|

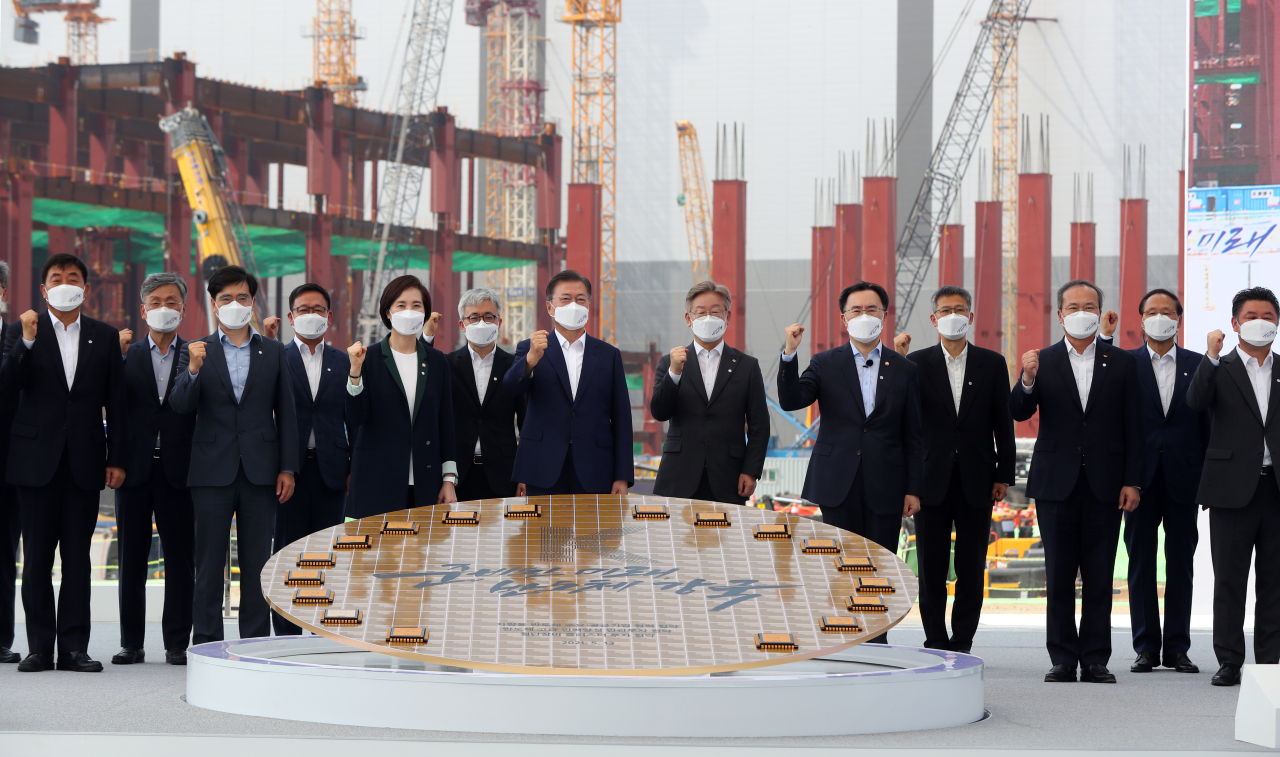

President Moon Jae-in speaks before chipmakers' announcements of their investment plans in Pyeongtaek, Gyeonggi Province, on Thursday. (Yonhap) |

South Korea on Thursday announced a sweeping set of new government policies aimed at safeguarding and further expanding the country’s prowess in chips, which include the most generous tax credits ever given to chipmakers -- up to 50 percent.

The chip manufacturers, led by Samsung Electronics and SK hynix, responded to the support package by committing investments of over 510 trillion won ($458.1 billion) in total over the next 10 years. Samsung unveiled plans to spend 171 trillion won on projects including a third chip manufacturing plant in Pyeongtaek, Gyeonggi Province.

Addressing over 70 industry officials, President Moon Jae-in vowed a renewed focus on the chip industry, the backbone of the economy, as it faces a new wave of market uncertainties amid the rising tides of trade protectionism, the US-China rivalry and major economies’ thrust to rebuild their own semiconductor industries, viewing chips as a key strategic item.

“Korea will achieve its goal of becoming the world’s top integrated device manufacturer, including the system-on-chips by 2030,” President Moon Jae-in said during the event at Samsung’s Pyeongtaek complex.

“Based on the prowess of the country’s semiconductor industry, Korea will also preoccupy competitive edges in all industries to take a new leap in the post-coronavirus era. Through concerted efforts by the private sector and the government, Korea will overcome the wave of risks of reshaping global supply chains.”

Measures announced Thursday center on what the government called the “K-Semiconductor Strategy,” which aims to establish by 2030 the world’s top semiconductor supply chain in its territory, with the so-called “K-Chip Belt” in the middle of the country, and also contains plans to upgrade related infrastructure and nurture the talent pool.

During the event, Samsung, the world’s No. 1 memory player, unveiled system-on-chips and foundry investment plans worth 171 trillion won in total, to be completed by 2030.

This includes the previously announced 133 trillion won investment in the system-on-chips business and a new pledge of 38 trillion won for expanding its research capabilities for foundry and manufacturing facilities.

Samsung also announced it aims to complete the third fabrication line in its Pyeongtaek complex by the second half of 2022, with a goal of making it the world’s most advanced and biggest chip-producing cluster.

The P3 fab is about the size of 25 football stadiums, and will be equipped with EUV equipment that will mainly produce DRAMs on 14-nanometer nodes and logic chips on 5-nanometer nodes. All manufacturing processes will be controlled through automated systems, it said.

“Even in the memory market, where Korea has always been the leader, the competition is getting fiercer,” said Kim Ki-nam, vice chairman of Samsung. “Rather than striving to keep the post, Samsung will make preemptive investments to widen the gap that can never be narrowed.”

“Korea’s semiconductor industry is at a watershed moment, and it is the right time to set a long-term vision and plans for investments,” Kim added.

Samsung plans to expand EUV technologies to its upcoming DRAMS, develop high bandwidth memory-processing-in-memory chips and spur research on future memory solutions like CXL DRAM, it said.

The memory industry’s No. 2 player, SK hynix, didn’t reveal a specific amount of investment Thursday.

But the memory-reliant chipmaker hinted at plans to expand its foundry capacity.

SK hynix Vice Chairman Park Jung-ho said, “We are currently considering measures to double the chipmaker’s foundry capacity.” Park also said SK hynix will consider various options including mergers and acquisitions.

“SK hynix will invest in the 8-inch foundry business, which will allow domestic fabless firms to easily commercialize their chips,” an SK hynix official said.

|

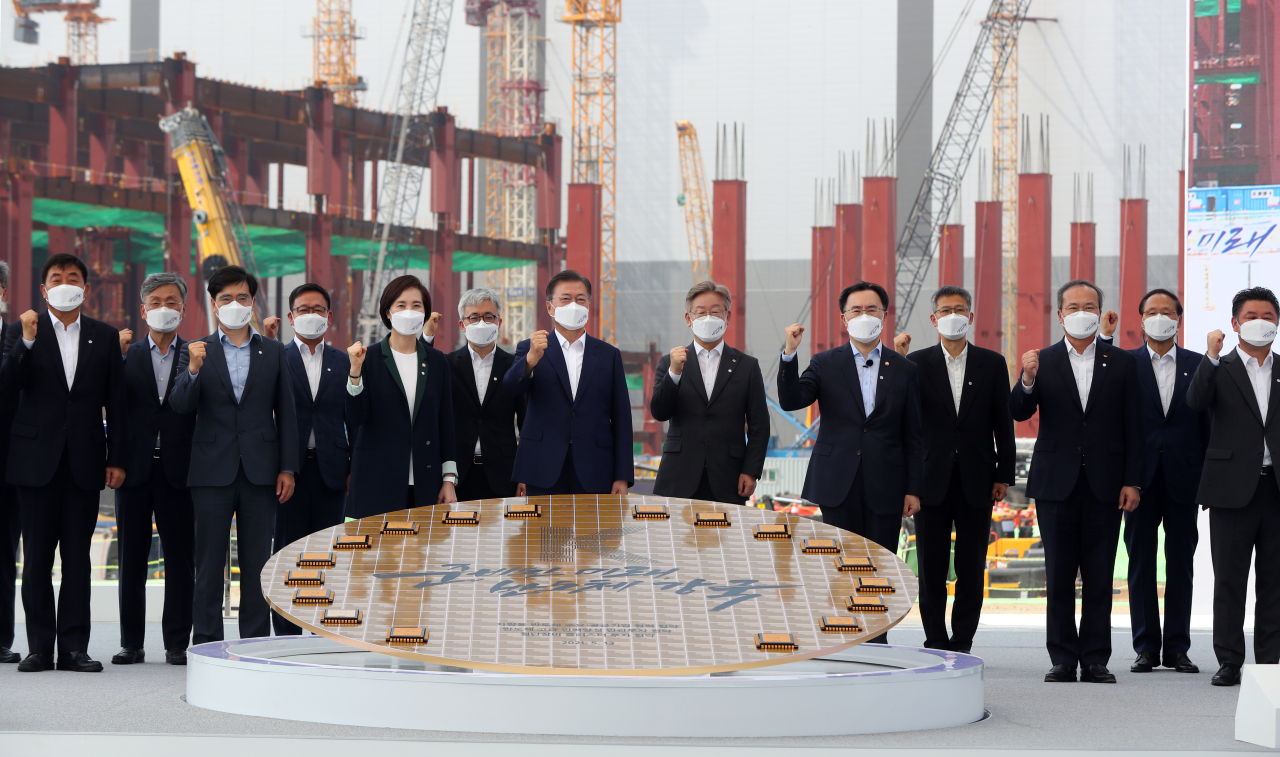

President Moon and government officials pose at a construction site for Samsung's third chip manufacturing plant in Pyeongtaek, Gyeonggi Province, on Thursday. (Yonhap) |

Korea is home to the world’s two biggest memory providers, Samsung and SK hynix, with chips accounting for nearly 20 percent of the country’s exports. The chip industry accounts for 45 percent of the country’s total manufacturing investment.

The measures announced Thursday include the establishment of the K-Chip Belt, which encompasses areas where Samsung and SK hynix currently operate production facilities.

From Gyeonggi Province’s Pangyo, which is going to be a hub for fabless, through Giheung, Hwaseong and Pyeongtaek to Onyang in South Chungcheong Province, the belt will be a strategic base for chip manufacturing equipped with cutting-edge equipment for memory, foundry and packaging, government officials explained.

In Hwaseong, Netherlands-based ASML, the world’s largest chip manufacturing equipment company, decided to invest 240 billion won to build a facility consisting of an office, training center and remanufacturing center for extreme ultraviolet lithography equipment, the most advanced equipment enabling Korean chipmakers to produce microchips on 7-nanometer nodes and below. The ASML facility is scheduled to be completed by 2024.

Yongin, Gyeonggi Province, where SK hynix is planning to build a total of four chip fabrication lines, is set to be home to a complex for chip materials, components and equipment, providing suppliers easier access to the large fabs.

As for tax policies, Samsung and SK hynix could see a drastic increase in tax benefits.

For research and development projects at large and medium-sized chipmakers, tax credits will be expanded from the current 2 percent to 30 percent range to 30 percent to 40 percent, according to the new tax policy. For small chipmakers, the tax credit will be increased from 25 percent to somewhere between 40 percent and 50 percent.

Large chip manufacturers like Samsung and SK hynix used to receive a 2 percent tax credit for their capital expenditures on R&D projects, but the tax benefits will grow as much as twentyfold.

For facility investments by large chipmakers, tax credits will be raised from the current 1 percent to 6 percent. For medium-sized firms, the tax credit percentage will go up from 3 percent to 8 percent, and for smaller firms it will increase from 10 percent to 16 percent.

The raised tax credits will start to be applied to upcoming investment plans scheduled for the second half of this year, through 2024.

The government will also create a special fund for companies that plan to ramp up 8-inch foundry facilities and increase investments in the fields of chip materials, components, equipment and packaging. The volume of the financial support will be over 1 trillion won, including a 1 percentage point discount for loans.

Regulations on using chemicals, high-pressure gases and radio application facilities at chipmakers will also be eased as part of the government’s efforts to improve infrastructure for the chip industry.

To turn Pyeongtaek and Yongin into the country’s semiconductor valley, the government will secure industrial waters to be used for the next 10 years.

The government and state-run Korea Electric Power Corporation will waive up to 50 percent of the electricity bills charged to chip manufacturers.

Korea also aims to foster a 36,000-strong semiconductor workforce over the next 10 years, the ministry announced.

The plan includes supporting 14,400 university students in obtaining bachelor’s degrees in semiconductors, and training 13,400 employees at chip companies in chip design and manufacturing processes.

Through co-investments between companies and the government, the ministry plans to expand joint programs for up to 7,000 master’s and Ph.D. holders to nurture them as top-level talent.

To support the development of next-generation chips, including artificial intelligence chips and sensors, the government will inject 2.5 trillion won into new R&D projects.

“In a welcoming response to the 510 trillion won investment plan from the private sector, the government decided to increase tax credits by more than five times and spare no effort to support the chip industry,” said Industry Minister Moon Sung-wook.

“If the latest K-Chip Strategy is successfully carried out, the country’s exports would grow to $200 billion by 2030 and employ as many as 270,000 in the chip industry,” he said.

By Song Su-hyun (

song@herladcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)

![[Graphic News] International marriages on rise in Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050091_0.gif)