This is the third in a series of articles analyzing the top 10 companies by market capitalization traded on the tech-heavy KOSDAQ market. --Ed.

For a company holding the No. 3 spot on the Kosdaq stock exchange, Dongsuh Companies Inc. has surprisingly little presence in the Korean media. This family-run company is known for not being accessible to journalists, with no interviews, press conferences or other typical media-relations activities that companies here often do to promote themselves.

For investors at least, this media shyness seems to add to the company’s appeal as a quiet achiever on the hype-prone Kosdaq.

Through its subsidiary which controls nearly 80 percent of Korea’s instant coffee mix market, the company logs solid profits every quarter and, perhaps more importantly in the dividend-shy Corporate Korea, returns nearly half of them to shareholders through dividends.

|

Dongsuh Food's instant coffee product lineup |

“Growth has stalled in Korea’s instant coffee mix market, but Dongsuh is still an attractive buy,” Kim Seung, an analyst from Seoul-based SK Securities, said in a rare research note on the company released in January. The company’s policy towards stock analysts seeking information is said to be not all that different from its policy towards the media.

“It stands to benefit this year from lower prices of coffee beans and its dividend payouts keep rising,” he said.

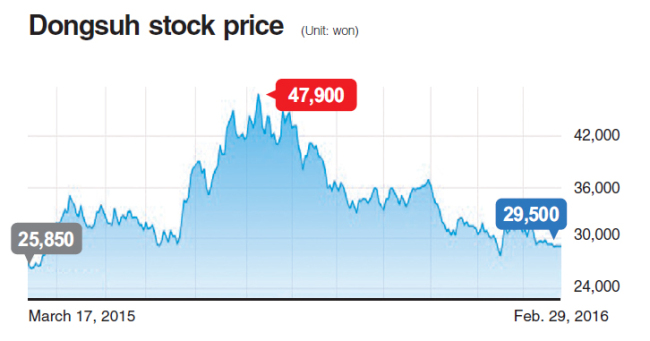

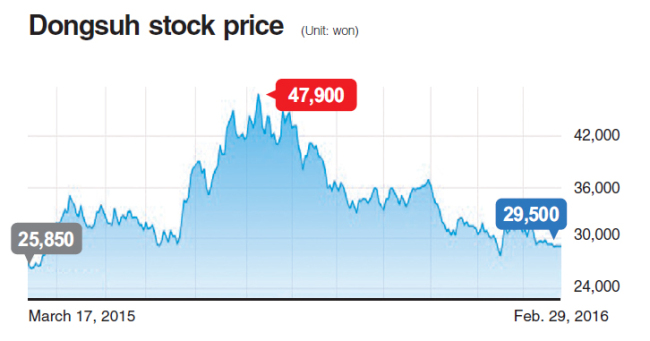

Dongsuh’s performance in 2015 was rather disappointing though.

Net profit came in at 125 billion won ($100 million), down 4.6 percent from a year earlier, while revenue grew 1.3 percent to 509.3 billion won. Operating profits were down 9.7 percent to 48.8 billion won.

Despite the lackluster results, the company decided on a 12 percent increase in dividend per share. It paid 670 won per share to shareholders, spending a total of 66.5 billion in dividend payouts, 53 percent of its 2015 net income.

Shares in Dongsuh closed at 29,500 won on Monday, losing 3.3 percent in value so far this year. With a market cap of 2.94 trillion, it ranks third on the list of Kosdaq’s top-cap companies, distantly behind Celltrion at No.1 and Kakao at No.2.

Chasing closely at fourth is CJ E&M, the entertainment unit of CJ Group, with a market cap of 2.88 trillion won.

The company’s share ownership is one of the reasons behind its generous dividend policy and a reason to believe this will continue.

Dongsuh is nearly 67 percent controlled by its founding family, with Kim Sang-heon, the eldest son of founder Kim Jae-myung, holding the largest stake of over 20 percent. Foreign investors own slightly over 10 percent of the total outstanding shares.

Kim of SK Securities sees better times ahead for Dongsuh this year, in terms of earnings.

Coffee bean prices, which were higher in 2014, have come down nearly 25 percent last year. This will be reflected in the company’s bottom line this year, he said.

Among investors, expectations are high that subsidiary Dongsuh Food’s expected foray into China may open a new era of growth for its de-facto holding firm.

Dongsuh Food is a cash cow for Dongsuh Companies, with its revenue at 1.5 trillion won in 2014, triple that of Dongsuh Companies. It is unlisted and 50 percent owned by its parent firm. It also runs household brand instant coffee mix Maxim, which was the driving force behind the unique coffee culture in Korea of ubiquitous coffee vending machines in the 1980s and 1990s, before Koreans developed a taste for espressos and drip coffee.

The key challenge for both Dongsuh and Dongsuh Food may be at home, industry insiders say, as Koreans these days have an increasingly diverging taste for coffee. This poses a threat to their dominant player position. Dongsuh Food must also recover consumer confidence, especially after it was caught selling germ-tainted cereals in 2014.

By Lee Sun-young (

milaya@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)