South Korea’s foreign exchange reserves fell by the most in nearly three years in September due mainly to the weaker dollar conversion value of non-dollar assets and suspected dollar-selling intervention.

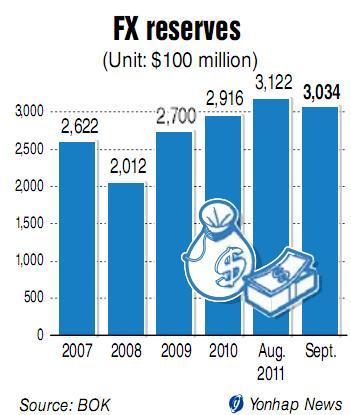

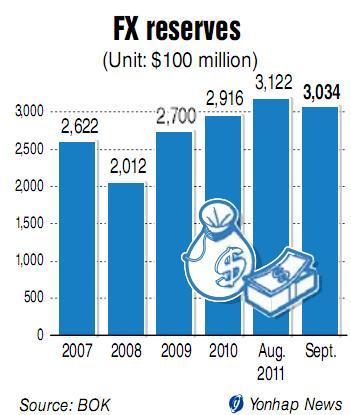

The country’s foreign reserves reached $303.38 billion as of the end of September, down $8.81 billion from the previous month, the Bank of Korea said Wednesday.

The September reading marked the largest monthly fall since the foreign reserves declined by $11.74 billion in November 2008, the central bank said. The monthly decline was the fourth-largest since the central bank began to compile related data.

Foreign reserves consist of securities and deposits denominated in overseas currencies, along with International Monetary Fund reserve positions, special drawing rights and gold bullion.

The FX reserves hit a fresh record high of $312.19 billion in August since they surpassed the $300 billion mark for the first time in April amid sustained inflows of foreign capital and robust exports.

“Last month, the FX reserves fell mainly because a stronger U.S. dollar curtailed the conversion value of assets in other currencies,” Shin Jae-hyuk, an economist at the BOK, told reporters.

Shin declined to comment on foreign exchange authorities’ dollar-selling intervention, but market players speculated that their dollar sale aimed to curb the won’s sharp weakness led the foreign reserves to fall last month.

In September, gloomier global economic outlooks and Europe’s debt crisis raised demand for the dollar as safe assets. Last month, the euro depreciated 6.8 percent to the dollar and the pound declined 4.1 percent against the greenback. The Japanese yen inched down 0.6 percent to the dollar.

The heightened eurozone debt crisis is heating up the debate whether South Korea has enough ammunition to cope with a potential foreign exchange liquidity crunch.

South Korea’s financial markets underwent gyrations last month, hit by the global recovery woes and nagging concerns about the eurozone debt crisis. The key stock index declined around 6 percent and the Korean won fell 9.45 percent against the dollar in September.

In the height of the global financial crisis, South Korea tapped the FX reserves to bolster the sliding local currency and ease a dollar crunch, leading the FX holdings to fall to $200.51 billion in November 2008.

BOK Gov. Kim Choong-soo told lawmakers last week that South Korea is able to deal with global financial market uneasiness with its current volume of FX holdings, saying that it is not appropriate to view the current level of more than $300 billion in foreign reserves as small.

The Korean government vowed to take “preemptive” action in order to head off a potential crisis, saying it will make efforts to ease fluctuations and herd behavior in the financial markets.

As of the end of August, South Korea’s FX reserves ranked eighth in the world, down one notch from the previous month.

(Yonhap News)