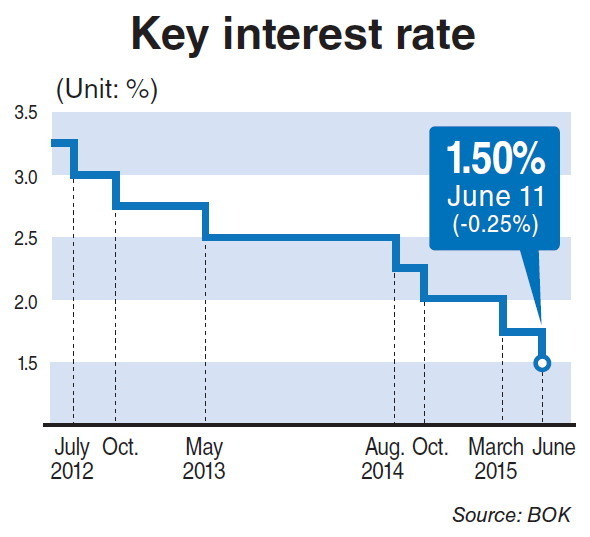

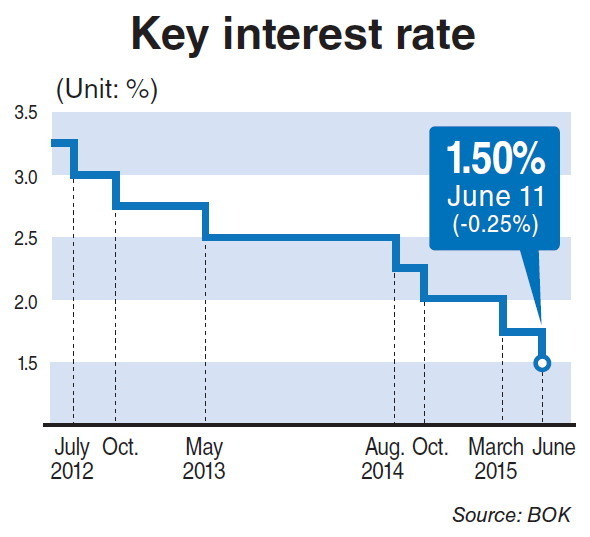

South Korea’s central bank Thursday lowered the key interest rate to a new record low of 1.5 percent per annum, reflecting the growing concerns that the spread of the Middle East respiratory syndrome will dampen private consumption.

The Bank of Korea, after holding its monthly monetary policy committee meeting, announced that it has decided to cut the base rate by 0.25 percentage point from the previous 1.75 percent.

This was the fourth rate cut since last August, which brought down the base rate by a total of 100 basis points in less than a year.

|

Bank of Korea Gov. Lee Ju-yeol on Thursday. (Yonhap) |

“We decided to carry out a preemptive rate cut in order to alleviate the negative effect of MERS on economic sentiment and the actual economy,” BOK Gov. Lee Ju-yeol told reporters in a press briefing.

Korea currently stands as the world’s second-most MERS-affected country, with 122 cases of confirmed infection and 10 deaths, as of Thursday. Over 3,000 people are being quarantined for potential infection.

The sudden fear hit heavily on the domestic consumption, adding on to the pessimism that the country’s growth rate may end up below 3 percent.

The key rate cut is thus considered an emergency measure to haul the sagging economy, but it has also increased concerns over household debts.

“Right now, the MERS outbreak and the consequent decrease of consumption is an emergent issue at hand, whereas the household debt issue has been around for quite a long time,” Lee said.

But the lowered rate would surely lead to the expansion of household debts, so it is crucial that the government comes up with valid countermeasures to secure financial stability in the market, he added.

“The committee members share the opinion that the government should step out more actively in improving long-term growth potential through structural reform,” Lee said.

It yet remains unsure, however, whether the central bank will make a downward adjustment of its economic forecast in July.

“Within predictable ranges, there is a probable chance that the figure will be lowered from our April forecast,” Lee said.

When the BOK decided to freeze the rate at 1.75 percent in May, Gov. Lee had presented an optimistic view, claiming that the nation’s economy was on a slow recovery.

But key figures remained low in May, with exports at $42.4 billion, down 10.9 percent from the previous month and marking the fifth straight month of decline. The consumer price index, too, remained in the zero percent range for the sixth straight month.

“We expect the rate cut to have a positive yet limited impact on exports,” the bank chief said.

“It was not just rates that brought down Korea’s exports over recent months, but also external reasons such as the slow growth trend observed in China and the global economy in general.”

The local stock market, too, remained relatively stable despite the rate change. The benchmark KOSPI closed at 2,056.61 points Thursday, up 0.26 percent from the previous day, with little notable fluctuation during the day.

By Bae Hyun-jung (

tellme@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)