|

Doosan Group Chairman Park Jeong-won (third from right) looks around Doosan’s exhibition at CES 2024 in Las Vegas in January. (Doosan Group) |

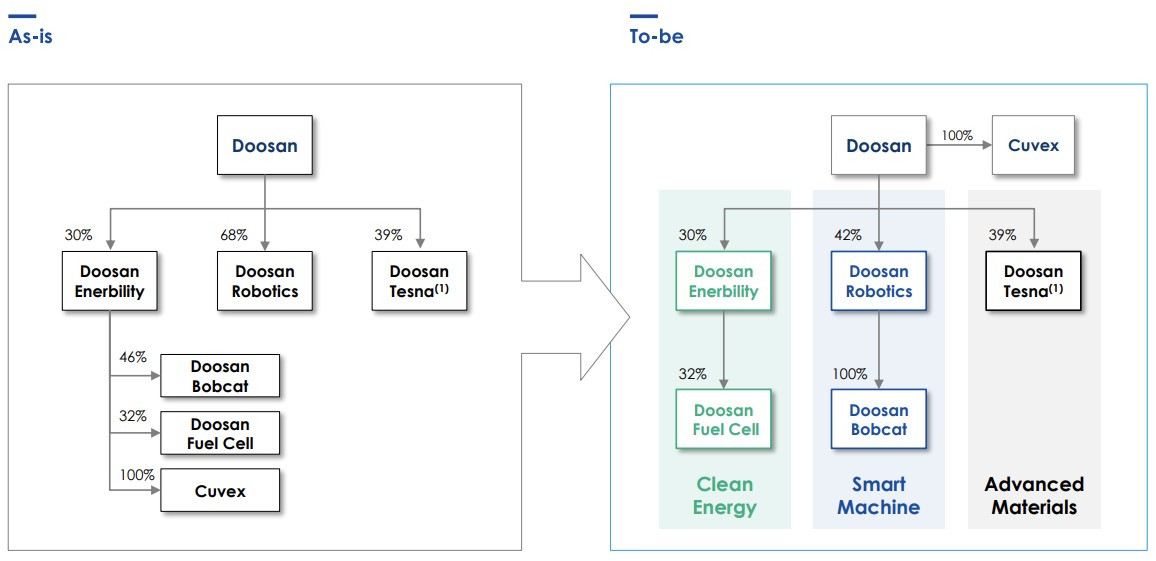

South Korean conglomerate Doosan Group has decided to shake up its business structure to focus on clean energy and smart machine sectors to maximize synergy between it’s affiliates.

According to Doosan’s regulatory filing Thursday, Doosan Bobcat, a compact equipment and industrial vehicle builder, will undergo a spin-off merger process to become a 100 percent-owned subsidiary of Doosan Robotics.

Doosan Enerbility, which currently owns a 46 percent stake in Doosan Bobcat, will split into two companies: one that handles its ongoing businesses in energy sectors, namely nuclear power plants and small modular reactors, and an investment firm that will take control of the 46 percent stake in Doosan Bobcat. The investment firm will transfer the Bobcat stake to Doosan Robotics.

Doosan Robotics looks to complete the merger by buying the remaining 54 percent stake from the market through a tender offer. Doosan eventually plans to delist Bobcat from Korea’s main bourse Kospi after the robotics firm takes the 100 percent stake in the machinery builder.

Once the spin-off merger is completed, the stake of Doosan Corp., the group’s holding company, in the robotics firm will be diluted to 42 percent from the current stake of 68 percent.

|

Doosan Group's affiliates restructuring plan (Doosan Group) |

With the business reorganization, Doosan said it would seek to expand the robotics firm’s presence in North America and Europe by using Bobcat’s strong footholds in customer touchpoint, channel management and financing in the advanced markets. It added that Doosan Robotics could also leverage Bobcat’s production facilities as test beds to develop autonomous solutions while increasing captive sales to Bobcat.

“We expect to remove overlapping investments and create synergy by jointly carrying out (research and development) tasks that the two companies have been carrying out individually, such as developing motion control technology using artificial intelligence, strengthening vision recognition technology and developing high-performance autonomous driving technology,” said a Doosan official.

Through the affiliates reshuffle, Doosan underscored the three pillars for the group’s future growth: "Clean Energy," "Smart Machines" and "Advanced Materials." While Doosan Robotics and Bobcat are charged with the smart machine business, Doosan Enerbility and its subsidiary Doosan Fuel Cell will lead the group’s clean energy sector.

The conglomerate said that Doosan Enerbility, which has acted as the group’s intermediate holdings company, will be able to focus more on its businesses through the reshuffle. It also pointed out that Doosan Enerbility’s financial structure will be improved as the business shakeup will reduce borrowings by about 1.2 trillion won ($870 million).

Doosan Tesna, Korea’s leading semiconductor wafer testing company, will continue at the helm of the advanced materials business.

“The restructuring is expected to create an efficient business environment, create synergy for each business sector and serve as a stepping stone to explore and expand new business opportunities,” said the Doosan official.