The Korea Herald is publishing a series of articles looking at the performance of various sectors on Korea’s main bourse KOSPI. The following is the third installment. -- Ed.

South Korea’s retail stocks suffered a series of challenges last year, including the broader economy’s downturn to a nationwide outbreak of a deadly virus. Experts see no turnaround in sight for them this year, as economic worries continue to weigh down on consumer sentiment while competition from online and mobile rivals intensify.

“It’s hard to expect a dramatic turnaround for the retail industry, except from the base effect from the year-earlier period when the MERS outbreak kept people holed up in their homes,” said Kim Ji-hyo, an analyst at Eugene Investment & Securities,

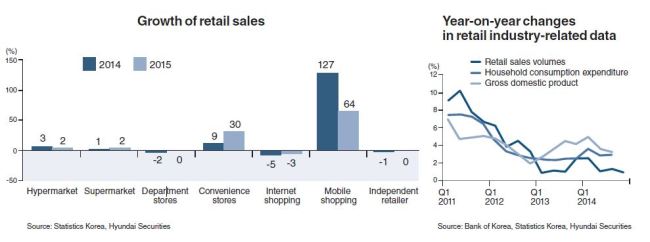

The combined operating profit of 10 major retail companies, including

department stores, home shopping firms and convenience stores, declined 11 percent in 2015 from a year earlier, according to Hyundai Securities.

The government had pushed retailers to hold coordinated sales events last year starting in October, which helped increase private consumption by an annual 3.2 percent in the final quarter of 2015 -- the strongest figure in five years.

But the spike in spending seemed short-lived after the bargain ended.

January’s consumer sentiment index slipped to a level on par with July last year when consumption fell into the doldrums in the aftermath of the Middle East respiratory syndrome outbreak.

“For the time being, I do not expect to see meaningful growth in domestic consumption,” Kim said.

Last December, hypermarkets reported a 5.1 percent year-over-year drop in sales as they failed to recover from the human traffic loss to department stores during the massive sale events initiated by the government, according to Mirae Asset Securities.

Department stores were also affected by an unseasonably warm winter that held back the sales of winter goods, which suffered a 5.7 percent year-on-year decline.

Shares of retail giant Shinsegae fell by nearly 20 percent, from 262,500 won ($212.63) in November to 211,000 won in Monday’s trading.

Some say the malaise of the retail sector owes much to a shift in consumer spending patterns.

Major retailers are failing to adapt to the growth of online and mobile shopping, they say.

“The sharp drop in retail firms’ earnings is bound up with the mobile shopping market’s growth. It won’t be an easy battle to fight against online rivals,” Kim Keun-Jong, analyst at Hyundai Securities said.

For traditional retailers, opening of physical retail outlets used to provide significant advantages in expanding the geographical reach of business, but with the huge spike in mobile shopping, they have lost the competitive advantage, he added.

In contrast to large retailers, Korea’s mobile retail market is large and growing. Its value increased to 13 trillion won in 2015 from just 60 billion won in 2008.

Convenience stores remain a bright spot for the retail industry. Sales at convenience stores jumped 29.6 percent on-year to 16.52 trillion won last year, due to the popularity of convenient meals prepared away from home and increased margins in cigarette prices.

“Although the positive impact of the cigarette price hike on the convenience stores’ revenues will fade away this year, they are expected to improve profitability by expanding a range of private brand products, such as prepackaged meals and coffee,” Lim Dong-geun, an analyst at Mirae Asset said.

By Park Han-na (

hnpark@heraldcorp.com">

hnpark@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)