Central bank expects 3.9% inflation and 4.5% growth this year

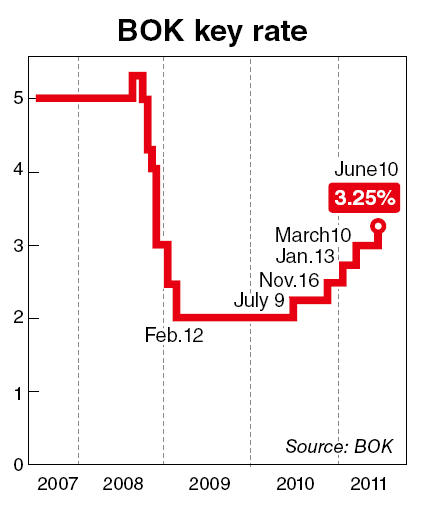

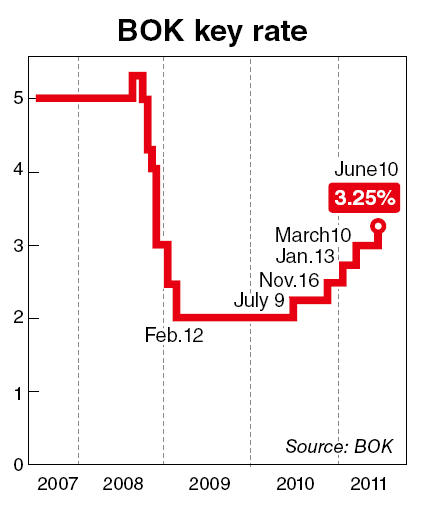

The Bank of Korea on Friday raised its benchmark interest rate by a quarter percentage point to 3.25 percent, surprising the market that expected another rate freeze to accommodate slowing exports and surging debt burdens on households.

The monetary policy committee at the central bank lifted the seven day repurchase rate for the third time this year after boosting it by the same amount in January and March.

“The decision to increase the rate was agreed unanimously by the committee,” BOK Governor Kim Choong-soo said. The rate adjustment decision is made by a majority vote from the six-member committee.

“Inflation will remain high for a considerable amount of time. The central bank’s rate policy will prioritize stabilizing prices in the medium- to long-term,” he said.

A total of 12 of 20 economists surveyed by Reuters expected a freeze this month.

Pressure to raise the benchmark interest rate more quickly has been growing after inflation began to surge five months ago. Consumer prices rose 4.1 percent in May from a year earlier, exceeding the central bank’s target range of 2 to 4 percent for the fifth consecutive month. But the pace at which it was rising has waned.

The producer price index for May, a gauge indicating future consumer prices, dropped for the first time in 11 months, increasing by 6.2 percent from May last year after posting a 6.8 percent on-year rise the previous month.

The BOK expects inflation of 3.9 percent this year and growth of 4.5 percent.

Gross domestic product for the first quarter came in lower than expected, reflecting weaker domestic demand and declining exports.

Asia’s fourth-largest economy grew 1.3 percent in the January-March period, narrowly missing the central bank’s target of 1.4 percent.

Private consumption, accounting for about 60 percent of the economy, only expanded 2.8 percent in the same period, compared with an average 4.1 percent last year.

Record household debt has been another issue the central bank has to juggle. Household debt exceeded 801.4 trillion won ($740 billion) won last month, or 146 percent of income, complicating the bank’s inflation fight efforts, as a rate increase makes these debts harder to service.

“Governor Kim appeared to be increasingly dovish of late, and this was reflected in the past few months with its surprisingly slow pace,” Oh seok-tae, a senior economist at SC First Bank said before the rate review meeting.

“It seems more appropriate to speed up the rate hikes for the next few months not to lose its grip on price control,” he added.

Governor Kim had earlier said the benchmark interest rate should be normalized with the “pace in which global rates normalize, not at the pace to meet short-term needs.”

By Cynthia J. Kim (

cynthiak@heraldcorp.com)