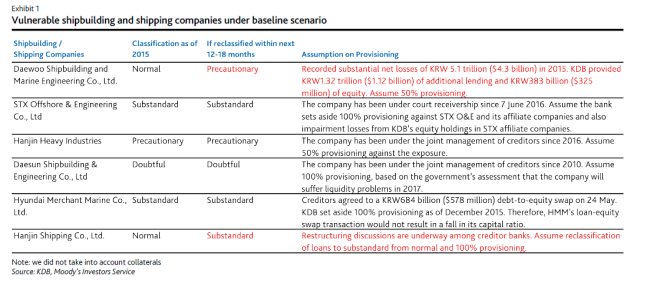

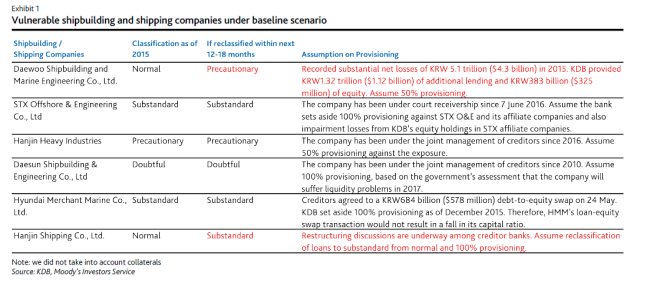

We expect Korea Development Bank (KDB, Aa2, stable) to report continued asset pressure from its exposures to the shipbuilding and shipping industries. However, its capital buffers are sufficient to absorb related credit costs, even under our stressed scenario.

The Korean government‘s (Aa2 stable) announcements on 8 June of its Restructuring Plan for the Shipping and Shipbuilding Industries and Measures for the Recapitalization of Policy Banks do not change the fundamental credit issue facing the bank, namely the continued rises in credit costs related to these sectors.

KDB can maintain a Tangible Common Equity Capital (TCE) ratio of 10-11% even without external capital injections. We assess that KDB can sustain a TCE/risk weighted assets (RWA) ratio in line with its current capital profile because of the sale of its stake in KDB Daewoo Securities Co., Ltd. (Baa2, review for downgrade) and its equity method earnings from Korea Electric Power Corporation (KEPCO, Aa2 stable).

The government’s assessment that the bank would require a recapitalization in the order of KRW2.5-4.0 trillion in its worst case scenario underpins its regulatory concern that KDB would need more capital to support further credit disbursements to the shipbuilding and shipping sectors, as well as meet tighter RWA regulations. In addition, the government‘s planned capital injection will occur well above the point where KDB would face a capital shortage that would jeopardize its solvency or viability.

Pressure on KDB’s standalone credit strength could increase from further disbursements. Moody‘s expects KDB will continue to support the restructuring of both industries through providing loans and refund guarantees.

Downward pressure on its Baseline Credit Assessment (BCA) will rise if future capital increases do not sufficiently compensate for the additional risk incurred from additional disbursements.

No pressure on KDB’s Aa2 foreign currency senior unsecured debt ratings which benefit from a nine-notch uplift to reflect our assumption of governmentbacked support. KDB is a government-owned policy bank that enjoys extremely high government support. This strong support is evident in Article 32 of the KDB Act which

obliges the government to replenish any deficit should KDB‘s reserves prove insufficient. The government’s recapitalization plan for the country‘s policy banks also underpins its strong commitment to support KDB.

Source: Moody‘s www.moodys.com

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)