Central bank projects headwinds from debt woes in U.S. and Europe

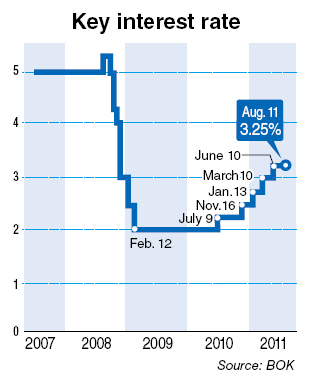

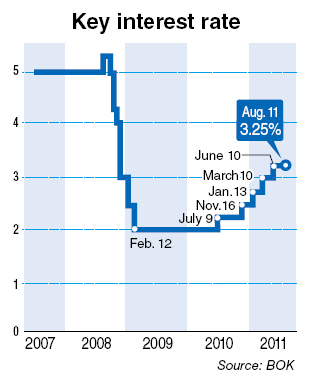

South Korea’s central bank on Thursday kept the key interest rate steady at 3.25 percent for the second month in a row, as global financial market turmoil sparked by the U.S. credit rating downgrade and Europe’s debt woes outweighed worries over rising inflation at home.

“The downside risks are expected to rise as the U.S. and other major economies are likely to see their recovery slowing on top of the sovereign debt problems in Europe and the turmoil in the global financial market,” said Kim Choong-soo, governor of the Bank of Korea.

As for the central bank’s target inflation range of 4 percent for this year, Kim said there were no grounds for adjusting the figure.

“We don’t have any intention to raise the inflation target range nor is the Korean economy in that stage that warrants such adjustment,” Kim said.

|

Bank of Korea Governor Kim Choong-soo (Yonhap News) |

The rate freeze came as the global economy faces a dimmer outlook following Standard & Poor’s’ downgrade of the U.S. credit rating for the first time and the debt crisis spreading to Europe’s bigger economies Italy and Spain. The Korean economy, which depends heavily on exports, is expected to sustain damage stemming from the slowdown of the U.S. economy and other trading partners in Europe.

The U.S. Federal Reserve on Tuesday pledged to keep interest rates at a record low for two more years in a bid to prop up the world’s biggest economy and restore confidence among investors who demonstrated their panicky sentiment in the past week.

“The Korean economy is expected to continue its upward trend but the uncertainty has grown over its growth path due to the external risks,” the central bank said in a statement issued Thursday.

Analysts said the widely expected move on Thursday by the central bank indicates that it would not accelerate rate hikes to normalize the monetary police.

“Like other observers, we have adjusted our forecast that the Bank of Korea would go for one more rate hike within this year, down from two, and if things get worse in the global financial sector, the rate will be kept at the current level by the year-end,” said Jeong Yong-taek, economist at KTB Investment & Securities.

The rate freeze, however, is likely to raise concerns about whether and how the BOK will rein in the runaway inflation. The country’s consumer prices jumped 4.7 percent in July from a year earlier, staying above the government’s target inflation range of 4 percent for seven months in a row. Core inflation, which excludes volatile food and energy prices, also rose 3.8 percent from a year earlier, hitting a 26-month high.

The BOK has raised the borrowing costs by a total of 1.25 percentage points since July last year to contain inflationary pressure, though some analysts earlier said the central bank should have raised the rates more aggressively.

KTB’s Jeong said the BOK seems to bet that inflation will stabilize from October, due largely to the high base effect, though it will surge temporarily in September when the Chuseok holiday is expected to boost prices.

The country’s economy, the fourth-largest in Asia, grew 3.4 percent in the second quarter and 4.2 percent in the first. Exports jumped 27.3 percent on-year to a record $51.4 billion in July. But in mid-July the central bank recently revised down the gross domestic product forecast for 2011 from 4.5 percent to 4.3 percent on growing concerns about the embattled global economy.

By Yang Sung-jin (

insight@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)