argued that corporate tax cuts under the previous conservative President Lee Myung-bak’s administration have done little to induce companies to expand investments, just letting them sit on large amounts of cash reserves. He said profits reaped by big businesses have brought no trickle-down effect to the Korean economy, with many middle-class families tumbling into poverty.

But the conservative ruling Saenuri Party and business circles have opposed corporate tax increase, noting local companies are already saddled with no less tax burden than their competitors in other advanced countries.

“The tax burden on Korean companies has already been rising due to reductions in tax benefits and other steps taken by the government,” said Song Won-geun, an official at the Federation of Korean Industries, a major business lobby. “Furthermore, corporate tax hikes would go against prevalent global trends.”

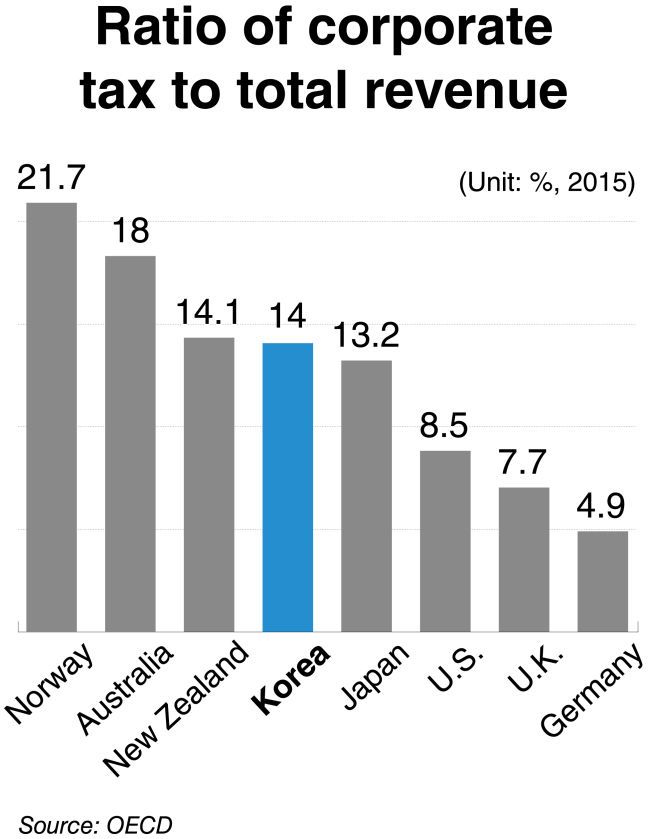

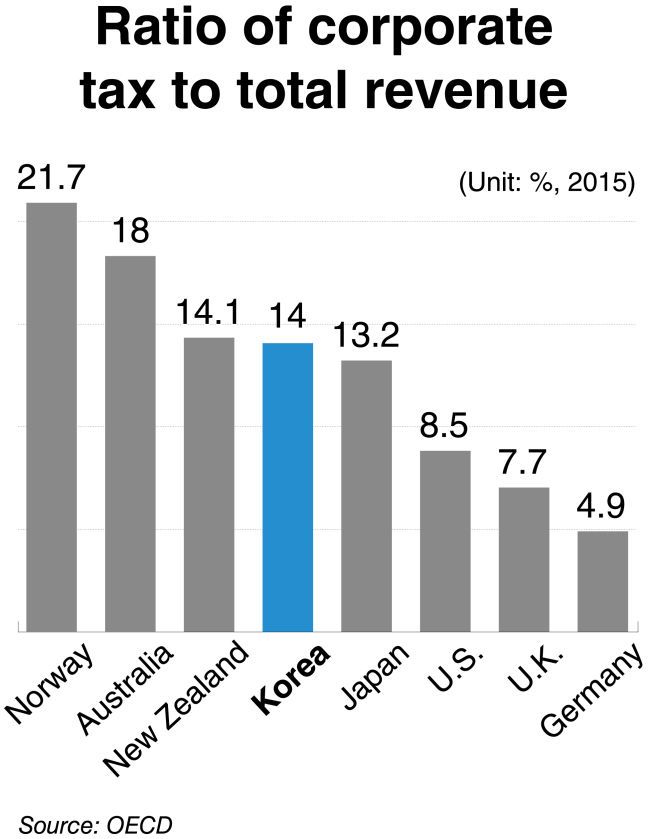

International comparison may help give a more accurate and balanced view of the matter that is likely to be subject to intense debate down the road as the country struggles to finance broader benefit programs while its growth momentum is weakening in a rapidly aging society.

In terms of maximum corporate tax rate, Korea ranked 19th among 34 member states of the Organization for Economic Cooperation and Development last year. Its rate of 22 percent falls far short of the OECD average of 23.19 percent, with the corresponding figure going up to 35 percent for the U.S. and 34.4 percent for France.

But the amount of taxes paid by Korean businesses is relatively large. The ratio of Korea’s corporate tax to its total revenue amounted to 14 percent in 2015, the fourth highest among OECD members, following Norway with 21.7 percent, Australia with 18 percent and New Zealand at 14.1 percent.

According to data from the National Assembly Budget Office, the proportion of the country’s corporate tax in gross domestic product stood at 3.7 percent in 2013, the sixth largest among OECD member states.

It is notable that a handful of large corporations, which account for a mere 0.1 percent of more than 650,000 companies subject to taxation in Korea, pay about 64 percent of total corporate taxes.

Experts with cautious views argue that increasing corporate taxes would lead to weakening business activities and prodding companies to move abroad, particularly at a time when major advanced economies have been competitively lowering taxes levied on corporate profits. Over the past two decades, the average corporate tax rate in the OECD has been cut by about 10 percent, with 20 of its 34 members having reduced it since 2007.

“There should be no misunderstanding that corporate taxes are being collected smoothly now because our economy is going well,” said Park Hyung-soo, head of the Korea Institute of Public Finance. “It is more important to tighten loopholes in the taxation scheme than seeking to raise tax rates.”

Kim Jung-sik, professor of economics at Yonsei University in Seoul, noted that at a time of prolonged economic sluggishness, higher tax rates might not guarantee an increase in revenues. The main opposition party estimates raising the maximum corporate tax rate by 3 percent, as it has demanded, will result in increasing the revenue by more than 5 trillion won annually.

Many experts say that increasing national revenue needs to be pursued in a broader framework that takes into account raising income and value-added taxes as well as levies on corporate profits.

By Kim Kyung-ho (

khkim@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)