South Korea's financial market has already factored in expectations for US interest rate hikes this year, the finance minister said Friday, indicating it is well-positioned to withstand their impact.

After boosting its benchmark interest rate by a quarter point to 0.75 percent in December, the US Fed forecast it could raise the federal funds target rate three times in 2017, instead of the two quarter-point increases previously projected.

|

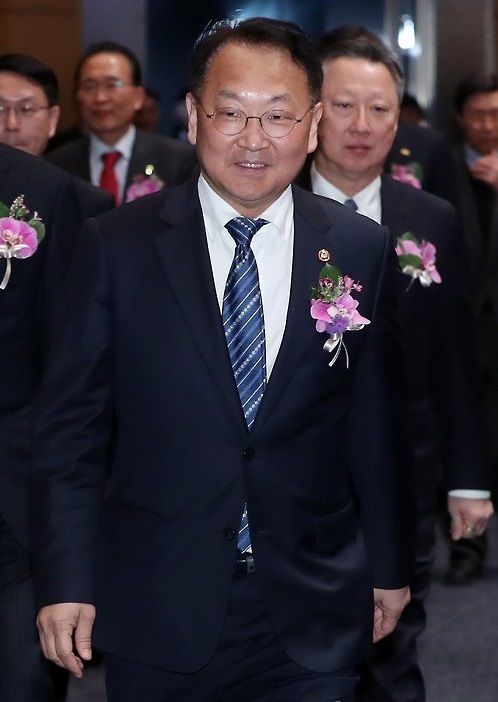

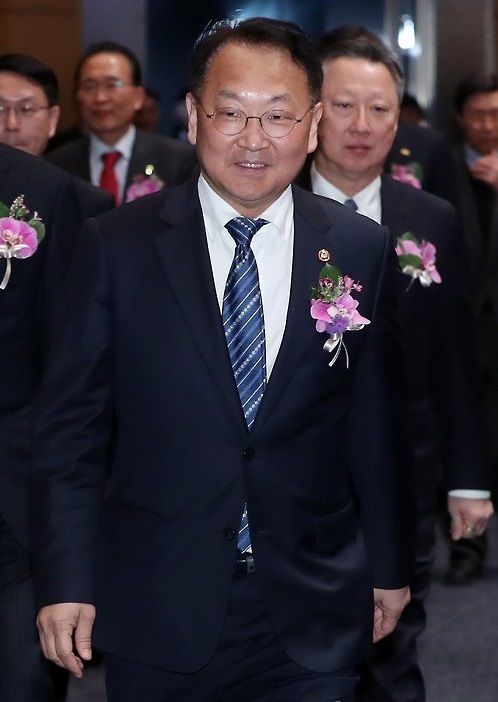

Finance Minister Yoo Il-ho attends a ceremony to mark Taxpayer's Day in Seoul on March 3, 2017. (Yonhap) |

"A rate hike in March would raise the possibility of three rises this year, having a greater impact on the domestic financial market (than two increases)," Yoo Il-ho said in a meeting with reporters in Seoul.

However, such expectations have been reflected in the domestic market to a certain degree since the end of last year, Yoo, who doubles as deputy prime minister for economic affairs, said after attending a ceremony to mark Taxpayer's Day.

Asked if a US rate increase would entail a rise in South Korea's key interest rate, Yoo said, "It's up to the Monetary Policy Board of the Bank of Korea to determine whether to hike the benchmark rate after assessing the situation."

There has been speculation that a US rate increase would force South Korea's central bank to follow suit in order to stem an outflow of foreign capital from Asia's fourth-largest economy.

In a rate-setting meeting last week, the BOK froze its policy rate at an all-time low of 1.25 percent for the eighth consecutive month in an apparent bid to bolster economic growth ahead of additional US rate hikes this year.

Yoo also said the government will take a recent rebound in exports into consideration when drafting a supplementary budget.

"The government should consider that, but take a comprehensive approach as domestic demand remains in the doldrums."

In a positive sign for the still sluggish economy, South Korea's exports jumped 20.2 percent last month from a year earlier on rising oil prices and recovering world trade, marking the second consecutive month of double-digit growth. In January, outbound shipments rose 11.2 percent on-year.

Yoo, meanwhile, said should prices of daily necessities surge, the government will take active measures to stabilize them, including imposition of tariff quotas.

Earlier on Friday, Statistics Korea said South Korea's consumer prices rose at a faster-than-expected rate of 1.9 percent in February from a year earlier as prices of oil-related products picked up. Core inflation, which excludes volatile oil and food prices, gained 1.7 percent on-year. (Yonhap)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)