Nokia-like failure may undermine overall economy: economist

The Korean economy holds a critically risky factor as it has been heavily dependent upon the two largest conglomerates ― Samsung and Hyundai Motor, economists say.

Their worries and skeptical view over the nation’s economic structure revolve around the fact that earnings of Samsung Group and Hyundai Motor Group account for a great portion of the nation’s gross domestic product.

The economy of Finland was led to “falter” due to its flagship Nokia losing ground in the global mobile telecommunications and smartphone market, former Morgan Stanley economist Andy Xie told a local news provider.

Issuing the possibility that Korea may follow a Finnish-like difficulty, he said it is necessary for the country to “disperse competitiveness” among the other business groups.

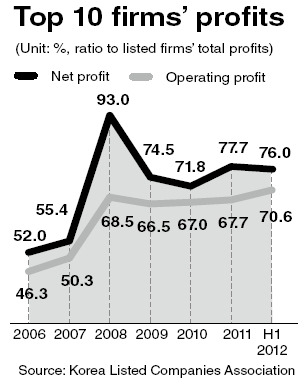

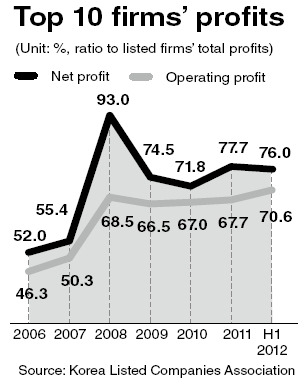

According to data from the Korea Exchange and chaebul.com, a conglomerate-tracking website, Korea saw the earnings gap between Samsung-Hyundai Motor and the other eight major groups widen this year.

During the first half of the year, Samsung and Hyundai Motor accounted for more than half of the combined operating profit of all companies listed on stock markets.

Samsung reported an operating profit of 11.6 trillion won ($10.4 billion) in the first half, up 59.8 percent over the same period last year. Hyundai Motor saw its operating profit increase 12.5 percent to 6.4 trillion won on a year-on-year basis. The two groups’ combined operating profits amount to 50.6 percent of the total operating profits made by all listed companies except for financial firms.

In contrast, LG, SK and Lotte groups suffered a drop in operating profit by 4.5 percent, 31.3 percent and 37.5 percent, respectively.

Hyundai Heavy Industries and GS Group reported a 49.4 percent and 47.8 percent fall in first-half earnings. Similarly, Hanjin Group posted a deficit of 258.8 billion won.

Earnings of Samsung accounted for 32.6 percent of the combined figure of the 10 groups, compared to 17.8 percent a year earlier. Hyundai Motor’s proportion climbed from 14 percent to 18 percent.

Foreign investors are cutting back their stakes in major Korean companies amid a sliding stock market hard hit by the European debt crisis.

But they are expanding ownership at Samsung and Hyundai, according to chaebul.com.

Ninety-three affiliates of the nation’s top 10 conglomerates saw their combined foreign ownership decline from 20.1 percent in March to 19.7 percent in July, it said.

By Kim Yon-se (

kys@heraldcorp.com)