Regulator grants equal opportunities for local and foreign bidders

The financial authorities have decided to allow foreign investors to participate in the coming bidding for Woori Financial Group, reversing their earlier stance to hand over the state-run group to a Korean investor.

With the decision, former Finance Minister Kang Man-soo, who is serving as chairman of KDB Financial Group, has failed to realize his ambition to set up a mega-bank.

The Financial Services Commission, in its report to lawmakers of the parliamentary National Policy Committee on Tuesday, said it would ban the state-controlled KDB Financial from taking over Woori Financial.

While the FSC is moving to privatize the public funds-injected Woori Financial, its chairman Kim Seok-dong told lawmakers that “it is desirable for the regulatory body not to let KDB Financial participate in the coming bidding.”

Chief regulator Kim cited insufficient public consensus toward a merger between the two state-run financial groups for regulatory policy not to support KDB Financial’s move.

|

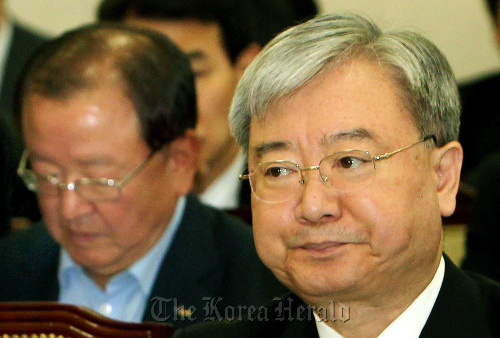

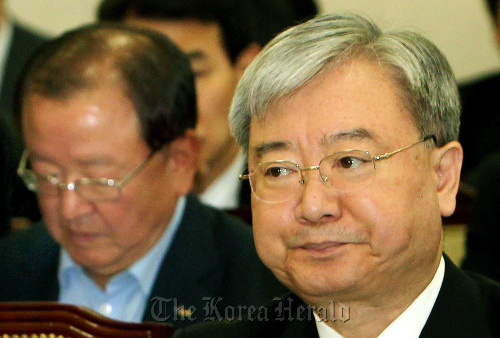

Financial Services Commission Chairman Kim Seok-dong attends a parliamentary committee on Tuesday to discuss the sale of Woori Finance. At left is KDB governor Kang Man-soo, who said the KDB would follow the government’s decision against the bank’s move to take over Woori. (Yang Dong-chull/The Korea Herald) |

“(As a revised policy to sell Woori,) the financial authorities will provide domestic and foreign investors with equal opportunity to attend the bidding,” he said.

Last month, he said, “Do we have to sell Woori Financial Group (one more financial company) to foreign investors again?”

He also promised to push for the sale on the basis of fairness and transparency according to relevant laws and principles.

Aside from the planned sale of Woori Financial, Kim said the FSC would map out the project to privatize KDB Financial while the latter had sought privatization after acquiring Woori.

KDB Financial chairman Kang, who also attended the meeting at the National Assembly, said he would follow the regulatory decision, adding that he had pushed the merger in consultation with the government. Kang is one of President Lee Myung-bak’s close confidants.

Despite the apparent rejection to a merger between KDB and Woori, the FSC chief said he would maintain the earlier position of pushing for the revision of laws on financial holding companies.

In a bid to induce keen competition among bigger bidders, the FSC has been considering proposing a revision to a bill allowing a financial group to own another financial group by acquiring a greater than 50 percent stake, from the current requirement for holding a 95 percent stake.

The move is allegedly aimed at promoting a financial group’s takeover of Woori Financial, though the regulator has vetoed KDB Financial’s project.

Still there is a possibility that the National Assembly will block the move as a group of opposition lawmakers and several ruling party lawmakers oppose a mega-bank in the nation.

By Kim Yon-se (

kys@heraldcorp.com)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)