Korean refineries and chemicals are trading sharply lower on unexpected events such as the Brexit issue and the resulting increase in global macroeconomic uncertainties. However, we believe risks of a possible down-adjustment of earnings consensus are fully priced in at current share valuations.

Relative valuation attractiveness could dip on a global view, but further downsides in share prices remain limited with key factors determining earnings, such as the spreads and refining margins of major products, expected to remain steady. We maintain

Lotte Chemical and

S-Oil as our top picks for the refining and chemical sectors.

Possible down-adjustment of earnings consensus fully priced in at current valuations

Based on 27 Jun 2016 close, refineries and chemicals in our universe are trading at an average P/B of 0.8x and 1.0x to 2017 BPS estimates, respectively.

After recent adjustments made to earnings forecasts, Lotte Chemical and S-Oil are each trading at a P/B of 0.9x and 1.2x to 2017 BPS estimates, and are seen undervalued considering ROE estimates of 14.2% and 16.8%, respectively. With the decline in major product spreads and changes in refining margin and official selling price reflected in revised earnings forecasts, we believe risks of a further down-adjustment of earnings consensus are fully priced in at current share valuations.

Relative valuation attractiveness down on a global view

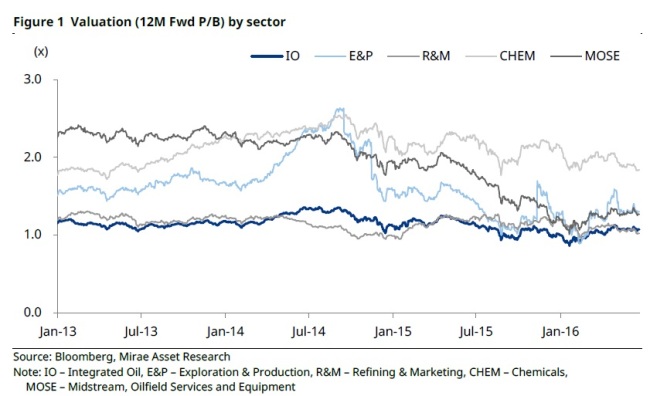

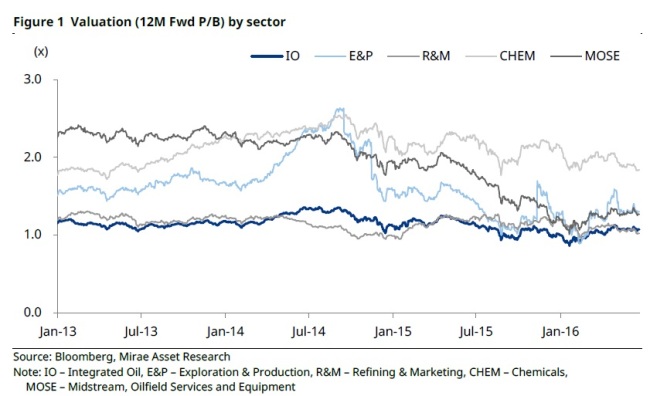

In the global oil/gas sector, over the past three months, upstream (E&P and oil) companies saw notable improvement in share valuations while downstream (refineries and chemicals) suffered from sharp declines. The upturn in international oil prices raised concerns over downstream earnings, weighing on the share valuations of major domestic chemicals and refineries as well. Relative valuations of downstream companies are still higher than historical averages, and may fall by an additional 10-15% from the rise in international oil prices (refer to Figure 1).

Major product spreads to stabilize going forward

We find that refining margins and major petrochemical product price spreads are starting to stabilize. The refining margin has ceased to fall, recording USD5.6/bbl on 22 Jun 2016 with the 2Q16 average at USD5.0/bbl.

The PE-Naphtha spread has stabilized around USD700/MT, remaining flat after continuing on a downtrend for 5-6 weeks. We expect to see further stabilization of refining margins and petrochemical product spreads, with: 1) major companies likely to cut back on production; and 2) the initial impact of new capacity additions in 1H16 wearing off.

OVERWEIGHT maintained; Lotte Chemical and S-Oil remain top picks

We maintain our OVERWEIGHT rating for refineries and chemicals. Major refineries and chemicals are trading sharply lower on recent macroeconomic events, such as the Brexit issue. However, we believe risks of a possible down-adjustment of earnings consensus are fully priced in at current share valuations.

We maintain Lotte Chemical among petrochemicals and S-Oil among refineries as our top picks, as the two companies hold solid financials and the long-term growth potential needed to plow through rising market uncertainties from macroeconomic issues.

Source: Mirae Asset Securities

http://securities.miraeasset.co.kr/eng/jsp/main.jsp

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)