Greece remains “accident prone” and may require further debt restructuring or additional financing from euro countries if it struggles to implement measures attached to a new 130 billion-euro ($171 billion) bailout, staff at the International Monetary Fund said.

The loan package is based “on ambitious fiscal and privatization targets and above all on a reinvigoration of structural reforms,” IMF staff wrote in a report released Friday.

“In the event of slower progress in policy implementation, or failure of the economy to respond rapidly enough to reforms, completion of reviews may require additional support from Greece’s European partners on yet more concessional terms than currently envisaged, and-or another restructuring of bonded debt,” according to the report.

The Washington-based IMF, which is already lending to Portugal and Ireland, has reduced its share in the second Greek bailout as it sees its exposure to the euro region posing what the staff called “unprecedented financial risks” to its finances. It has also pushed European governments to boost their own bailout fund in an effort to protect Spain and Italy from contagion.

The IMF board last week approved a 28-billion-euro loan for Greece. About 18.3 billion euros is fresh money, as the four- year arrangement follows a 2010 program that was canceled and left 9.7 billion euros undisbursed.

|

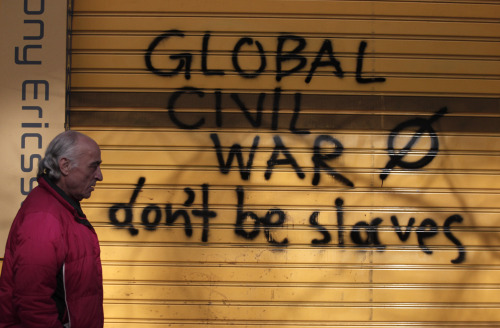

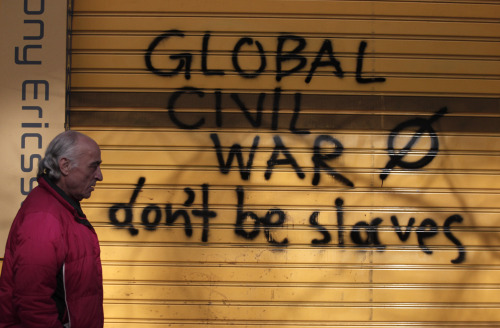

A pedestrian walks by graffiti on a shuttered shop window in Athens on Saturday. (AP-Yonhap News) |

The IMF calculates that the euro region will account for 80 percent of its credits in 2014. Greece is expected to start repaying its first loan to the fund next year.

“If the program goes off track, Greece’s capacity to meet its obligations to the fund would hinge critically on the willingness of European partners to continue to backstop Greece’s payments capacity and the Eurosystem’s capacity to backstop bank liquidity while further efforts are put in place to stabilize the Greek economy,” IMF staff warned.

The IMF estimates Greece’s financing needs to reach 164.5 billion euros through 2014 and to range from 8 billion euros to 21 billion euros for 2015 and the first quarter of 2016, depending on progress in restoring the country’s market access.

Greece completed the world’s largest sovereign-debt restructuring and had to agree to deeper spending cuts to obtain the new funds as it faces a fifth year of recession. The new program also seeks to overhaul the country’s economy from public enterprises to the labor market to make it more competitive.

The Greek government must continue to meet the conditions set by its international creditors to receive aid payments at three-monthly intervals.

The IMF report said the new program was “subject to exceptional risks,” including upcoming elections that create uncertainty over whether the measures will implemented.

“The materialization of these risks would most likely require additional debt relief by the official sector and, short of that, lead to a sovereign default,” it wrote. “In the absence of continued official support and access to” refinancing by the European Central Bank, “a disorderly euro exit would be unavoidable.”

(Bloomberg)